Ohio Joint-Venture Agreement - Speculation in Real Estate

Description

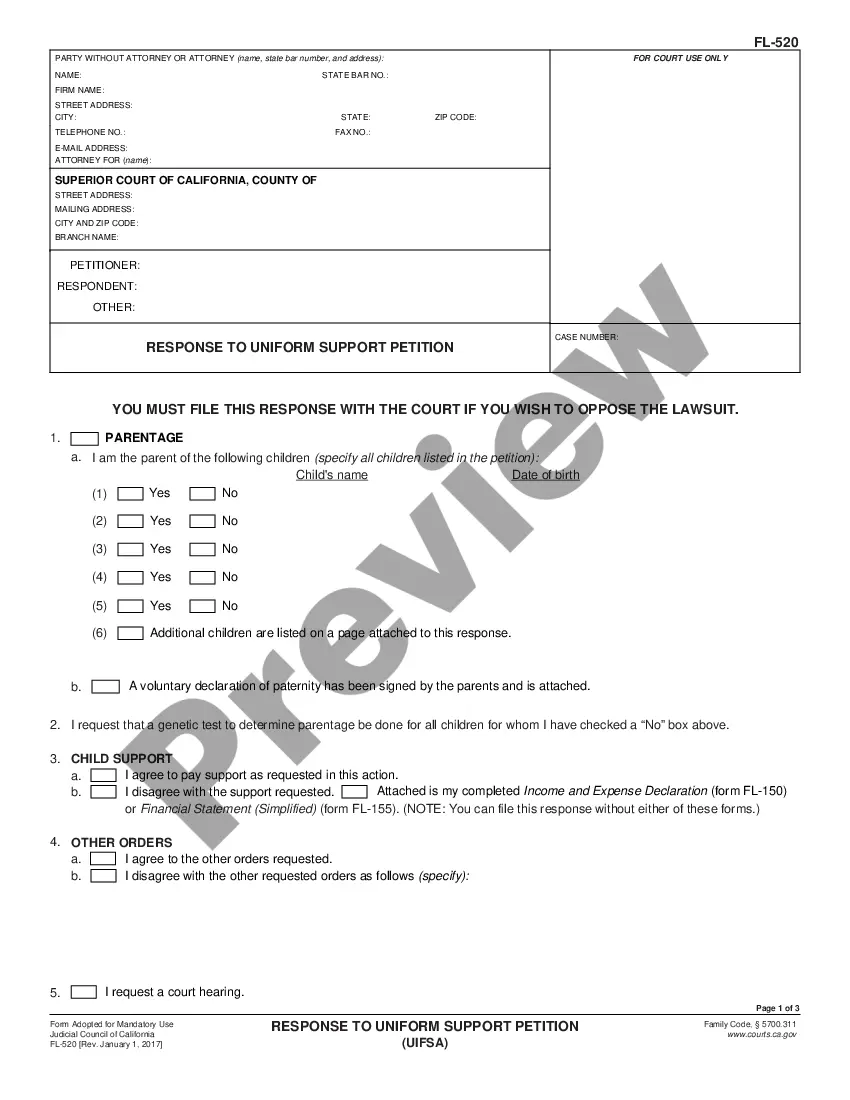

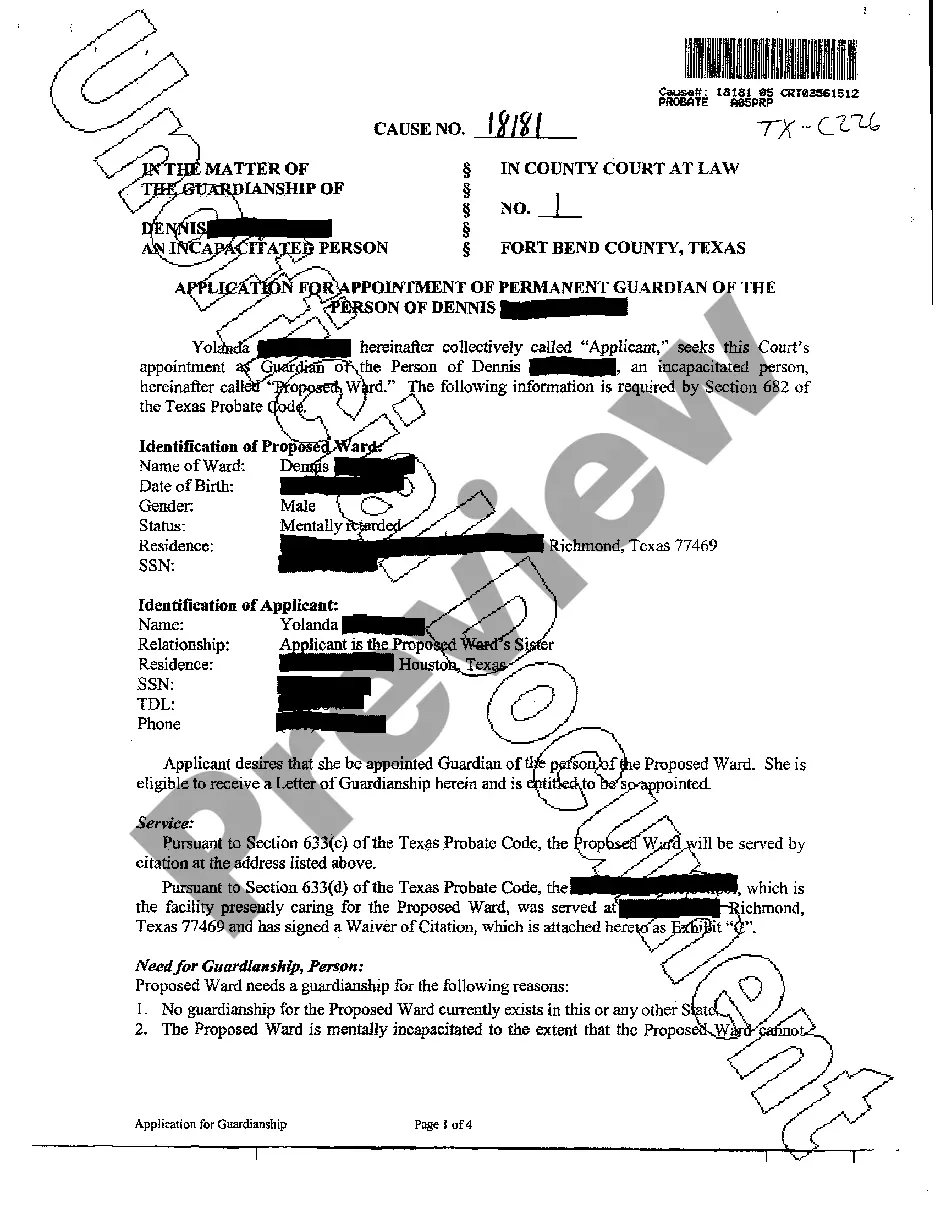

How to fill out Joint-Venture Agreement - Speculation In Real Estate?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document formats that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms such as the Ohio Joint-Venture Agreement - Speculation in Real Estate in a matter of minutes.

If you already have a monthly subscription, Log In and download the Ohio Joint-Venture Agreement - Speculation in Real Estate from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously obtained forms in the My documents section of your account.

Make edits. Fill out, modify, and print and sign the downloaded Ohio Joint-Venture Agreement - Speculation in Real Estate.

Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you require.

- Make sure you have selected the correct form for your city/region. Click the Review button to examine the contents of the form.

- Review the form description to ensure you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the template, confirm your selection by clicking the Download now button. Next, choose the pricing plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

In the property market, a joint venture is a temporary but formalised partnership of builders, finance houses and developers, which contract with each other for a particular development project, such as a housing estate, often through the creation of a temporary subsidiary company called a Special Purpose Vehicle (SPV)

Courts permit a contract for partnership to be implied without any formal agreement. To determine whether a joint venture has been formed, courts consider whether each party has agreed to contribute money, assets, labor or skill with the understanding that profits will be shared between them.

A joint venture in real estate is when two or more investors combine their resources for a property development or investment. Despite working together, each party maintains their own unique business identity while working together on a deal.

A real estate joint venture contract is an agreement between two or more individuals or businesses who have decided to put their money and other resources together to purchase real estate.

Commercial real estate can be an excellent diversifier to an existing investment portfolio. Investors with significant capital may consider investing in real estate through a joint venture.

A real estate joint venture (JV) is a deal between multiple parties to work together and combine resources to develop a real estate project. Most large projects are financed and developed as a result of real estate joint ventures.

Advantages of joint venture One of the most important joint venture advantages is that it can help your business grow faster, increase productivity and generate greater profits. Other benefits of joint ventures include: access to new markets and distribution networks. increased capacity.

A joint venture agreement is legally binding like other contracts.

The parties set out to accomplish a specific, mutually beneficial goal. Both parties contribute resources, share ownership of the joint venture's assets and liabilities, and share in the implementation of the project. The joint venture is temporary (but can be short or longer-term), dissolving once the goal is reached.

In a joint venture between two corporations, each corporation invents an agreed upon portion of capital or resources to fund the venture. A joint venture may have a 50-50 ownership split, or another split like 60-40 or 70-30.