Ohio Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process that occurs when a partnership is dissolved and its assets are sold off to settle all outstanding debts and obligations. This process ensures that the remaining partnership assets are fairly divided among the partners in proportion to their ownership interests. The Ohio Revised Code provides specific guidelines for the liquidation of partnerships, including the different types of liquidation that can take place. These may include: 1. Voluntary Liquidation: This occurs when the partners agree to dissolve the partnership and liquidate its assets voluntarily. All partners must consent to this decision, and the process is typically initiated through a formal partnership agreement or unanimous vote. 2. Involuntary Liquidation: In some cases, a partnership may be forced into liquidation by a court order or other external factors, such as bankruptcy proceedings. This type of liquidation is initiated by creditors or the court, and the assets are sold to repay outstanding debts. 3. Judicial Liquidation: This type of liquidation is similar to involuntary liquidation, but it is specifically initiated by a court due to disputes or conflicts among the partners. The court oversees the process and ensures the fair distribution of assets among the partners. During the Ohio Liquidation of Partnership with Sale and Proportional Distribution of Assets, the partnership assets, including real estate, equipment, inventory, and investments, are liquidated or sold off. The proceeds from these sales are then used to settle all outstanding debts, including loans, taxes, and payments owed to creditors. Once all debts have been paid, the remaining assets are distributed among the partners in proportion to their ownership interests. This ensures that each partner receives a fair share of the partnership's remaining value. It is important to note that the process of liquidating a partnership in Ohio can be complex and requires careful attention to legal requirements and obligations. Partners should consult experienced legal professionals to guide them through the process and ensure compliance with all applicable laws and regulations. In summary, Ohio Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal procedure used to dissolve a partnership and distribute its assets among the partners. Whether voluntary, involuntary, or judicial, this process ensures that the remaining assets are sold off to settle debts and obligations, with the remaining value allocated proportionally to each partner.

Ohio Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Ohio Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Have you been inside a place in which you need files for both enterprise or individual uses nearly every day time? There are plenty of legal file web templates available on the net, but locating types you can depend on isn`t easy. US Legal Forms delivers thousands of kind web templates, just like the Ohio Liquidation of Partnership with Sale and Proportional Distribution of Assets, which are written in order to meet federal and state requirements.

Should you be presently acquainted with US Legal Forms internet site and have a free account, basically log in. After that, you can download the Ohio Liquidation of Partnership with Sale and Proportional Distribution of Assets design.

Should you not offer an accounts and would like to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is to the appropriate city/county.

