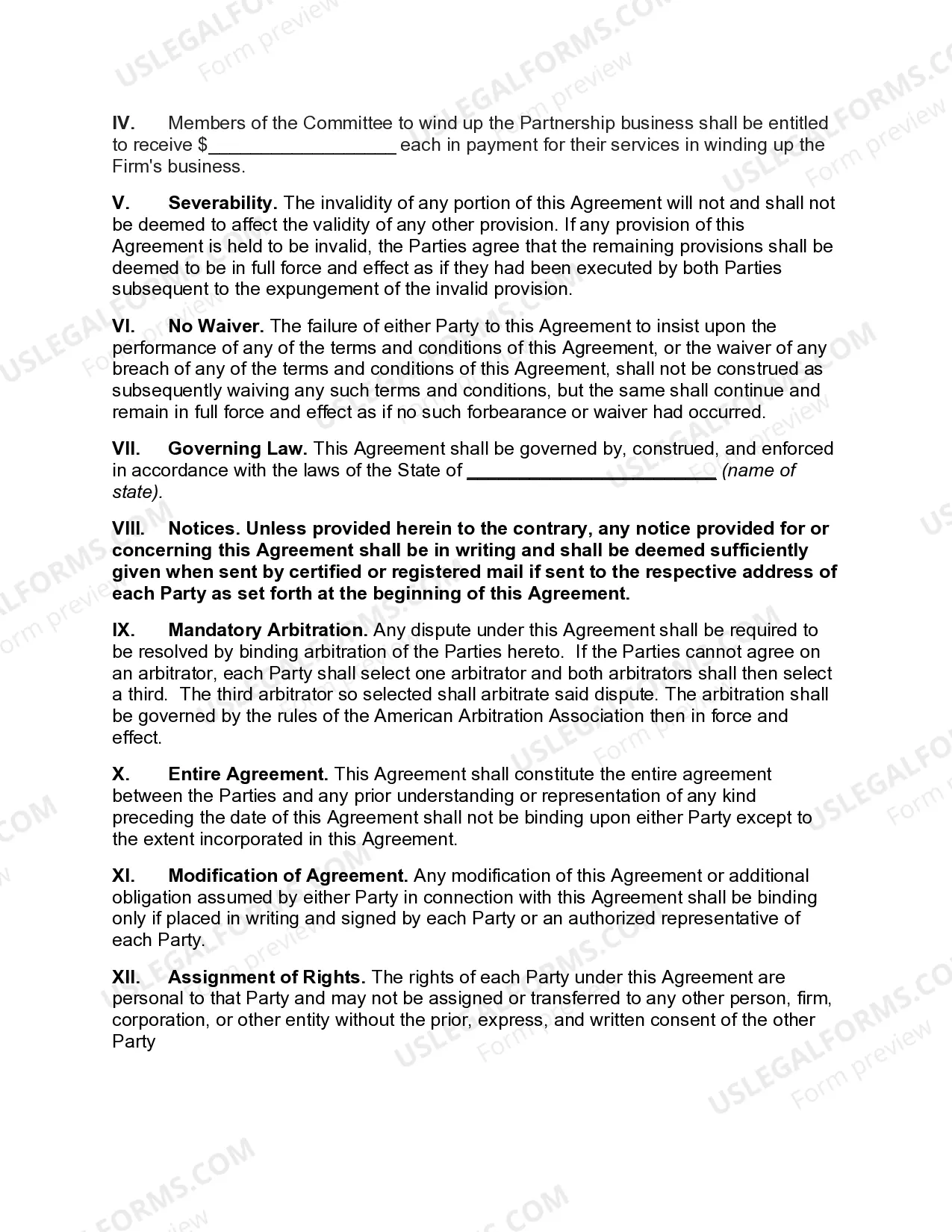

Ohio Agreement to Establish Committee to Wind up Partnership

Description

How to fill out Agreement To Establish Committee To Wind Up Partnership?

If you wish to obtain comprehensive, download, or print legitimate document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Utilize the site’s straightforward and user-friendly search function to locate the documents you require. Multiple templates for business and personal purposes are organized by categories and states or keywords.

Use US Legal Forms to discover the Ohio Agreement to Establish Committee to Wind up Partnership in just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you have purchased through your account. Click the My documents section and select a form to print or download again.

Stay competitive and download, and print the Ohio Agreement to Establish Committee to Wind up Partnership with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log Into your account and click on the Download button to acquire the Ohio Agreement to Establish Committee to Wind up Partnership.

- You may also access forms you have previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Review option to examine the form’s content. Do not forget to read through the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the required form, click the Get now button. Choose your preferred pricing plan and enter your credentials to create an account.

- Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize your purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Ohio Agreement to Establish Committee to Wind up Partnership.

Form popularity

FAQ

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

You don't have to file any paperwork to establish a partnership -- you can create a partnership simply by agreeing to go into business with another person.Choose a business name.Register a fictitious business name.Draft and sign a partnership agreement.Comply with tax and regulatory requirements.Obtain Insurance.

Dissolving a partnership is easier if there is a formal partnership agreement that spells out the exit strategy. If there is no partnership agreement, the partners will need to work together to negotiate the closing terms.

As provided in Ohio Revised Code Section 1776.65, a partner may file a Statement of Dissolution (Form 567), which signals the end of the partnership. Dissolution means the partnership will no longer be conducting new business, but concluding all existing business and ending the partnership's existence.

To dissolve your LLC in Ohio, you must provide the completed Certificate of Dissolution of Limited Liability Company / Cancellation of Foreign LLC form to the Secretary of State by mail, in person, or online. The Ohio Secretary of State does not require original signatures.

Forming a Partnership in OhioChoose a business name for your partnership and check for availability.Register the business name with local, state, and/or federal authorities.Draft and sign a partnership agreement.Obtain any required local licenses.More items...

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

To close your business at the state-level of government, you may need to file a dissolution with the Secretary of State as well as close any business accounts you have with the state. There may be more to do at federal and local levels.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.11-Mar-2020

Steps to Create an Ohio General PartnershipDetermine if you should start a general partnership.Choose a business name.File a Name Registration Form.Draft and sign partnership agreement.Obtain licenses, permits, and clearances.Get an Employer Identification Number (EIN)Get Ohio state tax identification numbers.