Ohio Private Trust Company (OPT) is a specialized financial institution that provides comprehensive and personalized trust services to individuals, families, and organizations in the state of Ohio, United States. With its roots deeply embedded in the state's rich history and robust financial sector, Ohio Private Trust Companies offer a range of unique advantages to clients seeking superior fiduciary solutions tailored to their specific needs. As a private trust company, OPT operates under Ohio law and is authorized to act as a trustee, executor, or custodian of various types of assets and trusts. The company's primary objective is to preserve and grow its clients' wealth while diligently adhering to applicable laws and regulations. Optics are regulated by the Ohio Division of Financial Institutions and need to obtain a license to operate lawfully within the state. Ohio Private Trust Companies come in various forms, each catering to specific client requirements. These different types include: 1. Family Private Trust Company (FTC): FPT Cs are designed to serve the unique needs of high-net-worth families. They provide professional trust administration services while allowing families to retain active control over the management and distribution of their assets. By establishing an FTC, families can maintain family values, preserve privacy, and enhance the continuity of wealth across generations. 2. Corporate Private Trust Company (CPC): Catch are specialized trust companies established by corporations to manage their own assets and minimize the reliance on external trustees. By creating a CPC, corporations can exercise more control over the administration, investment, and distribution of their trust assets, thereby aligning with their specific business objectives. 3. Multi-Family Private Trust Company (MF PTC): Match cater to multiple families and individuals, pooling their assets under a single trust institution. This structure allows families and individuals to benefit from economies of scale, share resources, reduce costs, and access specialized expertise. Match often serve as neutral and unbiased trustees, fostering collaboration among multiple beneficiaries while maintaining the distinct interests of each family or individual. 4. Charitable Private Trust Company (CH PTC): Chats are created for the purpose of managing charitable trusts and foundations. These trust companies have in-depth knowledge of philanthropic endeavors and focus on managing assets designated for charitable purposes, ensuring compliance with charitable laws, and handling distributions to various charitable programs. Ohio Private Trust Companies offer a wide range of services, including trust administration, estate planning, investment management, custody services, and philanthropic advisory. Their fiduciary expertise, combined with a deep understanding of local laws and regulations, enables clients to pursue their financial goals with confidence and peace of mind. When considering engaging the services of an Ohio Private Trust Company, it is crucial to consult with legal and financial professionals to select the most suitable structure and provider based on individual needs, goals, and the complexity of their wealth management requirements.

