Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization is a legal document that provides detailed information related to an upcoming event scheduled by a company in Ohio. This meeting is specifically called to discuss and evaluate potential recapitalization strategies. The document outlines the purpose, date, time, location, and agenda of the meeting. Keywords: Ohio, Notice of Special Stockholders' Meeting, Recapitalization, legal document, purpose, date, time, location, agenda, shareholders, company. There can be variations or specific types of Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization based on factors such as the specific company, industry, or other unique circumstances. However, the main objective remains the same — to discuss options and decisions related to recapitalization. Some types of Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization include: 1. Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization for Publicly Traded Companies: This document is tailored for publicly traded companies incorporated in Ohio, allowing them to inform their shareholders about an upcoming meeting solely focused on recapitalization matters. 2. Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization for Private Companies: Private companies in Ohio may issue this notice to provide their shareholders with important information in advance of a special meeting dedicated to recapitalization. Key details such as the proposed recapitalization strategies, how they will affect shareholder rights and value, and the potential benefits and risks will be communicated. 3. Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization for Financial Institutions: This variant of the notice is specific to financial institutions such as banks, credit unions, or insurance companies operating in Ohio. It serves to inform their shareholders of an upcoming meeting where recapitalization strategies will be deliberated upon. Given the unique regulatory environment that financial institutions operate in, this notice may include additional information related to compliance requirements and regulatory approvals. 4. Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization for Distressed Companies: This type of notice is used by struggling or financially distressed companies in Ohio to notify their shareholders about an imminent meeting discussing recapitalization options as part of a restructuring or recovery plan. Such notices may contain specific information about the need for recapitalization, the potential impact on existing shareholders, and how the company plans to navigate through challenging circumstances. It is important to note that these variations are not exhaustive, and the content and structure of a Notice of Special Stockholders' Meeting to Consider Recapitalization may vary depending on the specific requirements and circumstances of the company and its shareholders.

Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

How to fill out Ohio Notice Of Special Stockholders' Meeting To Consider Recapitalization?

Are you presently within a place the place you need to have documents for both business or specific uses just about every day time? There are a variety of legal document layouts available on the Internet, but locating types you can trust isn`t easy. US Legal Forms provides thousands of form layouts, such as the Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization, which can be composed to satisfy state and federal needs.

Should you be already knowledgeable about US Legal Forms web site and possess your account, just log in. After that, you can acquire the Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization format.

Should you not provide an profile and need to begin using US Legal Forms, follow these steps:

- Obtain the form you require and ensure it is for the right metropolis/region.

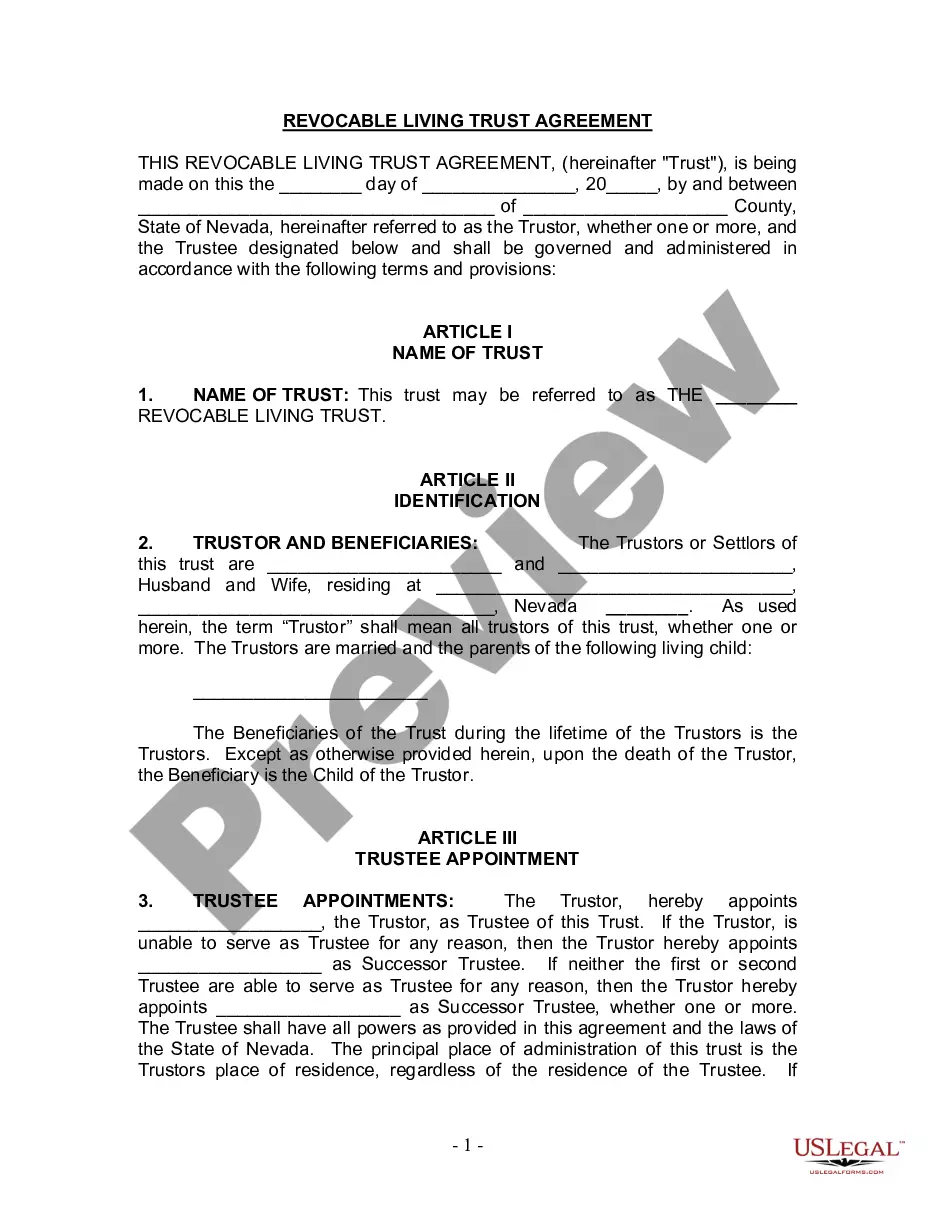

- Utilize the Preview button to review the form.

- See the information to ensure that you have chosen the correct form.

- In case the form isn`t what you`re looking for, use the Lookup area to get the form that suits you and needs.

- Whenever you get the right form, simply click Acquire now.

- Select the costs plan you want, fill out the necessary info to create your bank account, and pay for your order utilizing your PayPal or charge card.

- Select a practical data file format and acquire your backup.

Get all of the document layouts you might have purchased in the My Forms food selection. You may get a more backup of Ohio Notice of Special Stockholders' Meeting to Consider Recapitalization anytime, if possible. Just click the needed form to acquire or produce the document format.

Use US Legal Forms, by far the most extensive assortment of legal kinds, to save lots of efforts and stay away from faults. The services provides appropriately manufactured legal document layouts which you can use for a variety of uses. Generate your account on US Legal Forms and initiate generating your lifestyle a little easier.