Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

If you intend to finish, download, or print legal document templates, turn to US Legal Forms, the premier repository of legal forms available online.

Utilize the site's straightforward and convenient search to find the documents you need.

Different templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

- Use US Legal Forms to obtain the Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Ohio Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you’re using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the appropriate city/state.

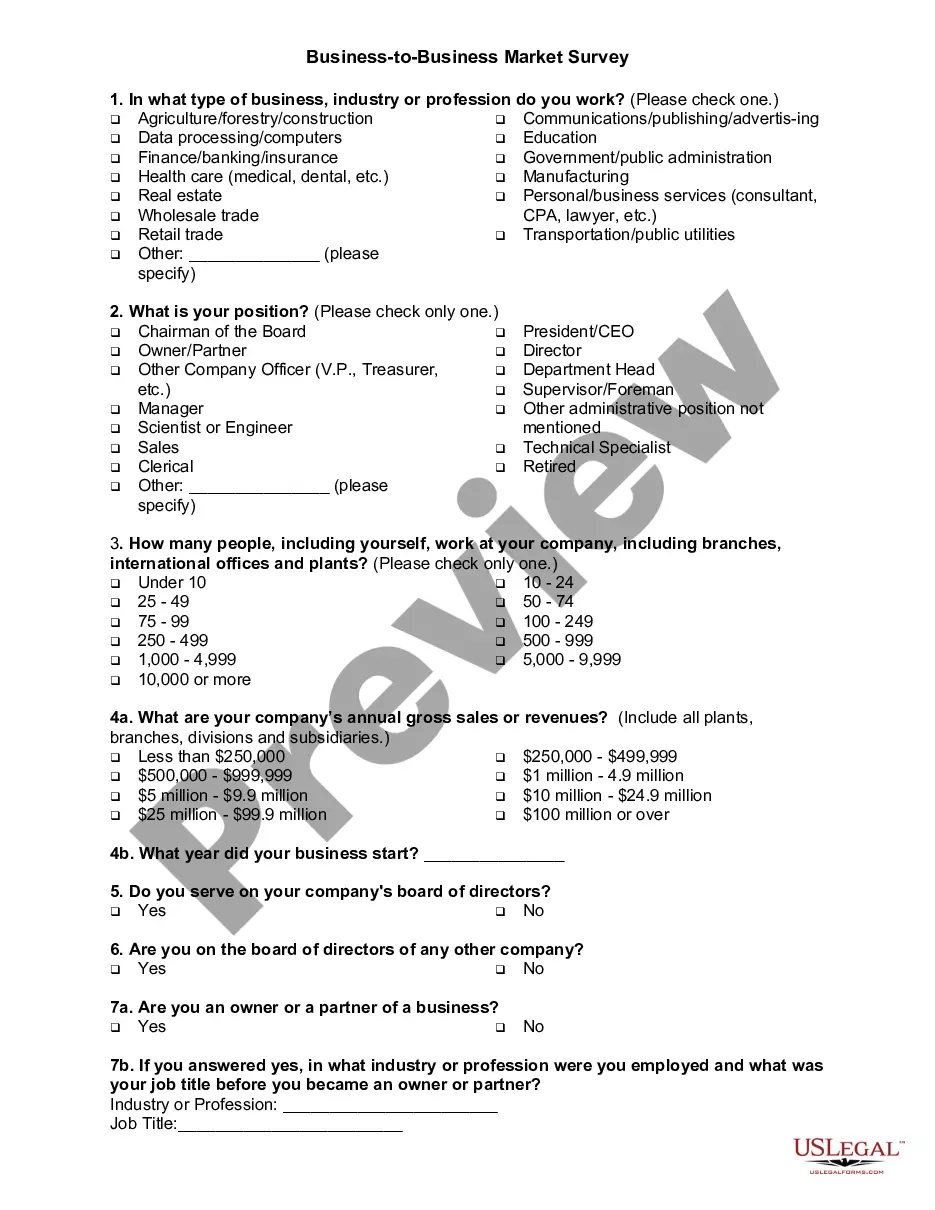

- Step 2. Utilize the Review option to examine the contents of the form. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions in the legal form format.

Form popularity

FAQ

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Separation Agreement to Prevent Partnership Dissolution When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.