Ohio Private Trust Company

Description

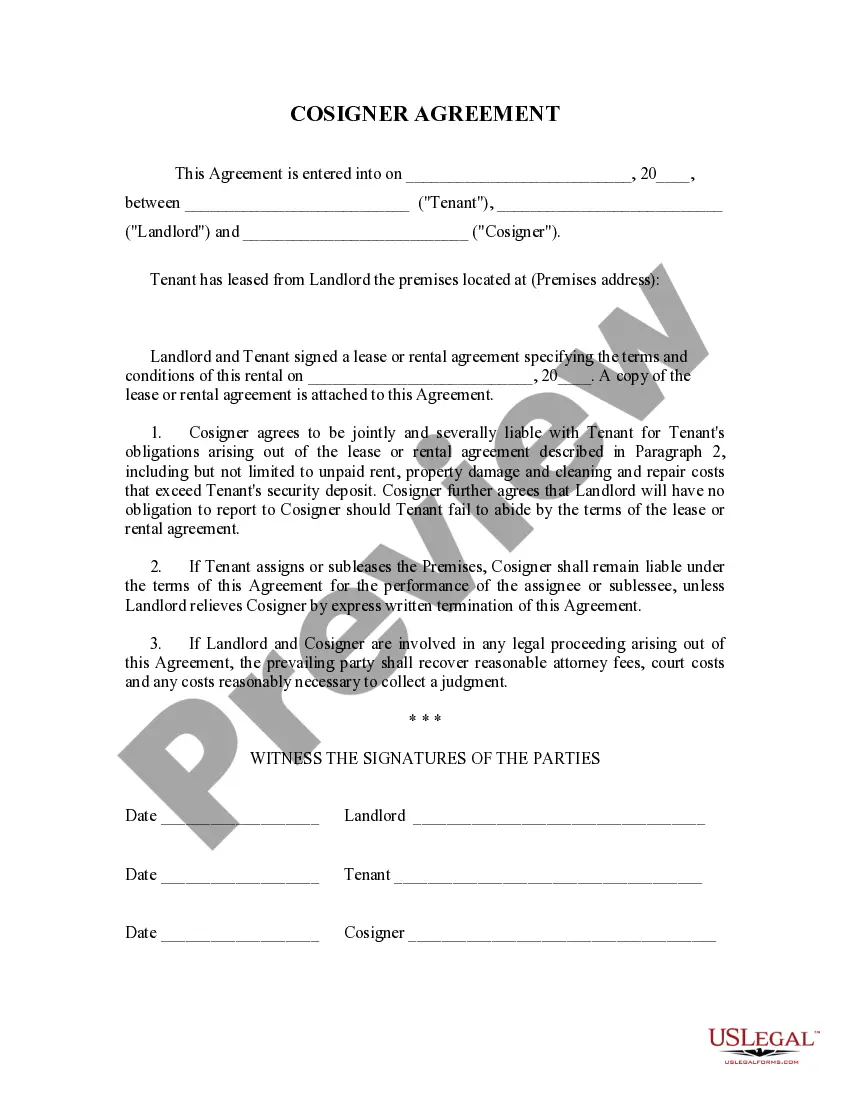

How to fill out Ohio Private Trust Company?

US Legal Forms - one of the most significant libraries of legal varieties in the States - provides an array of legal document layouts it is possible to download or print. Using the web site, you can find a huge number of varieties for enterprise and specific purposes, sorted by categories, claims, or search phrases.You will discover the newest types of varieties like the Ohio Private Trust Company in seconds.

If you already have a subscription, log in and download Ohio Private Trust Company from the US Legal Forms library. The Obtain switch will appear on each form you see. You gain access to all earlier acquired varieties inside the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, allow me to share easy directions to help you started:

- Be sure to have chosen the right form for your personal city/county. Click the Review switch to check the form`s articles. Browse the form outline to ensure that you have selected the appropriate form.

- If the form doesn`t match your specifications, utilize the Look for area at the top of the display screen to get the the one that does.

- When you are content with the form, confirm your choice by simply clicking the Get now switch. Then, select the rates prepare you want and provide your references to sign up to have an account.

- Process the purchase. Utilize your charge card or PayPal account to complete the purchase.

- Select the file format and download the form in your device.

- Make changes. Complete, modify and print and indication the acquired Ohio Private Trust Company.

Each format you included in your account lacks an expiry date and is yours eternally. So, if you want to download or print an additional copy, just go to the My Forms segment and click on on the form you require.

Get access to the Ohio Private Trust Company with US Legal Forms, by far the most extensive library of legal document layouts. Use a huge number of skilled and state-distinct layouts that fulfill your business or specific demands and specifications.

Form popularity

FAQ

According to independent rankings, the top states with the best trust laws are South Dakota trust law and Nevada in the US.

For now, note that the top states for perpetual trusts are Alaska, Delaware, Nevada, and South Dakota. These states all allow perpetual trusts and don't assess state income taxes on these trusts....Which States Allow Perpetual Trusts?Alaska.Delaware.District of Columbia.Hawaii.Idaho.Illinois.Kentucky.Maine.More items...

States that recognize regulated private trust companies include:Alabama.Colorado.Delaware.Massachusetts.Nevada.New Hampshire.Pennsylvania.South Dakota.More items...

If the funds from the private trust is used in the business, then the profit from the business becomes the property of the trust and the trustees (or author of the trust) cannot stake a claim. The whole income of the specific trust is then charged on the maximum marginal rate.

A trust can be used to run a business. But because it is not a legal entity, the trustee undertakes the business activities on behalf of the trust. A trustee can be an individual or a company we recommend a corporate trustee.

If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.

Advantages of a Private Trust CompanyEnhanced privacy protection. Potential tax advantages. No need to meet SEC registration requirements. Increased flexibility with regard to decision-making and asset management.

Because trust companies are subject to regulation substantially similar to that applicable to banks, they enjoy many of the same exemptions from securities and other laws.

Private Trust Definition: A Private Trust is a legal contract that holds and manages assets for relatives, family members and friends of the Grantor (the Trust creator and owner).

Private trust companies are designed to preserve ownership of family wealth, which may include business assets, real estate, alternative assets such as hedge funds or private equity. These assets are managed by the trustee in accordance with the wishes of the family.