Keywords: Ohio Partnership Buy-Sell Agreement, Fixing Value, Requiring Sale, Estate of Deceased Partner, Survivor Description: The Ohio Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor is a legal arrangement that establishes the terms and conditions under which the succession of a deceased partner's interest in an Ohio partnership will be handled. This agreement specifically addresses the valuation and sale of the deceased partner's share to the surviving partner. There are several types of Ohio Partnership Buy-Sell Agreements that Fix Value and Require Sale by Estate of Deceased Partner to Survivor, including: 1. Fixed Value Agreement: Under this type of agreement, the value of the deceased partner's interest is predetermined and fixed, typically based on a formula or appraisal method stated in the agreement. The surviving partner is obligated to purchase the deceased partner's share at the fixed value. 2. Appraised Value Agreement: In this type of agreement, the value of the deceased partner's share is determined through an independent appraisal process. The agreement sets out the procedure to be followed for valuing the interest, and the surviving partner is obliged to purchase the share at the determined appraised value. 3. Formula Value Agreement: This agreement utilizes a predetermined formula to establish the value of the deceased partner's interest. The formula may be based on factors such as book value, earnings, or a combination of financial indicators. The surviving partner is required to buy the share at the value calculated using the formula. The Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor provides clarity and guidance regarding the transfer of partnership interests upon the death of a partner. It aims to ensure a smooth transition, minimize disputes, and protect the interests of both the deceased partner's estate and the surviving partner. By establishing a fixed valuation and a mandatory sale between the estate and survivor, this agreement offers a clear mechanism for the orderly transfer of ownership in an Ohio partnership.

