Ohio Jury Instruction — 4.4.1 Rule 10(b— - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading Description: Ohio Jury Instruction — 4.4.1 Rule 10(b— - 5(a) refers to a specific legal provision related to insider trading and fraudulent activities within the state of Ohio. This instruction guides jurors on how to assess a case involving the use of devices, schemes, or artifices to defraud in connection with insider trading. Keywords: Ohio Jury Instruction, Rule 10(b), 5(a), device, scheme, artifice, defraud, insider trading. Insider trading refers to the practice of trading securities (stocks, bonds, etc.) based on confidential or non-public information that affects the price of those securities. It is considered illegal and is a violation of securities laws. The Ohio Jury Instruction — 4.4.1 Rule 10(b— - 5(a) specifically deals with cases where fraudulent activities utilizing various devices, schemes, or artifices are employed to defraud individuals or market participants in relation to insider trading. It aims to help the jury understand the complexities of such cases and ensure fair judgment. Types of Ohio Jury Instruction — 4.4.1 Rule 10(b— - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading: 1. Deceptive Devices: This involves the use of deceptive tactics, misrepresentations, or omissions of material facts to manipulate securities prices. Examples include spreading false rumors, spreading misleading information, or providing false documents. 2. Manipulative Schemes: Manipulative schemes involve actions or strategies with the intent to artificially inflate or deflate the price of securities. Common manipulative schemes may include wash trading, matched orders, or pump-and-dump schemes. 3. Artifices to Defraud: Artifice refers to a clever or cunning strategy employed to deceive or defraud someone. In the context of insider trading, artifices to defraud involve intentionally deceiving others by misusing non-public information for personal or financial gain. It is important to note that Ohio Jury Instruction — 4.4.1 Rule 10(b— - 5(a) is focused on cases related to insider trading and fraudulent activities. The instruction guides the jury in understanding the various methods and strategies used by individuals to engage in illegal practices, allowing for a fair analysis of the evidence presented during the trial. By following this instruction, jurors can better comprehend the nature of the alleged fraud and assess whether the accused party knowingly and intentionally used devices, schemes, or artifices to defraud in connection with insider trading. Overall, this instruction plays a vital role in upholding the integrity of Ohio's legal system and ensuring justice for those involved in insider trading cases.

Ohio Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading

Description

How to fill out Ohio Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading?

