Ohio Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

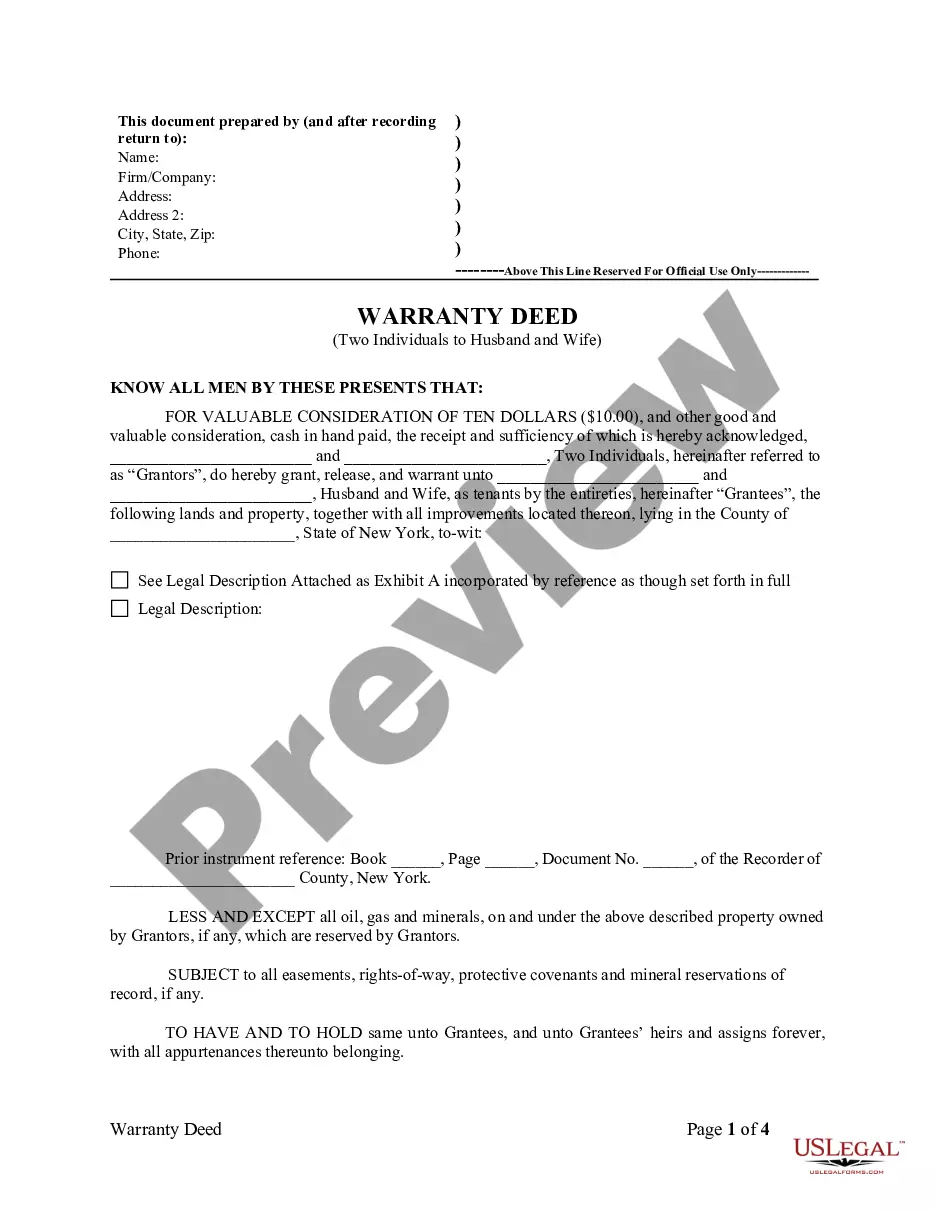

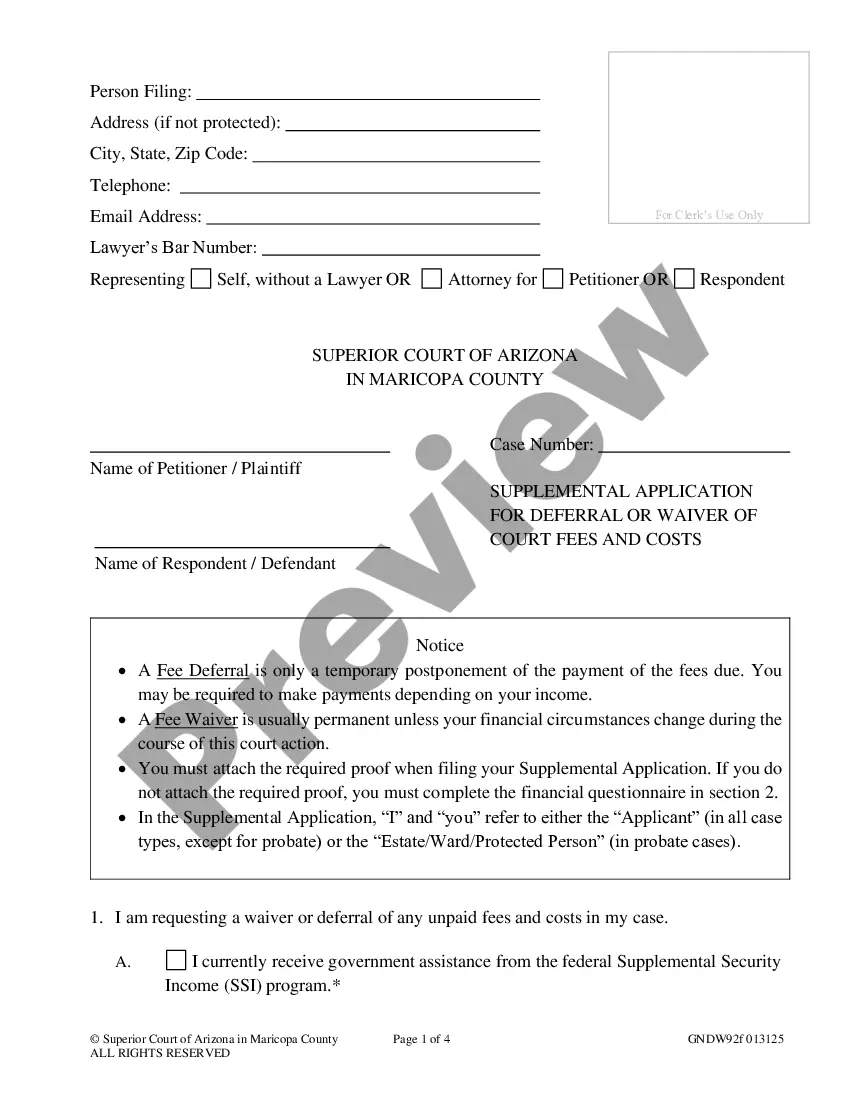

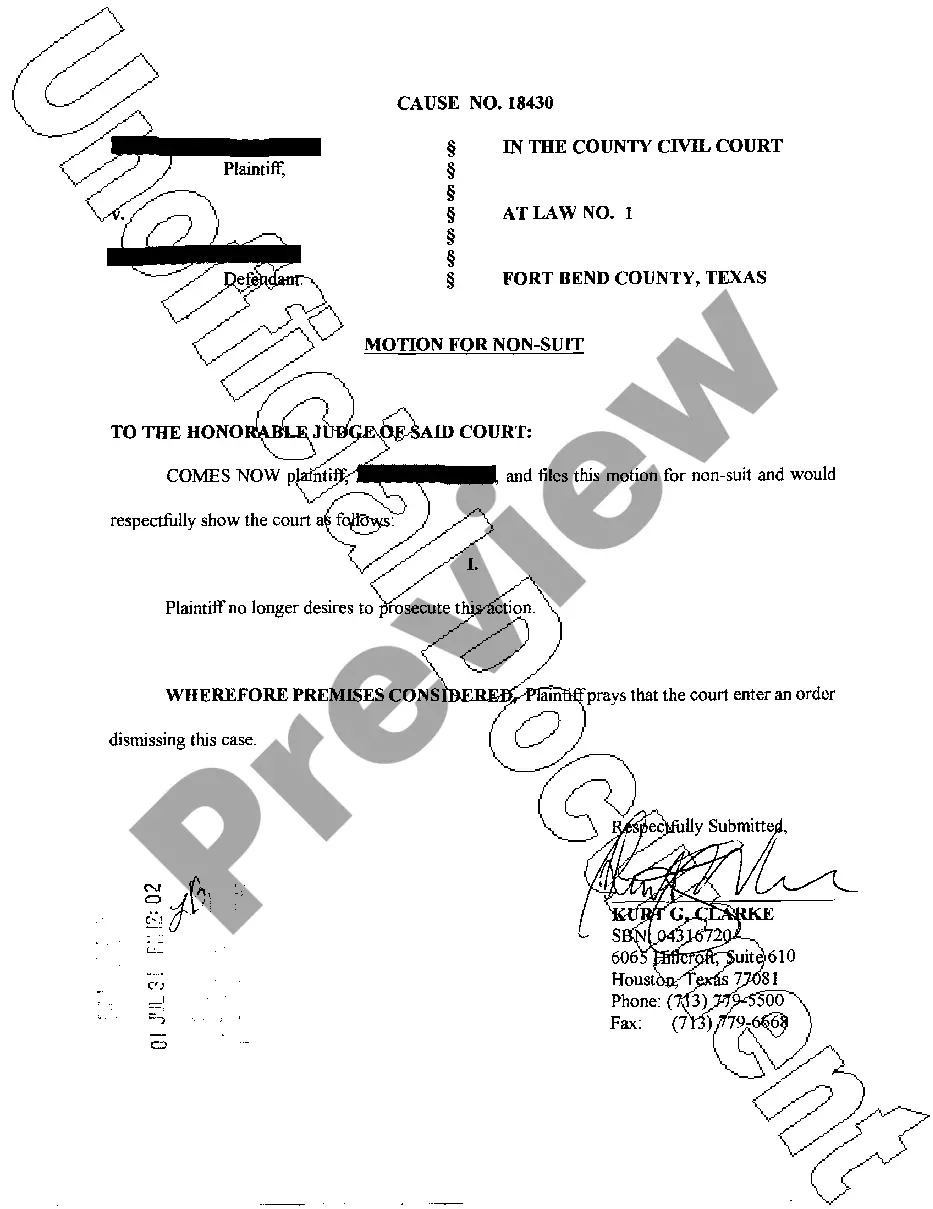

Finding the right legal document web template could be a have difficulties. Naturally, there are a variety of layouts available on the Internet, but how can you discover the legal develop you will need? Use the US Legal Forms site. The assistance provides a huge number of layouts, for example the Ohio Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders, which can be used for enterprise and personal demands. All the forms are checked out by specialists and meet up with state and federal needs.

In case you are currently authorized, log in to your bank account and then click the Download switch to find the Ohio Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders. Use your bank account to search through the legal forms you may have purchased formerly. Go to the My Forms tab of your own bank account and have one more copy from the document you will need.

In case you are a new end user of US Legal Forms, listed below are simple guidelines so that you can follow:

- Initial, ensure you have chosen the appropriate develop for your personal metropolis/state. You may examine the form making use of the Preview switch and read the form information to ensure it is the right one for you.

