Ohio Gift of Stock to Spouse for Life with Remainder to Children is a type of estate planning strategy that allows individuals in Ohio to transfer their stock assets to their spouse for their lifetime, with the remainder passing on to their children upon the spouse's death. This arrangement ensures that both the surviving spouse and the children are taken care of financially. One key advantage of the Ohio Gift of Stock to Spouse for Life with Remainder to Children is that it allows individuals to pass on their stock holdings to their loved ones while potentially minimizing estate taxes. By transferring the stock to the surviving spouse, the deceased individual's estate can take advantage of the unlimited marital deduction, which allows assets to pass between spouses tax-free. However, it's important to note that this strategy may not be suitable for everyone, and consulting with an experienced estate planning attorney is crucial to ensure compliance with Ohio's specific laws and regulations. There are different variations of the Ohio Gift of Stock to Spouse for Life with Remainder to Children, including: 1. Ohio Gift of Publicly Traded Stock to Spouse for Life with Remainder to Children: This type involves the transfer of publicly traded stocks, such as stocks traded on the major stock exchanges, to the surviving spouse. The surviving spouse can then enjoy the income generated by these stocks during their lifetime, while the remaining value is bequeathed to the children when the surviving spouse passes away. 2. Ohio Gift of Closely Held Stock to Spouse for Life with Remainder to Children: In this case, individuals can transfer stocks of closely held corporations or businesses to their spouse, allowing them to benefit from the dividends and ownership interests associated with these stocks for their lifetime. The remaining value of the closely held stock passes on to the children after the surviving spouse's death. 3. Ohio Gift of Appreciated Stock to Spouse for Life with Remainder to Children: This type involves the transfer of stocks that have significantly appreciated in value over time. By transferring these appreciated stocks to their spouse, individuals can potentially avoid capital gains taxes that would otherwise be incurred if the stocks were sold during their lifetime. The spouse receives the income generated by these stocks, and the remainder passes on to the children after the spouse's death. In conclusion, the Ohio Gift of Stock to Spouse for Life with Remainder to Children is an estate planning strategy that allows individuals in Ohio to transfer their stock assets to their spouse while ensuring the remainder passes on to their children. This strategy can potentially provide tax advantages and financial security to both the surviving spouse and the children. However, it's crucial to consult with a knowledgeable attorney to ensure compliance with Ohio's specific laws and regulations.

