The Ohio Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a type of trust established in Ohio that allows a single individual (the trust or) to provide for their spouse after their death while maintaining control over the distribution of assets. This type of trust is commonly used in estate planning to ensure that the surviving spouse is taken care of financially while also allowing the trust or to determine how the remaining assets will be distributed upon the spouse's death. The trust provides the surviving spouse with a lifetime income, typically in the form of regular payments, from the trust assets, ensuring their financial security. The distinguishing feature of this trust is the power of appointment granted to the beneficiary spouse. This power allows the surviving spouse to determine who will receive the remaining trust assets after their own death. The beneficiary spouse has the discretion to name individuals, such as children or other family members, as beneficiaries. This power of appointment enables the surviving spouse to have control over the ultimate distribution of the trust assets, providing flexibility and allowing for changing circumstances or family dynamics. It is important to note that there may be variations or different names for this type of trust, depending on specific circumstances or preferences. Some other possible names for similar trusts in Ohio could include: 1. Ohio Residuary Trust with Marital Deduction and Lifetime Income Trust 2. Single Trust or Residuary Trust with Marital Deduction and Power of Appointment in Beneficiary Spouse 3. Ohio Marital-deduction Qualified Terminable Interest Property Trust with Single Trust or and Lifetime Income 4. Ohio Lifetime Income Trust with Power of Appointment in Beneficiary Spouse and Single Trust or 5. Single Trust or Ohio TIP Trust with Lifetime Income and Power of Appointment in Beneficiary Spouse These variations may have subtle differences in the terms and provisions of the trust, but they generally serve the same purpose of providing for the financial needs of a surviving spouse while allowing control over the ultimate distribution of assets. It is always recommended consulting with an estate planning attorney to determine which specific type of trust best suits individual circumstances and objectives.

Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

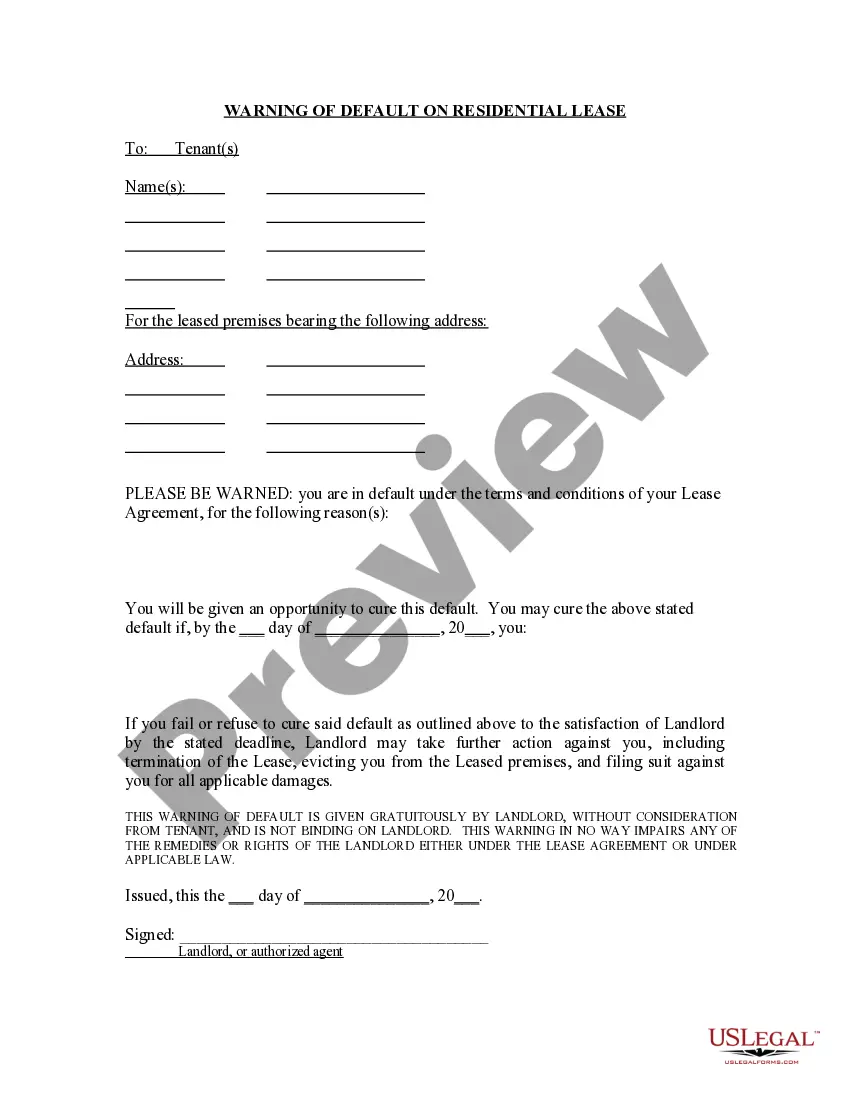

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Discovering the right authorized document design can be a have difficulties. Obviously, there are plenty of layouts accessible on the Internet, but how can you find the authorized type you need? Make use of the US Legal Forms website. The support offers thousands of layouts, like the Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, which can be used for organization and personal needs. Each of the kinds are checked out by professionals and satisfy state and federal demands.

Should you be currently signed up, log in to your profile and click on the Download button to obtain the Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. Utilize your profile to look with the authorized kinds you might have ordered previously. Proceed to the My Forms tab of your profile and obtain yet another copy from the document you need.

Should you be a whole new user of US Legal Forms, allow me to share basic recommendations that you can adhere to:

- Initial, make certain you have selected the correct type for your personal metropolis/area. You may examine the shape using the Review button and look at the shape information to make sure it will be the right one for you.

- In the event the type does not satisfy your expectations, take advantage of the Seach discipline to obtain the right type.

- When you are certain that the shape is proper, go through the Acquire now button to obtain the type.

- Select the pricing program you desire and enter the needed information. Design your profile and buy an order with your PayPal profile or bank card.

- Select the data file format and download the authorized document design to your product.

- Total, revise and produce and signal the obtained Ohio Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

US Legal Forms may be the greatest collection of authorized kinds for which you will find numerous document layouts. Make use of the company to download expertly-created files that adhere to express demands.

Form popularity

FAQ

A trust is especially important in California, where probate is expensive and lengthy. It will help save your loved one's time, money, and a lot of hassle. Besides, with trusts like a living trust, you can still buy, sell, and trade assets as usual. You can also move assets to and from the Trust as you please. Do I Need A Trust In California? 6 Important Factors to Consider hermancelaw.com ? blog ? do-i-need-a-trust-in-ca... hermancelaw.com ? blog ? do-i-need-a-trust-in-ca...

A will is a legal document that spells out how you want your affairs handled and assets distributed after you die. A trust is a fiduciary arrangement whereby a grantor (also called a trustor) gives a trustee the right to hold and manage assets for the benefit of a specific purpose or person.

In California, a trustor (person who creates a trust) can confer a ?power of appointment? on trust beneficiaries, empowering them to designate to whom they want to give their shares of the trust.

Make a trust document: Now it's actually time to put the legal trust document together. You can technically do this by yourself, but you may want to consult with a lawyer or financial advisor. Get the trust document notarized: Now you have to sign the trust in front of a notary public. How to Create a Living Trust in Ohio - SmartAsset SmartAsset ? estate-planning ? living-trust-... SmartAsset ? estate-planning ? living-trust-...

Having a trust in the state of Ohio keeps your loved ones out of probate court. Instead of your family experiencing a lengthy probate court process to gain access to your assets and distribute them as you intended, a living trust takes the hassle of probate court out of the equation.

$1,000 to $3,000 How much does a Trust cost in Ohio? The cost of creating a trust in Ohio varies depending on the complexity of your estate and the attorney's fees. The average cost for a basic Revocable Living Trust ranges from $1,000 to $3,000, while more complex trusts may cost more. Ohio: Make A Revocable Trust Online in 12 Minutes | Snug getsnug.com ? ohio-trusts getsnug.com ? ohio-trusts

Any asset that is controlled by the will goes through probate. Probate can cause estate administration to be slower, more burdensome and more costly. Assets that are controlled by a trust are not subject to probate. Avoiding probate is generally a good strategy for estate planning. A Will or Trust? - OSU Farm Office - The Ohio State University osu.edu ? blog ? will-or-trust osu.edu ? blog ? will-or-trust