Ohio Agreement for Auditing Services between Accounting Firm and Municipality is a legally binding document that outlines the terms and conditions under which an accounting firm provides auditing services to a specified municipality in the state of Ohio. This agreement is crucial for ensuring transparency, accuracy, and compliance in the financial operations of the municipality. In Ohio, various types of agreements for auditing services may exist between an accounting firm and a municipality, including: 1. General Auditing Services Agreement: This type of agreement covers the overall auditing services provided by the accounting firm to the municipality. It typically includes provisions on the scope of audit, timelines, fees, deliverables, and desired outcomes of the audit. 2. Financial Statement Auditing Agreement: This agreement specifically focuses on auditing the municipality's financial statements. It outlines the procedures, methodologies, and standards to be followed during the auditing process to ensure accurate representation of the financial position, performance, and cash flows of the municipality. 3. Compliance Auditing Agreement: This agreement is concerned with auditing the municipality's compliance with applicable laws, regulations, and internal policies. It entails reviewing whether the municipality is adhering to financial, legal, and operational requirements and implementing adequate controls to mitigate risks. 4. Performance Auditing Agreement: This agreement aims to assess the efficiency, effectiveness, and economy of the municipality's programs, projects, and operations. It involves evaluating the municipality's performance against predetermined objectives and identifying areas for improvement, cost savings, and increased effectiveness. Key elements commonly found in an Ohio Agreement for Auditing Services between an Accounting Firm and a Municipality include: a. Engagement of Services: The agreement provides a detailed description of the auditing services to be performed, specifying if it is a general audit, financial statement audit, compliance audit, or performance audit. b. Scope of Work: It defines the boundaries and extent of the audit, outlining specific areas, departments, or functions that will be subject to examination. c. Timeline: The agreement stipulates the start and end dates of the audit engagement, including specific milestones or deadlines for the completion of different audit phases or deliverables. d. Fees and Payment Terms: It determines the compensation structure for the accounting firm, whether it is based on an hourly rate, a fixed fee, or a combination of both. Payment terms, invoicing procedures, and any additional expenses, such as travel or accommodation, are also typically addressed. e. Deliverables and Reporting: This section outlines the expected deliverables, such as audit reports, management letters, or findings documentation. It specifies the format, content, and distribution of these reports, along with any confidentiality requirements. f. Acts of Non-Compliance: The agreement establishes protocols for dealing with non-compliance, including the ability to suspend the audit if the municipality fails to provide requested information or obstructs the auditing process. g. Confidentiality and Data Protection: It addresses the confidentiality of sensitive information obtained during the audit and outlines the measures to be taken to safeguard data privacy. h. Termination and Dispute Resolution: The agreement defines the circumstances under which either party can terminate the agreement and the procedures for resolving disputes, such as negotiation, mediation, or arbitration. It is important for both parties involved in an Ohio Agreement for Auditing Services to carefully review and understand the terms to establish a beneficial and professional partnership essential for maintaining the municipality's financial integrity and accountability.

