Ohio Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Are you presently in a placement where you need paperwork for either company or person purposes nearly every time? There are tons of legal file themes available on the net, but getting kinds you can depend on isn`t simple. US Legal Forms offers a huge number of type themes, such as the Ohio Challenge to Credit Report of Experian, TransUnion, and/or Equifax, which are published to satisfy state and federal specifications.

When you are already informed about US Legal Forms website and get a free account, basically log in. Afterward, you are able to acquire the Ohio Challenge to Credit Report of Experian, TransUnion, and/or Equifax template.

Should you not provide an account and need to begin using US Legal Forms, abide by these steps:

- Get the type you need and make sure it is for the proper city/area.

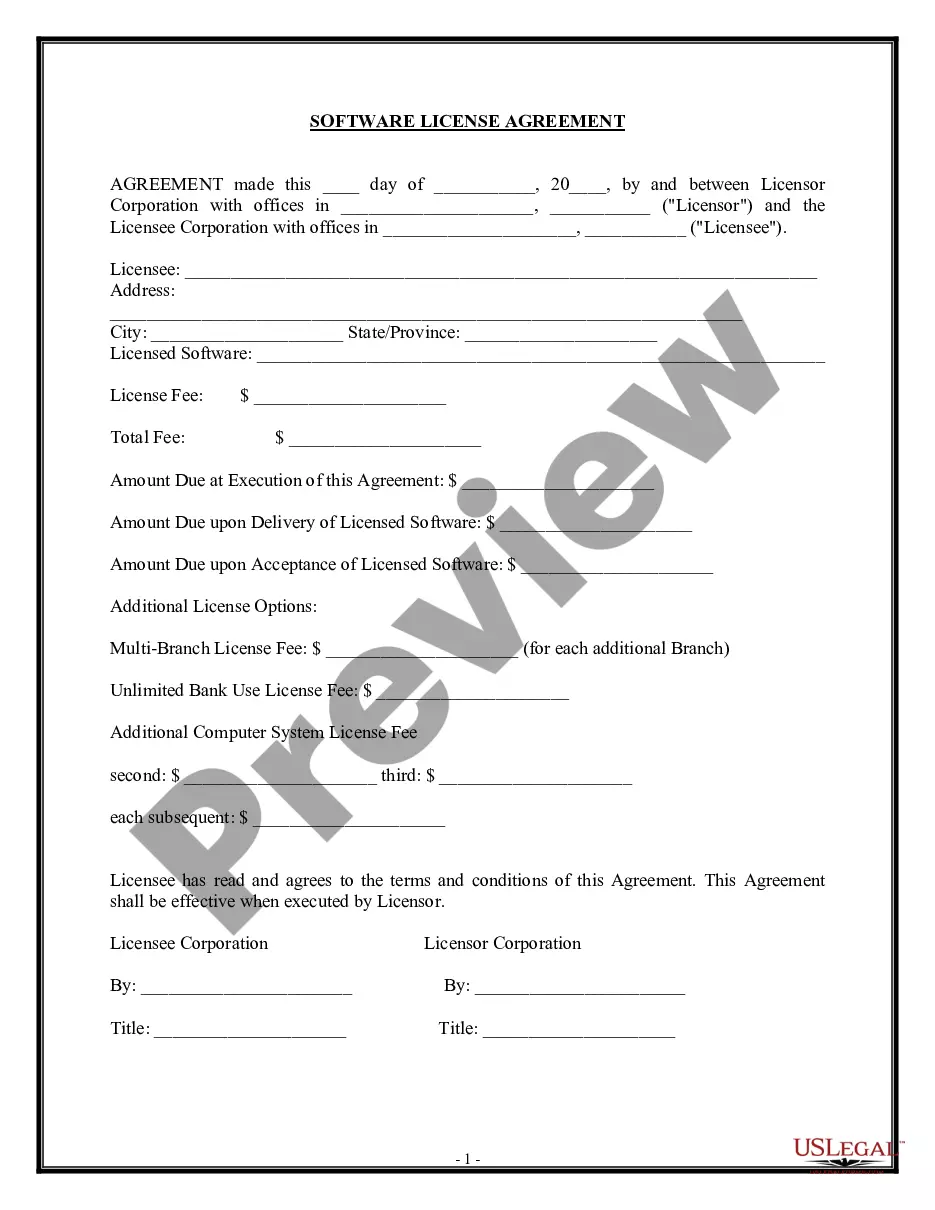

- Take advantage of the Preview switch to check the shape.

- See the information to ensure that you have chosen the appropriate type.

- In the event the type isn`t what you are seeking, take advantage of the Look for industry to find the type that meets your requirements and specifications.

- When you find the proper type, click on Get now.

- Opt for the pricing prepare you would like, fill in the necessary information and facts to generate your account, and buy an order using your PayPal or charge card.

- Decide on a practical data file formatting and acquire your copy.

Locate all the file themes you may have purchased in the My Forms food selection. You can obtain a additional copy of Ohio Challenge to Credit Report of Experian, TransUnion, and/or Equifax any time, if necessary. Just click the essential type to acquire or print out the file template.

Use US Legal Forms, one of the most considerable variety of legal varieties, in order to save time and steer clear of mistakes. The support offers appropriately manufactured legal file themes which you can use for a range of purposes. Produce a free account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports. And if you're willing, you can spend big bucks on templates for these magical dispute letters.

Dispute mistakes with the credit bureaus. You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureau's dispute form (if they have one), copies of documents that support your dispute, and keep records of everything you send.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

The law was passed in 1970 and amended twice. It is primarily aimed at the three major credit reporting agencies ? Experian, Equifax and TransUnion ? because of the widespread use of the information those bureaus collect and sell.

You have rights under federal law if this happens to you. The Fair Credit Reporting Act (FCRA) is the federal law that, among other rights, gives you the right to dispute incomplete or inaccurate information. The credit reporting company must take certain steps when you notify them of an error.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

What do I do if I see an inquiry I don't recognize on my credit report? Contact the lender directly to ask them about the inquiry. If they find it was made in error, ask them to inform the credit reporting agencies. If the lender finds the inquiry was made fraudulently, report it to the FTC.

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.