Ohio Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Selecting the ideal legal document web template may be challenging. It goes without saying, there is an assortment of templates available on the web, but how can you secure the legal document you need? Utilize the US Legal Forms platform.

This service offers a vast selection of templates, such as the Ohio Separation Notice for 1099 Employee, suitable for business and personal purposes. All templates are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and press the Download button to obtain the Ohio Separation Notice for 1099 Employee. Use your account to browse through the legal documents you may have purchased previously. Go to the My documents section of your account and retrieve another copy of the document you need.

US Legal Forms is the largest collection of legal documents where you can find various document templates. Utilize this service to obtain properly crafted documents that comply with state regulations.

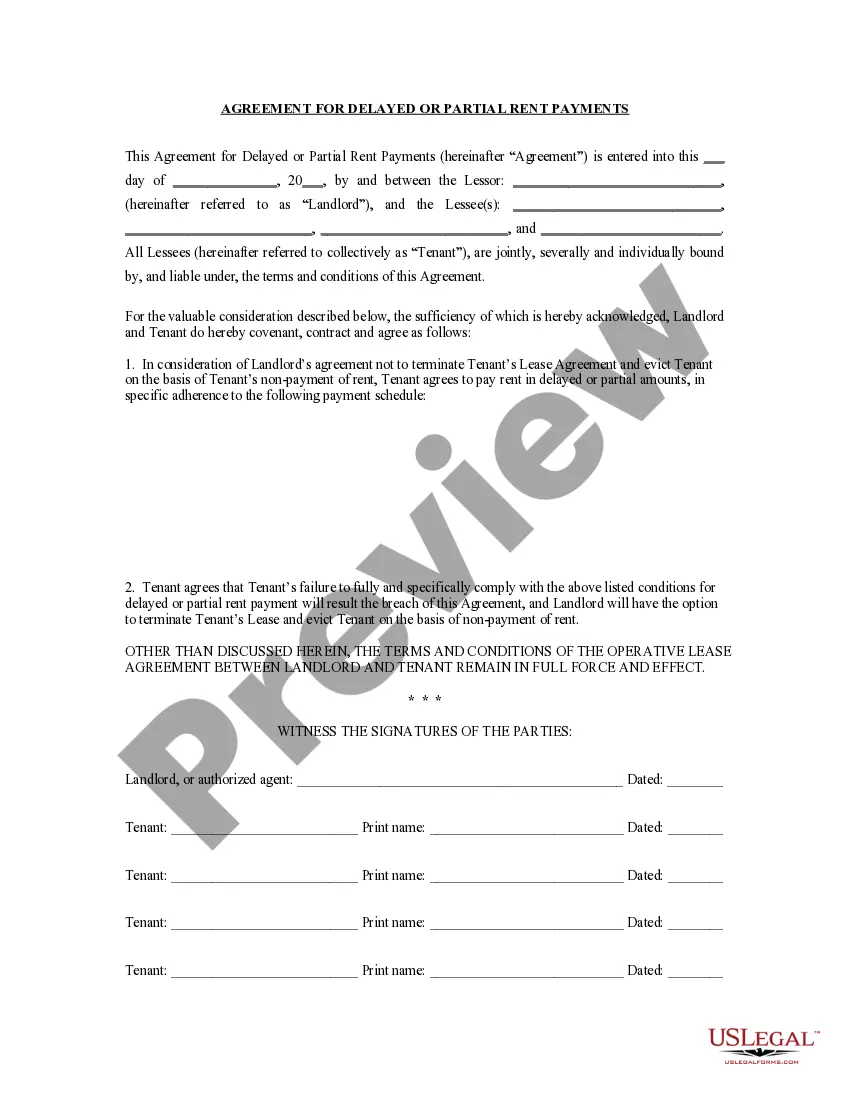

- First, ensure you have picked the correct document for your area/county. You can examine the document using the Preview button and read the document description to confirm it meets your needs.

- If the document does not fit your requirements, use the Search field to locate the appropriate form.

- Once you are confident that the document is suitable, click the Purchase now button to acquire the document.

- Select the pricing plan you wish and fill in the required information. Create your account and pay for your order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Ohio Separation Notice for 1099 Employee.

Form popularity

FAQ

The federal Pandemic Unemployment Assistance (or "PUA") program provided benefits for many individuals ineligible for state unemployment benefits, including self-employed workers, 1099 tax filers and part-time workers.

How To Resign From a Contract Position With GraceCommunicate with your recruiting partner. There are a lot of reasons why you might want to move on, most of which are perfectly understandable.Give proper notice.Keep the stakes in mind.Leave the job better than you found it.

Short answer: No. Longer answer: You can get rid of an independent contractor if they're not holding up their end of the contract. But it's not firing because independent contractors don't work for you, they work for themselves.

Ohio law requires every business with employees to provide workers' compensation insurance purchased through a state agency. This policy covers medical bills and partial lost wages for work-related injuries.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

In Ohio, because independent contractors are not considered employees, they are not eligible for workers' compensation benefits. However, if you manage an independent contractor, and regularly control their performance, this freelancer or subcontractor is now considered your employee and requires your coverage.

If an independent contractor or subcontractor controls the selection of materials, traveling routes and quality of performance of another worker, that independent contractor or subcontractor is considered an employer and, as such, is required to provide workers' compensation coverage for that worker.

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Working as an independent contractor gives you a number of freedoms that include allowing you to end a working relationship if you don't like your client.

The only problem is that it is often illegal. There is no such thing as a 1099 employee. The 1099 part of the name refers to the fact that independent contractors receive a form 1099 at the end of the year, which reports to the IRS how much money was paid to the contractor.