Ohio Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

Description

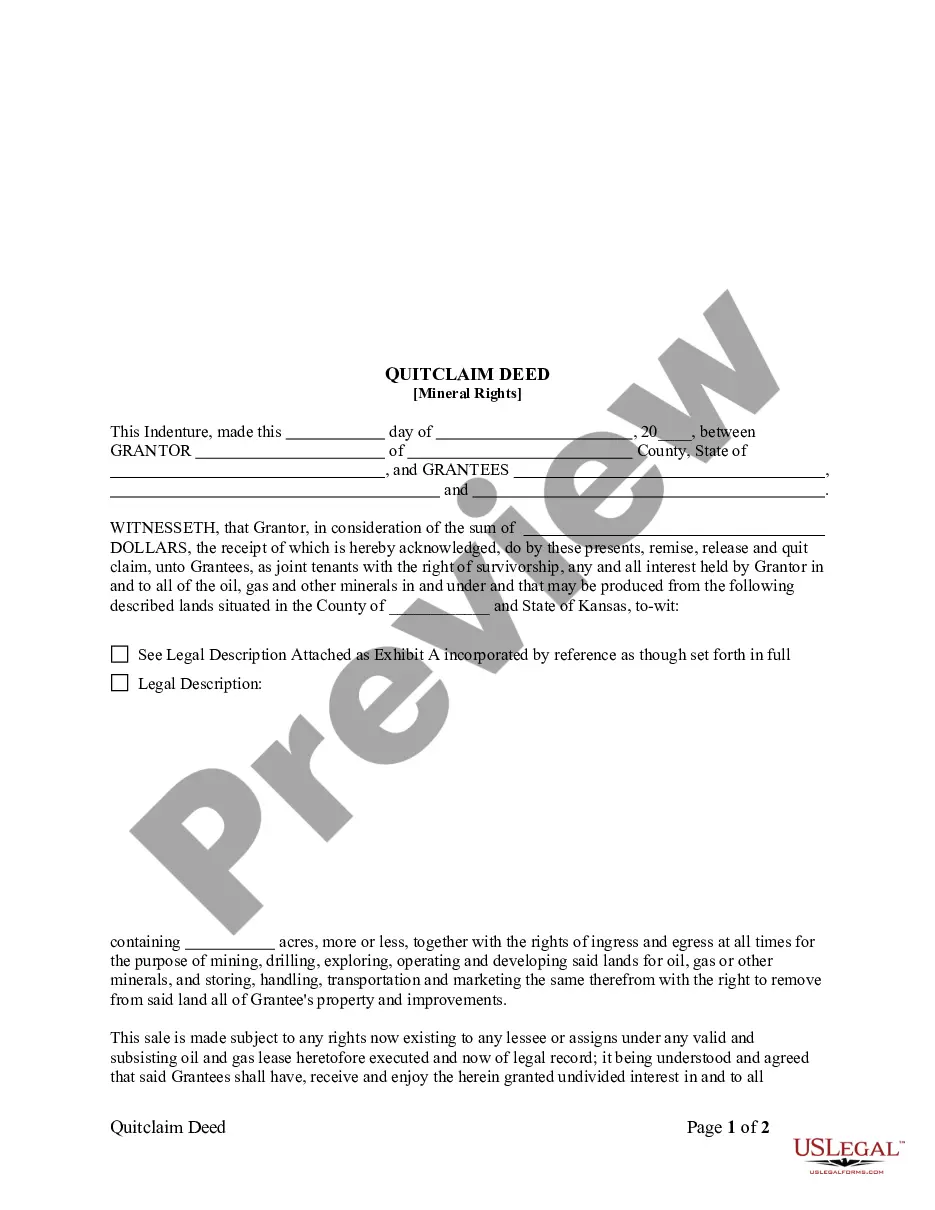

How to fill out Ohio Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor?

If you want to total, acquire, or produce authorized record themes, use US Legal Forms, the greatest selection of authorized types, that can be found on the web. Make use of the site`s simple and easy practical search to find the files you will need. Various themes for organization and person reasons are categorized by categories and suggests, or keywords. Use US Legal Forms to find the Ohio Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in a handful of clicks.

In case you are presently a US Legal Forms consumer, log in to your account and then click the Download switch to get the Ohio Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor. Also you can entry types you previously acquired within the My Forms tab of your own account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for the correct metropolis/region.

- Step 2. Utilize the Preview choice to look over the form`s information. Do not forget to learn the outline.

- Step 3. In case you are not happy with all the type, take advantage of the Look for discipline at the top of the display to locate other variations in the authorized type format.

- Step 4. Once you have identified the form you will need, select the Purchase now switch. Pick the rates strategy you choose and put your accreditations to sign up for the account.

- Step 5. Process the purchase. You can use your bank card or PayPal account to finish the purchase.

- Step 6. Choose the format in the authorized type and acquire it on your product.

- Step 7. Complete, modify and produce or indicator the Ohio Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor.

Every authorized record format you buy is yours eternally. You may have acces to every single type you acquired with your acccount. Select the My Forms segment and pick a type to produce or acquire once again.

Compete and acquire, and produce the Ohio Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor with US Legal Forms. There are many specialist and state-certain types you can utilize for your organization or person needs.

