Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

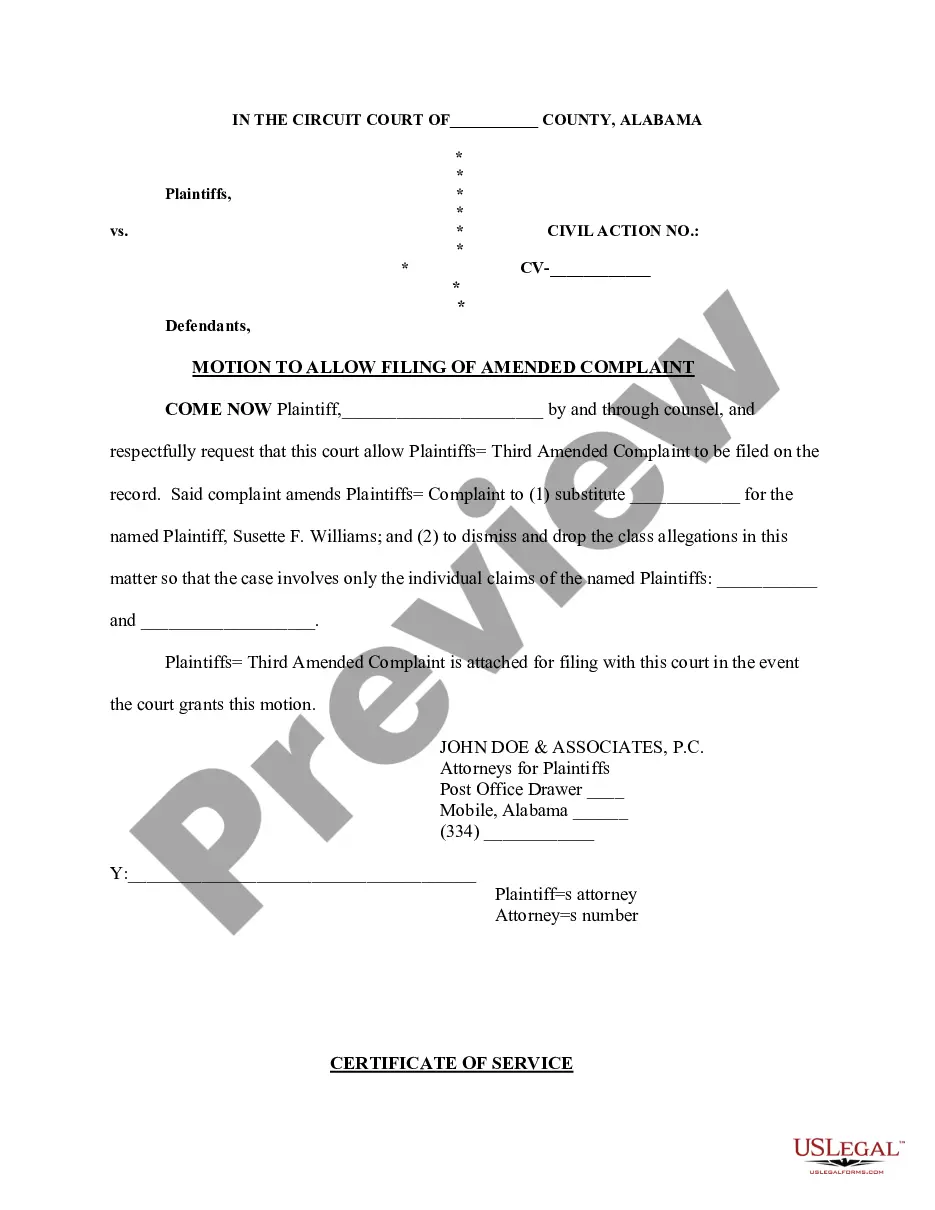

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

Are you currently in a situation where you need documents for either professional or personal purposes almost every day.

There are many legal document templates available online, but finding ones you can trust isn’t straightforward.

US Legal Forms provides thousands of template forms, such as the Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, which can be customized to comply with state and federal requirements.

Find all the form templates you have purchased in the My documents menu.

You can download or print the Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company at any time, if needed.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that can be utilized for various purposes.

Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/area.

- Utilize the Review button to examine the form.

- Check the description to make sure you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the right form, click Get now.

- Select the pricing plan you wish, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Section 1701.81 outlines limits on corporate distributions and conditions under which they can be made. This section helps protect the integrity of the company's finances while ensuring members receive fair distributions. Understanding this section is beneficial when drafting the Ohio Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company, as it helps avoid legal issues around unauthorized disbursements.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

Board resolutions should be written on the organization's letterhead. The wording simply describes the action that the board agreed to take. It also shows the date of the action and it names the parties to the resolution.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Ohio Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...