Ohio Agreement for Auditing Services between Accounting Firm and Municipality

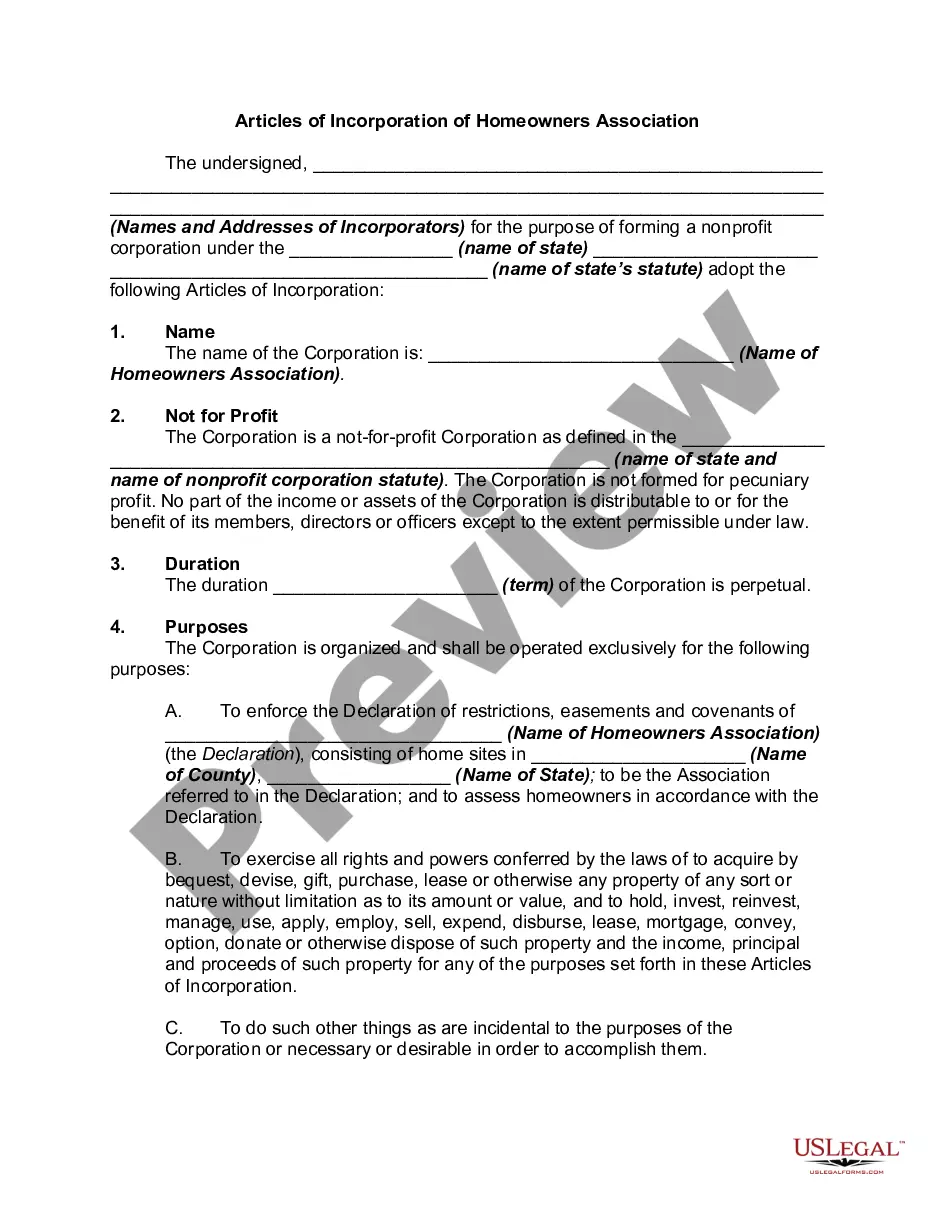

Description

How to fill out Ohio Agreement For Auditing Services Between Accounting Firm And Municipality?

It is possible to spend several hours on the Internet trying to find the legal file format that meets the federal and state requirements you need. US Legal Forms provides a large number of legal varieties which can be examined by professionals. You can easily down load or print out the Ohio Agreement for Auditing Services between Accounting Firm and Municipality from your assistance.

If you have a US Legal Forms bank account, it is possible to log in and then click the Down load key. After that, it is possible to comprehensive, edit, print out, or indicator the Ohio Agreement for Auditing Services between Accounting Firm and Municipality. Every single legal file format you buy is your own permanently. To have one more copy for any acquired type, check out the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms site the very first time, follow the easy guidelines beneath:

- Very first, ensure that you have selected the proper file format for the state/area of your liking. Look at the type outline to make sure you have selected the correct type. If offered, utilize the Review key to appear with the file format as well.

- If you would like discover one more edition of the type, utilize the Look for industry to obtain the format that meets your requirements and requirements.

- Once you have identified the format you desire, click Purchase now to proceed.

- Find the rates prepare you desire, enter your credentials, and register for an account on US Legal Forms.

- Total the deal. You may use your credit card or PayPal bank account to purchase the legal type.

- Find the format of the file and down load it for your gadget.

- Make adjustments for your file if needed. It is possible to comprehensive, edit and indicator and print out Ohio Agreement for Auditing Services between Accounting Firm and Municipality.

Down load and print out a large number of file web templates while using US Legal Forms website, which provides the largest collection of legal varieties. Use specialist and status-distinct web templates to tackle your business or individual requirements.