Ohio Monthly Retirement Planning refers to the process of strategizing and preparing for one's retirement in the state of Ohio on a monthly basis. It involves evaluating and maximizing various financial resources, such as pension, social security benefits, personal savings, and investments, with the aim of ensuring a secure and comfortable retirement lifestyle. One of the key aspects of Ohio Monthly Retirement Planning is developing an effective budgeting system that accommodates both regular expenses and future retirement needs. This includes accounting for healthcare expenses, insurance premiums, housing costs, daily living expenses, hobbies, and potential long-term care needs. By doing so, individuals can ensure that their retirement income can sufficiently cover their lifestyle requirements. Another critical consideration in Ohio Monthly Retirement Planning is assessing different retirement savings options and investment vehicles available in the state. This may include understanding and utilizing employer-sponsored retirement plans like 401(k) or 403(b), individual retirement accounts (IRA), annuities, and other investment opportunities. Efficiently allocating funds among these options can help to maximize returns and provide a reliable income stream during retirement. Furthermore, it is important to evaluate tax planning strategies within the context of Ohio Monthly Retirement Planning. This may involve understanding the state-specific tax laws and regulations regarding retirement income, Social Security benefits taxation, and property tax exemptions for seniors. Optimizing tax strategies can help retirees retain more of their income and potentially reduce their tax burden. Various types of Ohio Monthly Retirement Planning strategies exist to cater to individuals' unique needs and preferences. Some examples include: 1. Social Security Optimization Planning: This involves analyzing the most advantageous claiming strategies for Social Security benefits, such as waiting until full retirement age or delaying benefits to maximize monthly payments. 2. Estate Planning: Focusing on preserving and transferring wealth efficiently to future generations while minimizing estate taxes through strategies like wills, trusts, and powers of attorney. 3. Medicare and Healthcare Planning: Examining healthcare options, including Medicare, supplemental insurance plans, and long-term care coverage to ensure comprehensive health coverage during retirement. 4. Investment and Portfolio Management: Utilizing investment strategies that align with an individual's risk tolerance and retirement goals, such as diversification, asset allocation, and periodic rebalancing. In conclusion, Ohio Monthly Retirement Planning involves a comprehensive analysis of an individual's financial situation, retirement goals, and resources available in the state. By incorporating various strategies and considerations, individuals can achieve financial security and peace of mind throughout their retirement years.

