Ohio Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

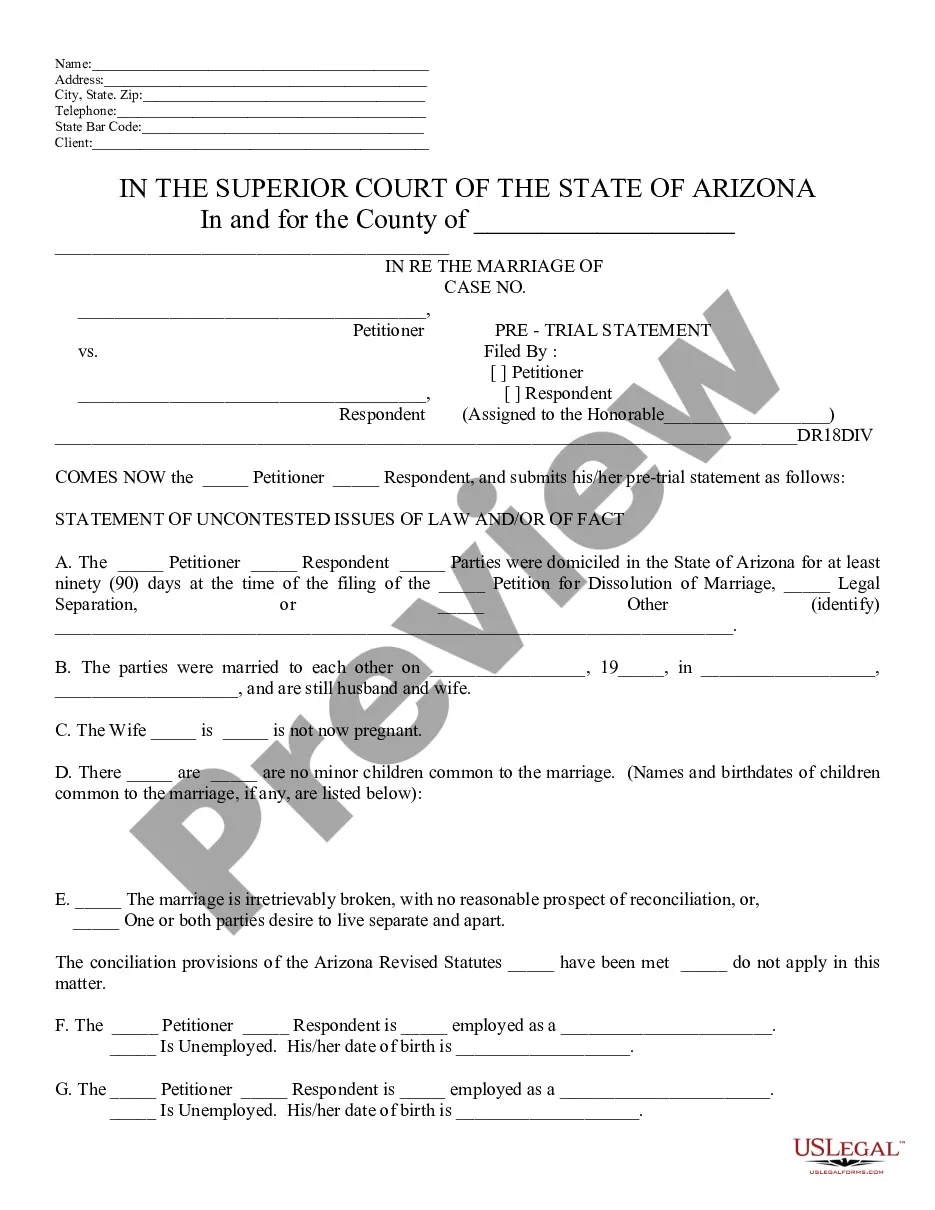

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

Are you within a position where you require papers for either enterprise or individual uses almost every time? There are tons of authorized record themes available online, but finding kinds you can trust is not straightforward. US Legal Forms gives thousands of develop themes, such as the Ohio Self-Employed Independent Contractor Consulting Agreement - Detailed, which can be published to meet federal and state requirements.

Should you be presently acquainted with US Legal Forms web site and have a free account, simply log in. Next, it is possible to download the Ohio Self-Employed Independent Contractor Consulting Agreement - Detailed design.

Unless you offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you require and ensure it is for the correct city/region.

- Take advantage of the Review switch to examine the form.

- Read the description to ensure that you have chosen the correct develop.

- In the event the develop is not what you`re trying to find, use the Search area to discover the develop that suits you and requirements.

- If you find the correct develop, click Acquire now.

- Choose the costs program you want, fill in the desired details to make your money, and purchase the transaction utilizing your PayPal or charge card.

- Decide on a handy file structure and download your version.

Get every one of the record themes you possess purchased in the My Forms menu. You can get a additional version of Ohio Self-Employed Independent Contractor Consulting Agreement - Detailed whenever, if needed. Just go through the required develop to download or printing the record design.

Use US Legal Forms, by far the most considerable selection of authorized varieties, to save time and stay away from faults. The support gives skillfully manufactured authorized record themes that can be used for a variety of uses. Produce a free account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

Contractor vs. The big difference is that contractors actually perform work to complete a task, and consultants create solutions to guide how a company can conduct its workflow.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

An independent contractor agreement between an individual independent contractor (a self-employed individual) and a client company for consulting or other services. This Standard Document is drafted in favor of the client company and is based on federal law.

At that point the Consultant may be said to become a Contractor. The terms have also become blurred as industry has incorporated them into employee job titles. Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.