Ohio Breakdown of Savings for Budget and Emergency Fund

Description

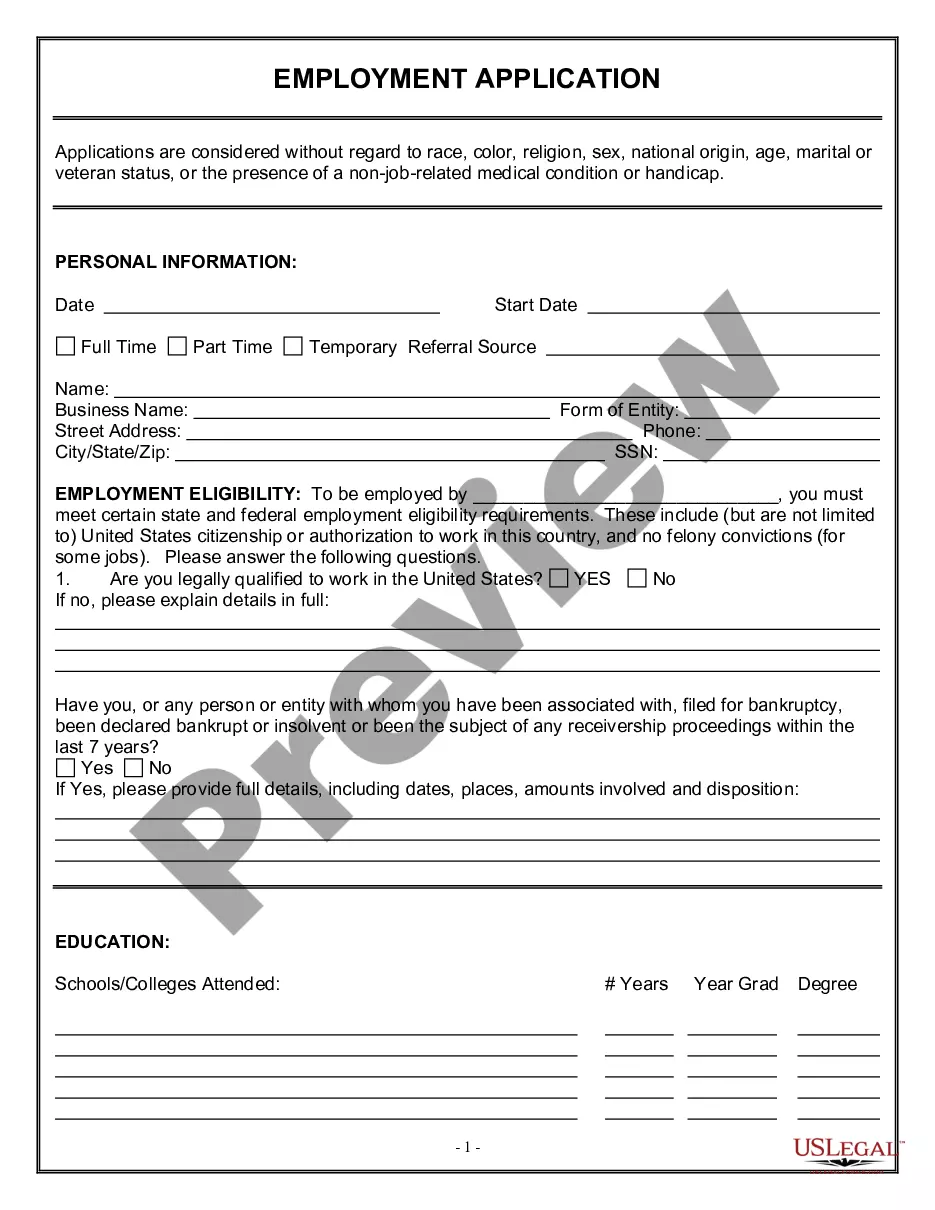

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

Have you ever entered a location where you are required to possess paperwork for either business or personal purposes almost daily.

There are numerous legal document templates accessible online, yet finding versions you can trust is not easy.

US Legal Forms provides thousands of form templates, such as the Ohio Breakdown of Savings for Budget and Emergency Fund, designed to meet federal and state requirements.

If you find the correct form, just click Get now.

Choose the pricing plan you desire, enter the required details to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Ohio Breakdown of Savings for Budget and Emergency Fund template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is for your specific state/region.

- Use the Review button to examine the document.

- Read the summary to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to locate the form that meets your needs and criteria.

Form popularity

FAQ

Standard advice says you should have at least three months' worth of savings put aside in a separate bank account that you only touch in emergencies. Other experts say this amount should be as much as one whole year's worth of cash.

Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment.

Most experts believe you should have enough money in your emergency fund to cover at least 3 to 6 months' worth of living expenses.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

Having savings set aside in an emergency fund provides a great source of comfort should something unforeseen like job loss or illness happens.

It's all about your personal expenses Those include things like rent or mortgage payments, utilities, healthcare expenses, and food. If your monthly essentials come to $2,500 a month, and you're comfortable with a four-month emergency fund, then you should be set with a $10,000 savings account balance.

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

An emergency fund is necessary for peace of mind and smoothing out financial bumps in the road. Let's look at the average emergency fund size by age and how much we should have. According to Federal Reserve data, the average savings amount is $8,863 in America as of 2019.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.