Form popularity

FAQ

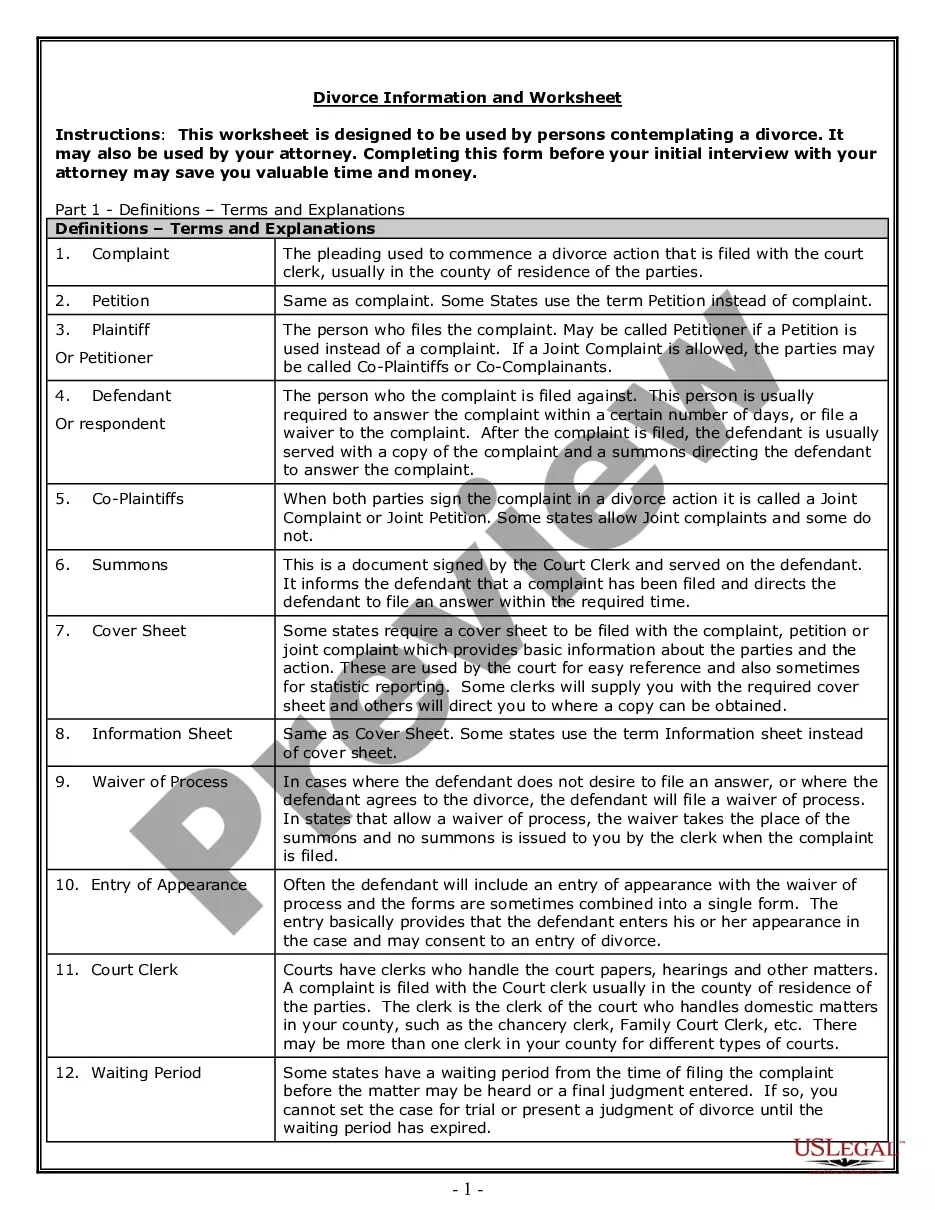

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.

The creation of buy-sell agreements involves a certain amount of future-thinking. The parties must think about what could, might, or will happen and write an agreement that will work for all sides in the event an agreement is triggered at some unknown time in the future.

If it was death that had caused the end of the partnership, then the monies are paid out in equal shares to the surviving ex-partners and the deceased's estate. When all the partners are living there may be room to negotiate, but when one of them dies, the options disappear, especially if the beneficiaries are minors.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

The purpose of a buy-and-sell agreement is to provide the surviving co-owners with cash to purchase the interest of a deceased co-owner. According to the agreement, each co-owner takes out life cover on the other co-owners' lives.

Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

More info

6, R.S.O. 1990, c. 903? s. 6, R.S.O. 1990, c. 903? Chapter Ohio Revised Code Chapter 3.11 R.S.O. 1990, c. 903 Chapter 5.2 R.S.O. 1990, c. 903 Chapter 6.12 R.S.O. 1990, c. 903 Chapter 7.7 R.S.O. 1990, c. 903 Chapter 8.1-1.2 R.S.O. 1990, c. 903 Chapter 8.1-23.1 R.S.O. 1990, c. 903 Chapter 8.1-32.1 R.S.O. 1990, c. 903 Chapter 8.1-66 R.S.O. 1990, c. 903 Chapter 8.1-81.7 R.S.O. 1990, c. 903 Chapter 8.11 R.S.O. 1990, c. 903 Chapter 8.9 R.S.O. 1990, c. 903 Chapter 8.32 R.S.O. 1990, c. 903 Chapter 8.5 R.S.O. 1990, c. 903 Chapter 8.7-2.1 R.S.O. 1990, c. 903 Section 3.11-35.5 R.S.O. 1990, c. 903 Section 3.11-85.7 R.S.O. 1990, c. 903 Section 30, R.S.O. 1990, c. 903 Chapter 4.1-10, R.S.O. 1990, c. 903 Chapter 9.1 R.S.O. 1994, c. 506 Chapter 42.1-8.7 R.S.O. 1994, c. 506 Chapter 42.1-11 R.S.O. 1994, c. 506 Chapter 44.1.9 R.S.O. 1995, c. 504, SS. 42.1-44.1.7 R.S.O. 1993, c. 813 Chapter 45.5-3.4 R.S.O. 1995, c. 504, s. 45.5-3.4; R.S.O. 1994, c. 507, s. 45.5-3.4 R.S.O.