Ohio Jury Instruction — 10.10.6 Section 6672 Penalty is a legal instruction that provides guidance to the jury regarding the penalties associated with Section 6672 of the Ohio Revised Code. This section of the code deals with penalties for individuals who have willfully failed to collect, account for, or pay over certain federal taxes, such as income tax or Social Security tax, withheld from employee wages. Under this section, there are different types of penalties that can be imposed based on the specific circumstances of the case. These penalties include: 1. Civil Penalty: In cases where an individual is found guilty of willful failure to withhold and pay over taxes, the jury may be instructed on the possibility of imposing a civil penalty. This penalty typically involves the payment of an amount equal to the unpaid taxes, along with interest and potential late payment penalties. 2. Criminal Penalty: In more severe cases, the jury may be instructed on the potential for a criminal penalty. Criminal penalties can result in fines and imprisonment. The severity of the penalty will depend on the amount of tax involved and the degree of willfulness exhibited by the defendant. It is important for the jury to carefully consider the evidence and instructions provided in determining the appropriate penalty to be imposed. They must evaluate whether the defendant knowingly and intentionally failed to collect, account for, or pay over the taxes in question, and whether this failure was willful. In determining the penalty, the jury may also take into account any mitigating factors presented by the defense, such as the defendant's previous tax compliance history, cooperation with authorities, and any financial or personal hardships that may have contributed to the failure to pay. It is crucial for the jury to fully understand their role in determining the correct penalty in accordance with the law. Their decision will have significant consequences for both the defendant and the government, and it is important to ensure a fair and just outcome. Overall, Ohio Jury Instruction — 10.10.6 Section 6672 Penalty provides clear guidance to the jury regarding the potential penalties associated with willful failure to withhold and pay over certain federal taxes. It aids in ensuring that the jury comprehends the legal framework for determining an appropriate penalty and delivers a fair verdict based on the evidence presented.

Ohio Jury Instruction - 10.10.6 Section 6672 Penalty

Description

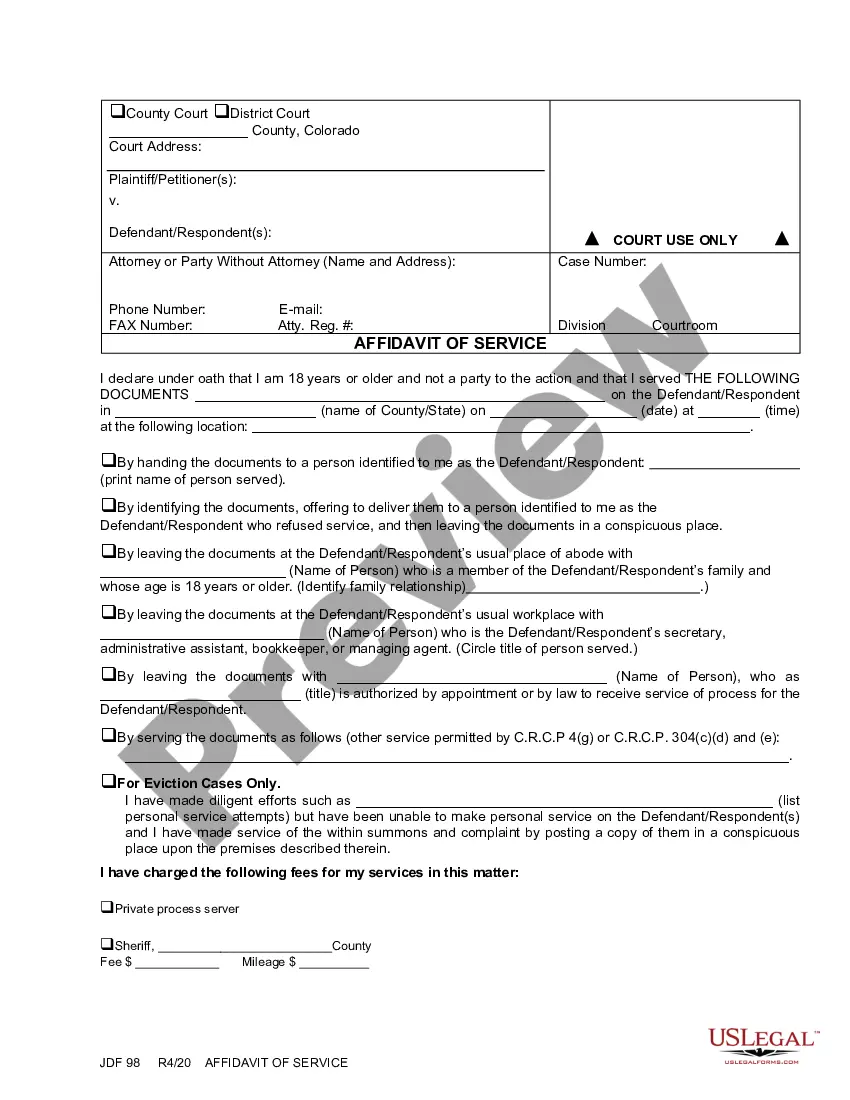

How to fill out Ohio Jury Instruction - 10.10.6 Section 6672 Penalty?

It is possible to spend several hours on the Internet searching for the lawful record format which fits the state and federal demands you want. US Legal Forms provides a huge number of lawful types that happen to be evaluated by experts. It is possible to obtain or printing the Ohio Jury Instruction - 10.10.6 Section 6672 Penalty from your support.

If you currently have a US Legal Forms profile, it is possible to log in and click on the Download button. Next, it is possible to full, revise, printing, or indicator the Ohio Jury Instruction - 10.10.6 Section 6672 Penalty. Each lawful record format you acquire is yours eternally. To have one more version for any purchased kind, visit the My Forms tab and click on the related button.

If you work with the US Legal Forms web site initially, adhere to the basic recommendations below:

- Initial, make certain you have selected the proper record format for that state/metropolis that you pick. Look at the kind information to ensure you have picked out the proper kind. If accessible, make use of the Review button to look with the record format at the same time.

- In order to locate one more version of your kind, make use of the Lookup discipline to discover the format that suits you and demands.

- Once you have located the format you would like, click on Get now to proceed.

- Pick the rates program you would like, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You should use your credit card or PayPal profile to pay for the lawful kind.

- Pick the structure of your record and obtain it to the product.

- Make alterations to the record if possible. It is possible to full, revise and indicator and printing Ohio Jury Instruction - 10.10.6 Section 6672 Penalty.

Download and printing a huge number of record layouts while using US Legal Forms website, which offers the largest selection of lawful types. Use professional and express-particular layouts to take on your small business or person demands.