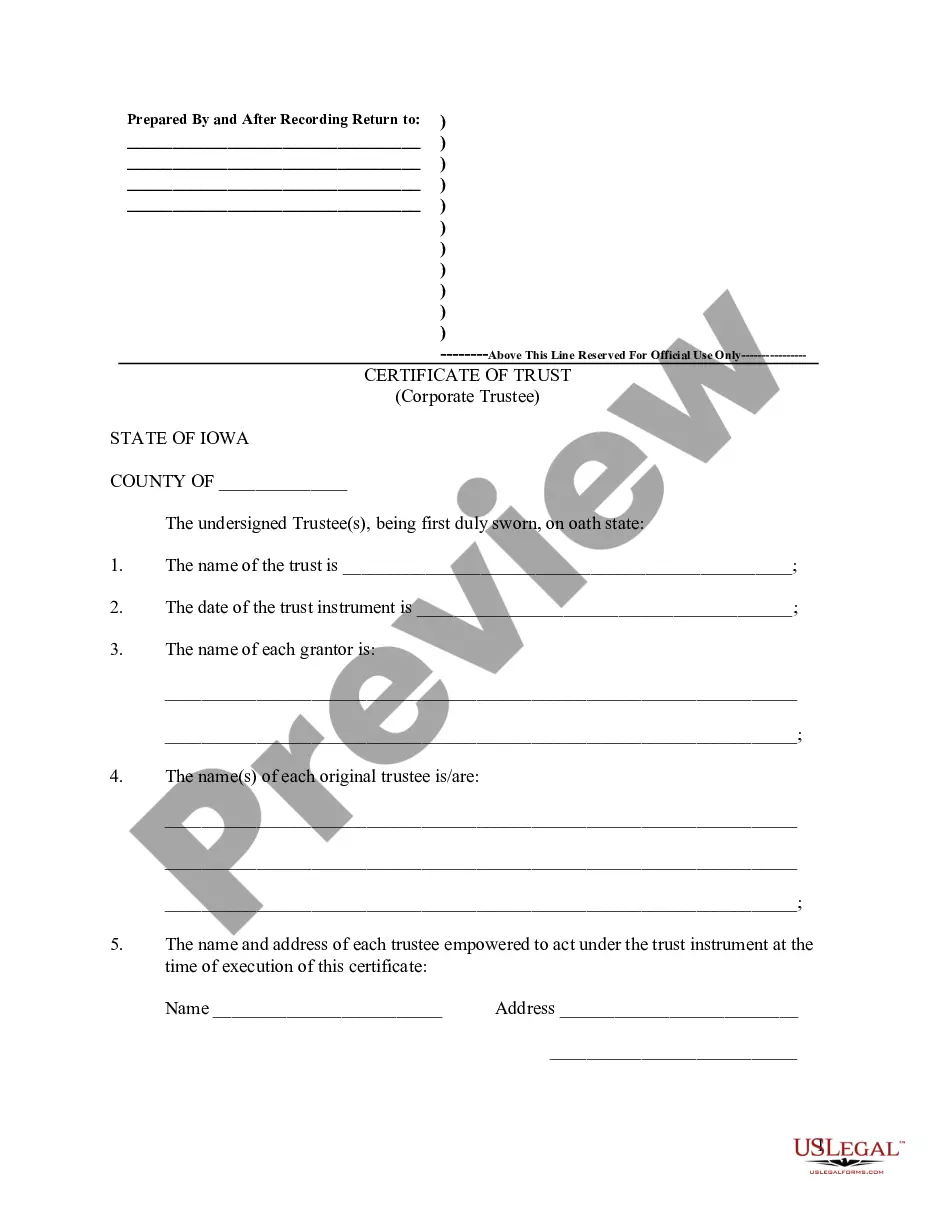

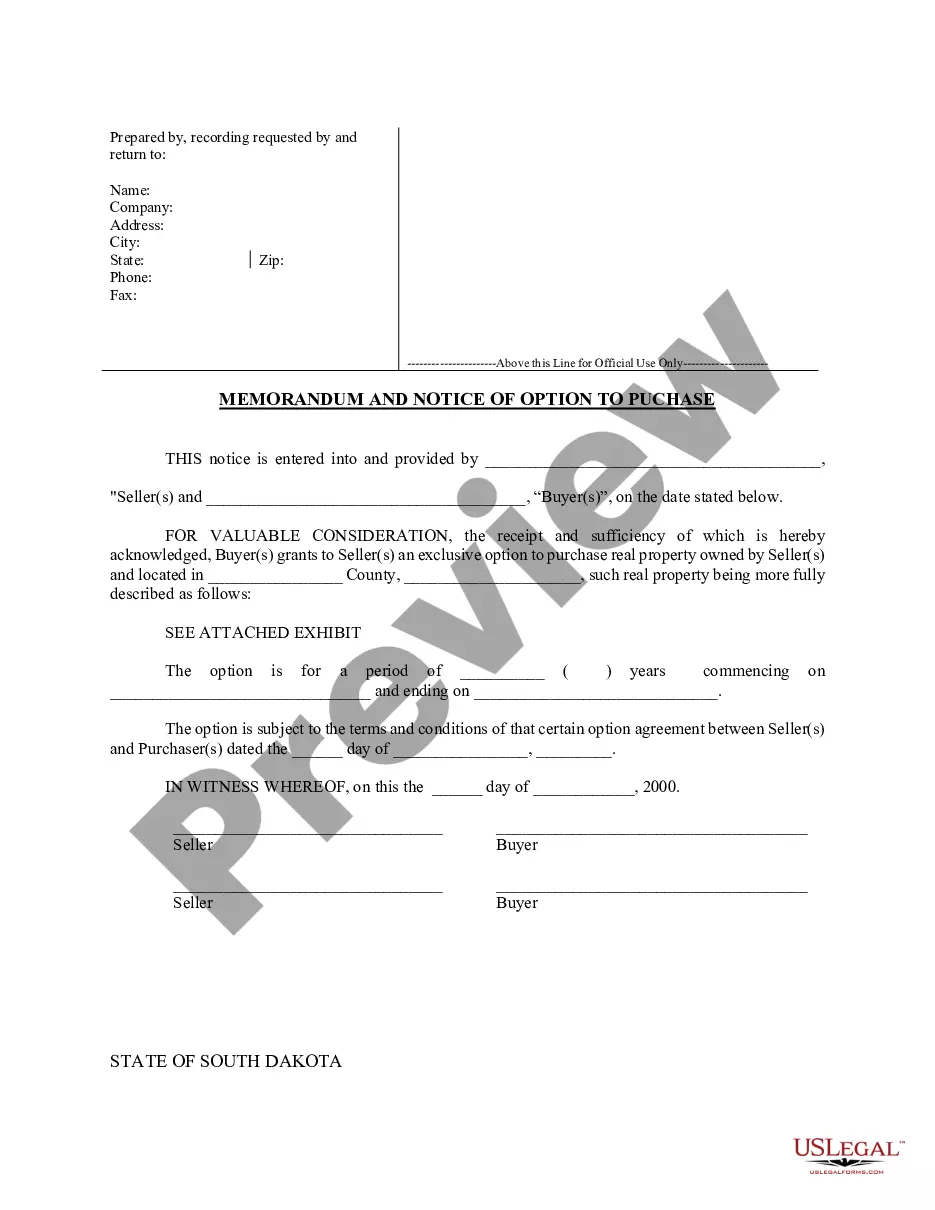

You may commit hrs online searching for the authorized file design which fits the state and federal requirements you will need. US Legal Forms supplies a huge number of authorized kinds that happen to be analyzed by pros. It is possible to download or printing the Ohio Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading from your service.

If you already possess a US Legal Forms accounts, you can log in and click on the Download key. Following that, you can full, change, printing, or signal the Ohio Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading. Every authorized file design you get is the one you have permanently. To acquire one more copy associated with a acquired type, proceed to the My Forms tab and click on the related key.

Should you use the US Legal Forms website the very first time, keep to the straightforward recommendations below:

- Initial, be sure that you have selected the correct file design for the region/area that you pick. Read the type description to ensure you have selected the proper type. If readily available, make use of the Preview key to appear through the file design at the same time.

- If you wish to find one more variation from the type, make use of the Research discipline to discover the design that meets your needs and requirements.

- After you have discovered the design you would like, simply click Acquire now to carry on.

- Select the costs prepare you would like, type your references, and register for an account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal accounts to fund the authorized type.

- Select the file format from the file and download it to the device.

- Make alterations to the file if necessary. You may full, change and signal and printing Ohio Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading.