- If the develop fails to meet up with your expectations, make use of the Seach field to find the appropriate develop.

- When you are certain the form would work, select the Buy now switch to find the develop.

- Opt for the pricing program you need and enter the needed details. Make your bank account and buy the order utilizing your PayPal bank account or credit card.

- Select the document file format and obtain the legal document web template to your product.

- Complete, edit and print and signal the acquired Ohio Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

US Legal Forms may be the biggest local library of legal forms where you will find numerous document layouts. Use the company to obtain expertly-created documents that follow express needs.

Form popularity

FAQ

The two directors or their attorneys and the secretary or other person shall sign the share certificate. Companies (Issue of Share Certificates) Rules, 1960 - MCA mca.gov.in ? actsbills ? rules ? CIoSCR mca.gov.in ? actsbills ? rules ? CIoSCR

A share certificate should be signed by two company directors or one director and the company secretary. For companies with a single director and no company secretary, the company director should sign in the presence of a witness who attests to his or her signature.

In addition, the certificate must be signed by an authorized officer or director of the corporation. Since the validity of electronic signatures is well established under federal law, all of the above requirements can be implemented digitally on the face of an electronic stock certificate. Understanding electronic stock certificates DLA Piper Accelerate ? knowledge ? un... DLA Piper Accelerate ? knowledge ? un...

You may still request a stock certificate through the issuing company or via a broker. Brokerage firms keep an account in your name with the number of shares that you hold. Outdated stock certificates may have value as decorative collectibles. Stock Certificates Have Gone With the Winds of Change Investopedia ? Investing ? Stocks Investopedia ? Investing ? Stocks

A share certificate needs to be signed by: A director and the company's secretary; or. In the event that the company has no company's secretary but single director then, the company director in the presence of an eyewitness who confirms to their signature. Share certificate guide - what you need to know yourcompanyformations.co.uk ? blog ? shar... yourcompanyformations.co.uk ? blog ? shar...

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.