The Ohio Investment Management Agreement for Separate Account Clients is a legally binding document that outlines the terms and conditions between an investment management firm and its clients in the state of Ohio. This agreement is specifically designed for clients who wish to have their investments managed on a separate account basis, providing them with a personalized investment strategy tailored to their specific needs and objectives. The agreement covers various crucial aspects such as the scope of the investment management services provided, the investment goals and objectives of the client, the investment strategy to be followed, and the related fees and expenses. It defines the roles and responsibilities of both parties, ensuring transparency and clarity in the client-advisor relationship. The Ohio Investment Management Agreement for Separate Account Clients typically includes provisions related to the investment authority granted to the investment manager. This grants the manager the discretion to make investment decisions on behalf of the client, such as buying or selling securities within certain set parameters. It also outlines the circumstances under which the investment manager may deviate from the agreed investment strategy, addressing any potential risks and limitations. Additionally, the agreement may specify the duration of the agreement and the procedures for terminating it, outlining the responsibilities of both the investment management firm and the client in such cases. It may also include clauses related to confidentiality, governing law, dispute resolution, and disclosure requirements, ensuring compliance with applicable regulations and protecting the interests of both parties involved. While the Ohio Investment Management Agreement for Separate Account Clients is a general term encompassing various types of agreements, specific account types can be mentioned. For instance, there may be separate agreements for taxable investment accounts, retirement accounts such as Individual Retirement Accounts (IRAs), or trusts. Each type of account may have its unique considerations and restrictions depending on the client's financial circumstances and objectives. In conclusion, the Ohio Investment Management Agreement for Separate Account Clients serves as a comprehensive framework ensuring a well-defined relationship between an investment management firm and its clients seeking personalized investment management services. By carefully addressing the key aspects of the agreement, it aims to establish clear expectations, protect the rights of both parties, and enable a successful investment journey for the clients.

Ohio Investment Management Agreement for Separate Account Clients

Description

How to fill out Ohio Investment Management Agreement For Separate Account Clients?

Have you been inside a situation in which you require files for sometimes organization or personal functions virtually every day time? There are a variety of legitimate file web templates available online, but discovering types you can trust isn`t straightforward. US Legal Forms provides thousands of form web templates, just like the Ohio Investment Management Agreement for Separate Account Clients, that happen to be created in order to meet federal and state requirements.

In case you are already familiar with US Legal Forms site and have a free account, simply log in. Next, you may acquire the Ohio Investment Management Agreement for Separate Account Clients web template.

If you do not offer an profile and would like to begin using US Legal Forms, follow these steps:

- Get the form you want and make sure it is for your appropriate city/county.

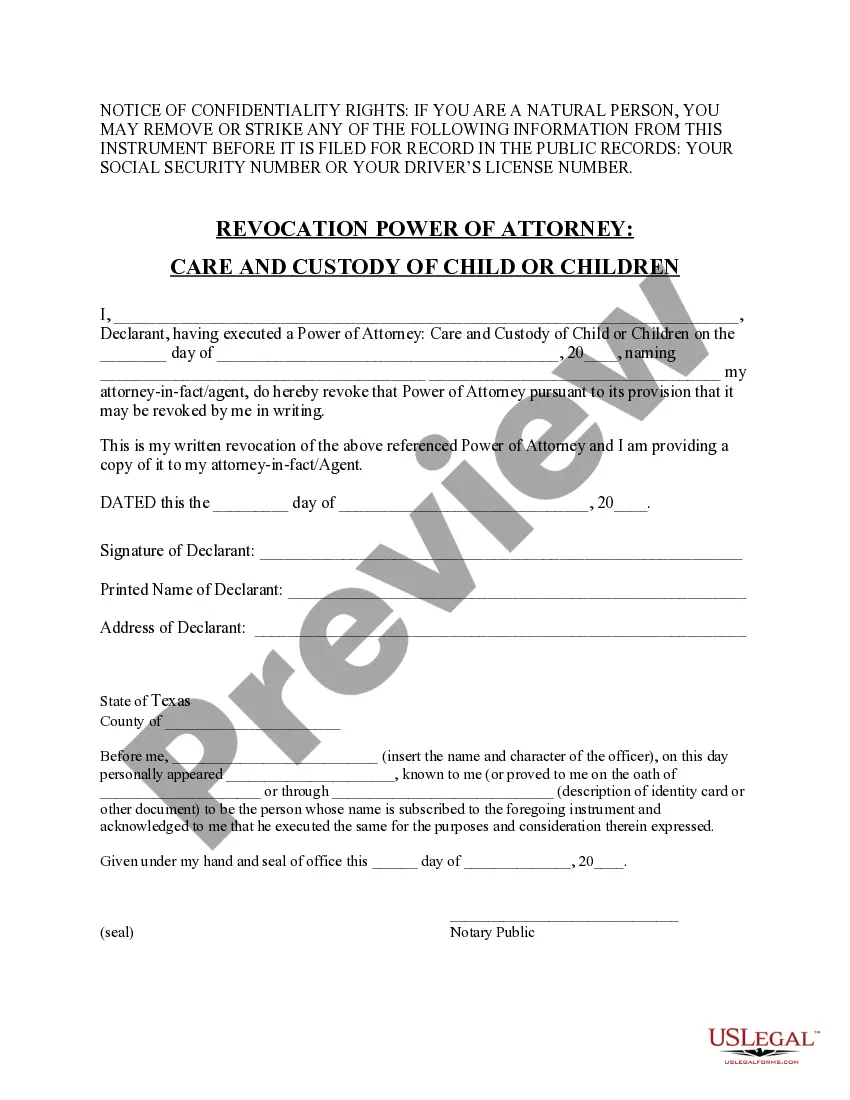

- Make use of the Preview key to examine the form.

- Look at the outline to ensure that you have chosen the appropriate form.

- When the form isn`t what you`re trying to find, utilize the Look for industry to discover the form that fits your needs and requirements.

- Whenever you discover the appropriate form, simply click Get now.

- Choose the prices strategy you want, submit the specified information to generate your money, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a practical paper file format and acquire your version.

Locate all of the file web templates you may have purchased in the My Forms menus. You may get a extra version of Ohio Investment Management Agreement for Separate Account Clients anytime, if needed. Just click the needed form to acquire or print out the file web template.

Use US Legal Forms, by far the most substantial assortment of legitimate forms, to save lots of some time and avoid errors. The assistance provides appropriately produced legitimate file web templates that can be used for a range of functions. Produce a free account on US Legal Forms and start generating your lifestyle easier.