Download and printing a huge number of file templates utilizing the US Legal Forms site, that offers the biggest variety of authorized kinds. Use expert and state-certain templates to handle your company or personal demands.

Form popularity

FAQ

Jury instructions are instructions for jury deliberation that are written by the judge and given to the jury. At trial, jury deliberation occurs after evidence is presented and closing arguments are made.

The judge will advise the jury that it is the sole judge of the facts and of the credibility (believability) of witnesses. He or she will note that the jurors are to base their conclusions on the evidence as presented in the trial, and that the opening and closing arguments of the lawyers are not evidence.

The idea behind a limiting instruction is that it is better to admit relevant and probative evidence, even in a limited capacity, and take the chance that the jury will properly apply it in its decision making, rather than to exclude it altogether.

PATTERN JURY INSTRUCTIONS WHICH PROVIDE A BODY OF BRIEF, UNIFORM INSTRUCTIONS THAT FULLY STATE THE LAW WITHOUT NEEDLESS REPETION ARE PRESENTED; BASIC, SPECIAL, OFFENSE, AND TRIAL INSTRUCTIONS ARE INCLUDED.

The Ohio Jury Instructions (OJI) are written by a committee of the Ohio Judicial Conference. The Law Library has the OJI in its Westlaw database, Lexis ebooks (Overdrive) as well as in print. You can buy Ohio Jury Instructions in print or electronically from LexisNexis.

The Texas Pattern Jury Charges series is widely accepted by attorneys and judges as the most authoritative guide for drafting questions, instructions, and definitions in a broad variety of cases.

It is not required that the government prove guilt beyond all possible doubt. A reasonable doubt is a doubt based upon reason and common sense and is not based purely on speculation. It may arise from a careful and impartial consideration of all the evidence, or from lack of evidence.