Title: Ohio Letter from Debtor to Credit Card Company: Requesting a Lower Interest Rate for a Certain Period of Time Keywords: Ohio, letter, debtor, credit card company, lower interest rate, certain period of time, types 1. Introduction: In the state of Ohio, debtors often find themselves burdened with high credit card interest rates, making it difficult to manage their finances effectively. To address this issue, debtors can write a compelling letter to their credit card company, requesting a lower interest rate for a specific period. This article provides a detailed description of how to draft such a letter, ensuring debtors in Ohio can navigate this process effectively. 2. Types of Ohio Letters from Debtors to Credit Card Companies: a. Ohio Letter from Debtor to Credit Card Company: Request for Temporary Reduction in Interest Rate: Ohio debtors can request a temporary reduction in their credit card interest rate. This type of letter is suitable when debtors are facing a short-term financial challenge or are undergoing temporary financial strain. b. Ohio Letter from Debtor to Credit Card Company: Request for Long-Term Reduction in Interest Rate: When a debtor in Ohio faces consistent financial difficulties, they can request a permanent reduction in their credit card interest rate through this type of letter. This letter highlights an ongoing need for lower rates to facilitate better financial management. 3. Letter Content: a. Greeting and Introduction: Begin the letter by addressing the credit card company directly and provide a brief introduction, identifying yourself as a valued customer. b. Explanation of Financial Hardship: Reveal the reasons for your temporary or long-term financial difficulties in a clear, concise manner. This can include job loss, medical expenses, or any other relevant circumstances contributing to your financial strain. c. Request for Lower Interest Rate: Clearly state your request for a lower interest rate for a certain period, supporting it with logical arguments. Mention any specific rate reduction you have in mind, ensuring it is reasonable. d. Explanation of Positive Financial Management: Demonstrate your commitment to responsible financial management by highlighting steps you have taken or plan to take to improve your financial situation. This can include budgeting, seeking additional income, or attending financial planning workshops. e. Supporting Documents: If applicable, provide copies of relevant supporting documents such as pay stubs, medical bills, or unemployment records to validate your financial hardship claims. f. Closing Statement: Conclude the letter by thanking the credit card company for their consideration and expressing your hope for a positive resolution to your request. Provide your contact information for further communication. 4. Conclusion: Writing an Ohio Letter from Debtor to Credit Card Company: Requesting a Lower Interest Rate for a Certain Period of Time requires careful consideration of individual circumstances. By following the guidelines above, Ohio debtors can effectively communicate their financial struggles and convey a compelling case for a reduced interest rate. Remember to adapt the letter to the specific situation and maintain a respectful tone throughout the communication process.