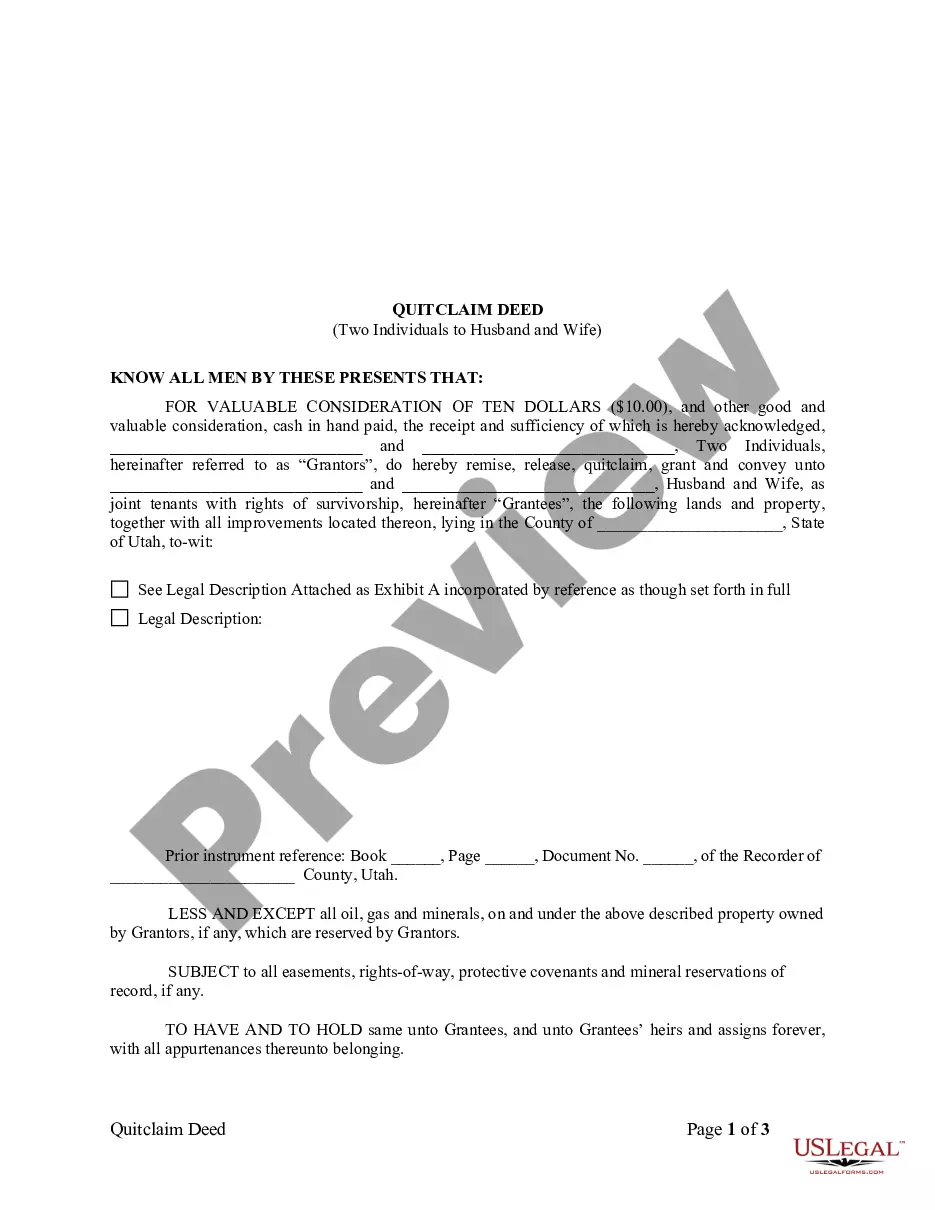

- Make use of the Review key to examine the shape.

- See the explanation to ensure that you have selected the correct kind.

- If the kind isn`t what you are looking for, use the Search area to discover the kind that meets your requirements and requirements.

- Once you obtain the appropriate kind, just click Purchase now.

- Choose the rates prepare you need, fill in the desired information to generate your account, and buy the order utilizing your PayPal or charge card.

- Decide on a convenient document file format and download your version.

Get every one of the file web templates you have bought in the My Forms menus. You can get a further version of Ohio Liquidation of Partnership with Sale and Proportional Distribution of Assets anytime, if possible. Just click the necessary kind to download or print out the file design.

Use US Legal Forms, probably the most comprehensive variety of legal kinds, to save some time and stay away from faults. The assistance delivers professionally manufactured legal file web templates that you can use for a selection of uses. Produce a free account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

A distribution is a transfer of cash or property by a partnership to a partner with respect to the partner's interest in partnership capital or income. Distributions do not include loans to partners or amounts paid to partners for services or the use of property, such as rent, or guaranteed payments.

When a partnership business is terminated, partners are expected to pay taxes on the taxable gain distributed to them upon liquidation of current and fixed assets.

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

Partnership withdrawalsPartners withdrawing from the partnership are not taxed to the extent the withdrawal is a return of the partner's investment. In other words, any return or withdrawal paid to the partner up to and including the partner's capital investment will be non-taxable for the partner.

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

Upon the winding up of a limited partnership, the assets shall be distributed as follows: (1) To creditors, including partners who are creditors, to the extent permitted by law, in satisfaction of liabilities of the limited partnership other than liabilities for distributions to partners under section 34-20d or 34-27d;

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.