Ohio Monthly Retirement Planning

Description

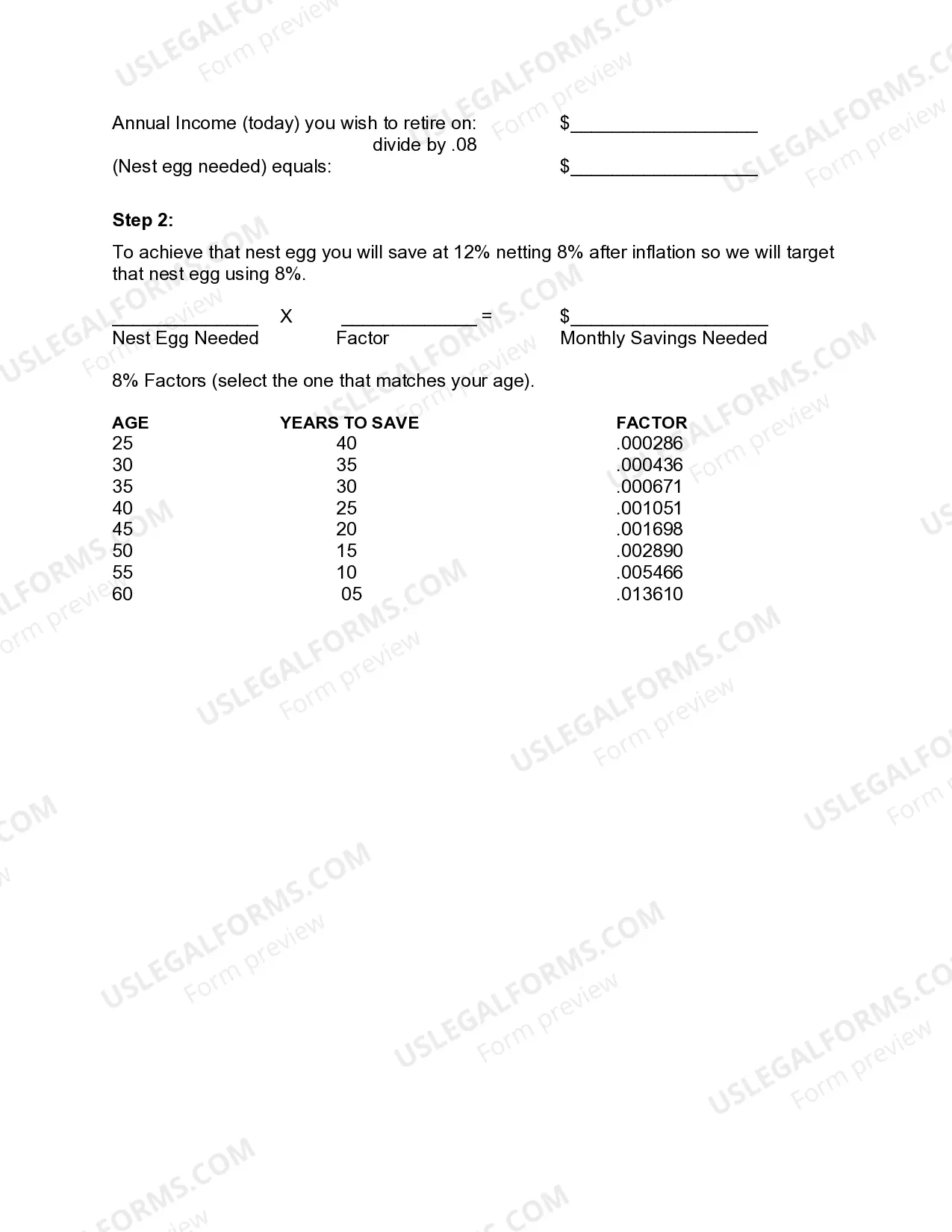

How to fill out Monthly Retirement Planning?

US Legal Forms - among the largest libraries of authorized types in the United States - gives a wide range of authorized file themes you can obtain or printing. Using the site, you can find a large number of types for organization and person purposes, sorted by categories, says, or keywords and phrases.You will find the most recent models of types much like the Ohio Monthly Retirement Planning in seconds.

If you already possess a monthly subscription, log in and obtain Ohio Monthly Retirement Planning from the US Legal Forms library. The Download option can look on each kind you see. You gain access to all formerly downloaded types in the My Forms tab of your respective bank account.

If you wish to use US Legal Forms for the first time, listed below are basic recommendations to help you get started off:

- Ensure you have chosen the best kind for your city/state. Click the Preview option to review the form`s information. See the kind information to actually have selected the correct kind.

- When the kind does not match your specifications, utilize the Lookup industry on top of the display to obtain the the one that does.

- In case you are happy with the shape, confirm your choice by visiting the Get now option. Then, choose the pricing prepare you prefer and supply your credentials to register for the bank account.

- Procedure the transaction. Make use of your Visa or Mastercard or PayPal bank account to finish the transaction.

- Find the format and obtain the shape in your product.

- Make alterations. Load, revise and printing and indication the downloaded Ohio Monthly Retirement Planning.

Every web template you added to your account does not have an expiration date which is yours permanently. So, in order to obtain or printing another duplicate, just visit the My Forms segment and click on on the kind you need.

Gain access to the Ohio Monthly Retirement Planning with US Legal Forms, the most considerable library of authorized file themes. Use a large number of specialist and status-distinct themes that fulfill your organization or person demands and specifications.

Form popularity

FAQ

How are my Social Security retirement benefits calculated? Social Security benefits are based on earnings averaged over most of a worker's lifetime. Your actual earnings are first adjusted or "indexed" to account for changes in average wages since the year the earnings were received.

Under the Defined Benefit Plan, your retirement income is determined by a calculation that uses your age at retirement, years of service credit and final average salary ( FAS ) the average of your five highest salary years.

Multiply the amount of service credit (years) you want to purchase by the contribution rate for your age. Multiply the result by your highest annual compensation earnable during the last three school years.

For members in Groups A and B, the retirement benefit calculated under the Traditional Pension Plan consists of an annual lifetime allowance equal to 2.2 percent of FAS, multiplied by the first 30 years of service plus 2.5 percent of FAS for each year, or partial year for service credit over 30.

Andrea may find the STRS Ohio Combined Plan is the best choice. This plan allows you to direct your investment choices, while providing benefits during teaching and retirement.

CalSTRS is required to withhold the 20%. You cannot opt out of federal tax withholding for eligible rollover distributions.

Your retirement income is based on a formula: You can retire early with an actuarially reduced benefit at age 60 with five years of service or age 55 with 29 years of service. Members can also retire early with a reduced benefit at any age with at least 30 years of service.

STRS Ohio will withhold federal tax at a rate of 20%. If you receive the payment before age 59-1/2, you may have to pay a 10% tax penalty for an early withdrawal.