Ohio Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

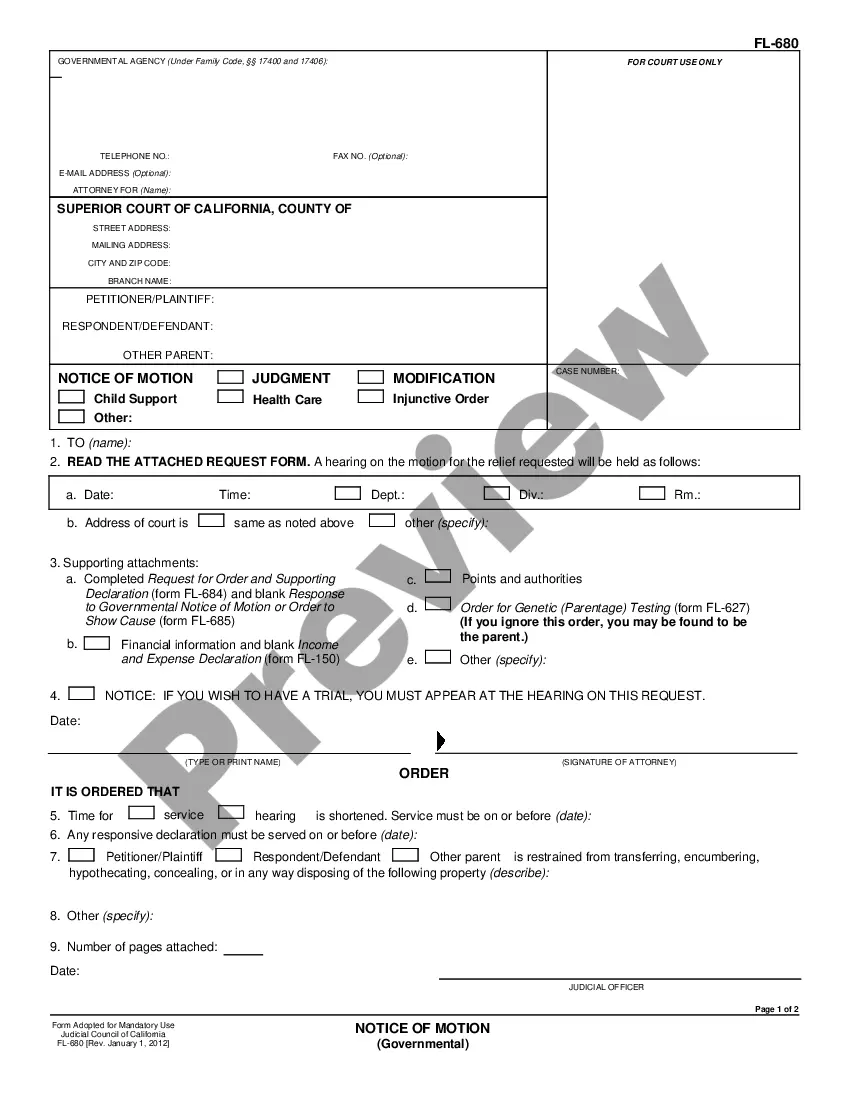

How to fill out Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

Discovering the right authorized file format can be a have difficulties. Needless to say, there are a variety of web templates available on the Internet, but how can you discover the authorized form you want? Take advantage of the US Legal Forms site. The services provides a huge number of web templates, including the Ohio Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, that can be used for business and private demands. All of the forms are checked by professionals and fulfill state and federal needs.

In case you are already authorized, log in to the accounts and then click the Download key to get the Ohio Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Utilize your accounts to check through the authorized forms you may have purchased previously. Proceed to the My Forms tab of the accounts and have yet another copy from the file you want.

In case you are a new end user of US Legal Forms, here are simple instructions so that you can stick to:

- Initial, make sure you have selected the proper form to your city/state. You can look over the shape utilizing the Review key and browse the shape outline to ensure this is the best for you.

- When the form does not fulfill your preferences, use the Seach field to discover the right form.

- When you are certain that the shape is proper, select the Acquire now key to get the form.

- Select the rates prepare you want and type in the necessary info. Design your accounts and pay money for the order utilizing your PayPal accounts or bank card.

- Choose the data file structure and acquire the authorized file format to the gadget.

- Total, change and printing and signal the acquired Ohio Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

US Legal Forms is definitely the biggest local library of authorized forms in which you can find numerous file web templates. Take advantage of the service to acquire professionally-made files that stick to status needs.

Form popularity

FAQ

Reducing the credit card interest rate is indeed possible if you communicate effectively with your credit card provider. Present your current financial situation and why you need a lower rate, possibly using the 'Ohio Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.' Many companies are willing to negotiate, especially if you have a good payment history. Persistence and clear communication can lead to better rates.

Absolutely, you can ask your credit card company to lower your interest rate. Many companies are open to negotiating terms, especially if you have a good payment history. Utilize the Ohio Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time to formalize your request. Doing so increases your chances of getting a favorable outcome.

California has a statute of limitations of four years for most types of debt (20 years for state tax debt). The only exception are debts taken on via an oral contract, which are subject to a statute of limitations of two years. Be careful about paying or promising to pay debts that exceed the statute of limitations.

How Long Can a Debt Collector Pursue an Old Debt? Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

You can negotiate a lower interest rate on your credit card by calling your credit card issuerparticularly the issuer of the account you've had the longestand requesting a reduction.

I am writing this letter to state that on (Day) i.e. (Date), I got relieved from your (Company/ Organization) but my full and final settlement has not been done. I request you to kindly do the full and final settlement and send me all dues (if any).

It's often possible to negotiate terms, interest rates, and payments on credit card debt. You can also try to negotiate a settlement of the amount you owe. The steps you take and the options available will depend on your situation and the credit card company you're dealing with.

Writing the Settlement Offer LetterInclude your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

Ohio's statute of limitations is six years no matter the type of debt. And the six years is counted from the date a debt became overdue or when you last made a payment, whichever was more recent. If the timeframe is more than six years, a creditor cannot sue to collect the debt.

Once a judgment is obtained by a creditor, it remains in effect for years. Although the judgment can become dormant, it can be revived. This means your creditors can execute a judgment against you even five years after it is ordered.