Ohio Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Conflict Of Interest Disclosure Of Director Of Corporation?

If you require thorough, obtain, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Ohio Conflict of Interest Disclosure of Director of Corporation with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Ohio Conflict of Interest Disclosure of Director of Corporation.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

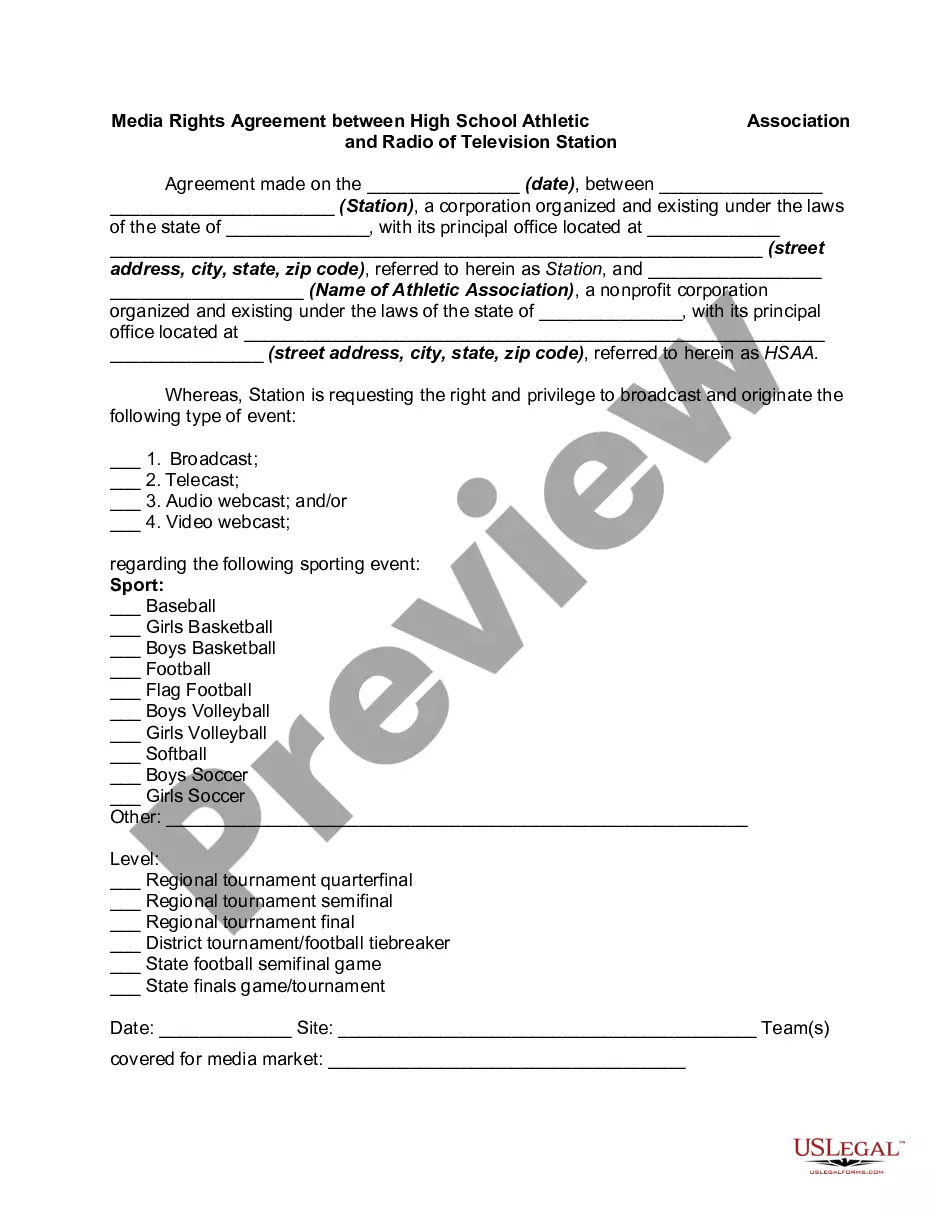

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Staff should make a conflict of interest disclosure as soon as there's a risk that a conflict or potential conflict might arise that is, as soon as you recognise that a conflict might be perceived (section 6.1, Disclosure of Conflict and Declaration of Interest Policy).

To answer this question successfully, assure your interviewer that you are a good listener who can accept opposing views without getting upset. You could also mention how conflict resolution should take place in a private space. Aim to provide an example if possible.

A Declaration of Conflicting Interests policy refers to a formal policy a journal may have to require a conflict of interest statement or conflict of interest disclosure from a submitting or publishing author.

If no conflict exists, you can state that The Author(s) declare(s) that there is no conflict of interest. If there are potential conflicts of interest, we highly encourage each author to identify and declare clearly to avoid any future investigations by the publisher.

How to Handle Conflict in the WorkplaceTalk with the other person.Focus on behavior and events, not on personalities.Listen carefully.Identify points of agreement and disagreement.Prioritize the areas of conflict.Develop a plan to work on each conflict.Follow through on your plan.Build on your success.

A conflict of interest involves a person or entity that has two relationships competing with each other for the person's loyalty. For example, the person might have a loyalty to an employer and also loyalty to a family business. Each of these businesses expects the person to have its best interest first.

This Declaration of Interest Form is designed to identify and address both actual and potential conflicts of interest and other ethics-related issues.

You may file your Conflict of Interest - Contracts statement online or by submitting a paper copy. If you wish to submit a paper copy, you may download the statement here. The completed, signed statement may be mailed or delivered in person to the address of the Office of the Inspector General listed on the form.

5 tips for dealing with conflicts of interestEstablish a process. The best way to handle a conflict of interest is to already have a process in place to manage it.Get the conflict of interest out into the open.Training is valuable.Declare your interests.Think about the conflicts of others.24-Sept-2014

Other strategies to consider: Removal from situation or conflict. Restricted involvement in the situation or conflict and documenting this involvement. Engaging an independent third party to oversee part or all of the relevant activity or process.