Ohio Gift of Stock to Spouse for Life with Remainder to Children

Description

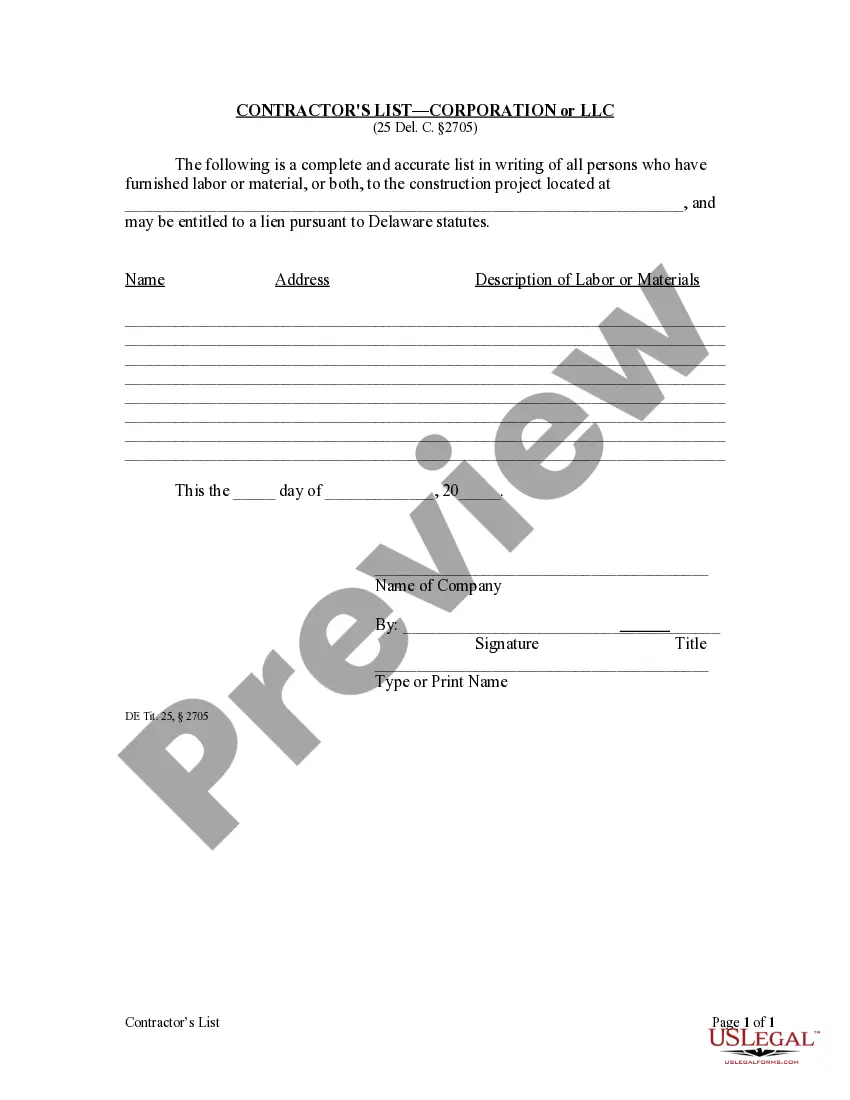

How to fill out Ohio Gift Of Stock To Spouse For Life With Remainder To Children?

Choosing the best lawful file design might be a have difficulties. Naturally, there are plenty of templates accessible on the Internet, but how can you get the lawful type you will need? Take advantage of the US Legal Forms web site. The support gives 1000s of templates, such as the Ohio Gift of Stock to Spouse for Life with Remainder to Children, which can be used for business and personal needs. All of the types are inspected by specialists and satisfy state and federal demands.

When you are already listed, log in to the profile and click on the Acquire option to obtain the Ohio Gift of Stock to Spouse for Life with Remainder to Children. Use your profile to search throughout the lawful types you might have acquired previously. Go to the My Forms tab of your profile and obtain an additional duplicate in the file you will need.

When you are a whole new customer of US Legal Forms, listed below are easy recommendations for you to comply with:

- Very first, make sure you have chosen the right type to your metropolis/area. You may look through the shape utilizing the Review option and browse the shape outline to ensure it is the best for you.

- When the type is not going to satisfy your requirements, make use of the Seach area to obtain the correct type.

- When you are certain that the shape is suitable, click on the Acquire now option to obtain the type.

- Select the rates prepare you need and type in the needed information and facts. Build your profile and purchase the transaction making use of your PayPal profile or Visa or Mastercard.

- Select the data file structure and download the lawful file design to the system.

- Total, modify and print and indication the received Ohio Gift of Stock to Spouse for Life with Remainder to Children.

US Legal Forms is definitely the biggest local library of lawful types in which you can discover different file templates. Take advantage of the service to download expertly-produced documents that comply with express demands.

Form popularity

FAQ

According to federal tax law, if an individual makes a gift of property within 3 years of the date of their death, the value of that gift is included in the value of their gross estate. The gross estate is the dollar value of their estate at the time of their death.

When you are gifted stock, the holding period includes the time that the stock was owned by the donor. In other words, should you wish to sell immediately, you won't be liable to pay higher short-term capital gains tax, provided that the person who gifted the stock bought it at least one year beforehand.

The lifetime gift tax exemption is the amount of money or assets the government permits you to give away over the course of your lifetime without having to pay the federal gift tax. This limit is adjusted each year. For 2021, the lifetime gift tax exemption as $11.7 million.

Process of transfer of shares from one Demat account to anotherStep 1 - The investor fills the DIS (Delivery Instruction Slip) and submits it to the current broker.Step 2 - The broker forwards the DIS form or request to the depository.Step 3 - The Depository will transfer your existing shares to the Demat account.More items...

Gifting stock you currently own If you're looking to gift to an adult friend or family member, you can generally transfer shares from your brokerage to theirs if you have their account information. You can also gift stock that you currently own to non-profit charities as a donation, instead of writing a check.

The simple answer to your question is no, the value of a gift of stock for gift tax liability is NOT the donor's cost basis, but rather the fair market value of the stock at the time the gift is given.

Gifting Stock When you make a non-cash gift such as a stock, house, or even a business, the person receiving the gift assumes your cost basis in the assets. They do not receive a step-up in basis at the time the gift is made.

The owner must endorse the stock by signing it in the presence of a guarantor, which can be their bank or broker. There may also be a form on the back of the certificate, which relates to the transferring of ownership. After the certificate is complete, it will be rendered non-negotiable and becomes transferable.

The cost basis of stock you received as a gift ("gifted stock") is determined by the giver's original cost basis and the fair market value (FMV) of the stock at the time you received the gift. If the FMV when you received the gift was more the original cost basis, use the original cost basis when you sell.

The recipient of a gift does not pay tax on any gift valued at $11,000 or less, no matter if it is a boat, car, cash, or stock. This means you don't owe taxes at the time of the gift of the stock. When the recipient sells the stock, however, it is a taxable event.