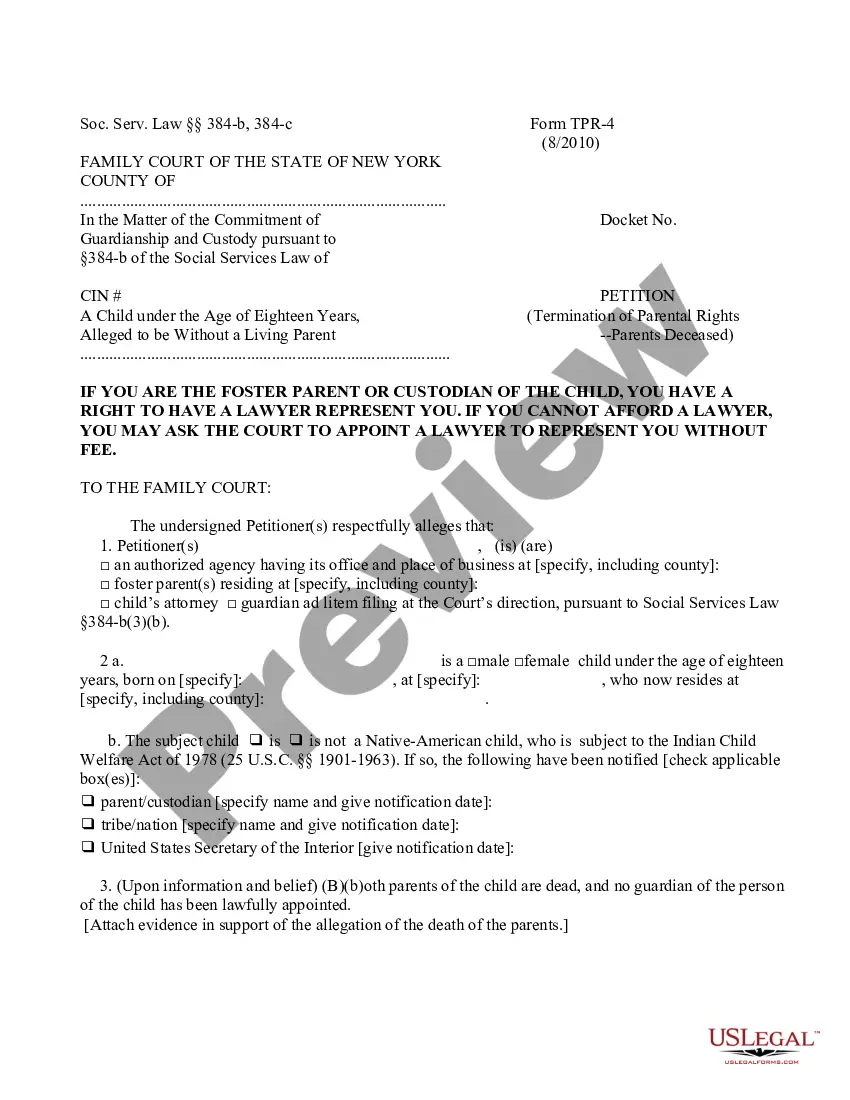

Ohio Employment Information Form is a vital document used by employers and employees in the state of Ohio to collect and record essential employment details. This form serves as a crucial tool in ensuring compliance with Ohio's labor laws and assists employers in accurately maintaining their employees' records. It is often required during the hiring process and helps facilitate the smooth onboarding of new employees. The Ohio Employment Information Form consists of various sections designed to collect detailed information about the employee. These sections typically include personal details such as name, address, contact information, social security number, date of birth, and emergency contact information. Moreover, it commonly requires data regarding an individual's eligibility to work in the United States, such as citizenship or immigration status, to ensure compliance with federal regulations. Another important component of this form includes tax-related details. Employees are usually required to provide their federal and state tax withholding information, including the number of allowances claimed and any additional tax withholding requests. This section helps employers accurately deduct the appropriate income taxes from employees' wages and fulfill their tax obligations to the government. Additionally, the Ohio Employment Information Form often includes sections that capture an employee's direct deposit information, allowing employers to efficiently process salary payments and avoid the hassles of physical checks. Employees are typically required to provide their bank account information, including the bank name, the account number, and the routing number. This information ensures the smooth and timely transfer of funds to the employees' designated bank accounts. Furthermore, some variations of the Ohio Employment Information Form may include additional sections specific to particular industries or professions. For example, healthcare-related forms may require employees to disclose their medical history or certifications, while education-related forms may seek academic qualifications and background. These sector-specific variations help employers gather information relevant to their industry's specific requirements. Overall, the Ohio Employment Information Form is a comprehensive document designed to gather pertinent employee details, ensuring compliance with state and federal regulations. Its sections encompass personal information, eligibility to work, tax-related details, direct deposit information, and potentially industry-specific sections. This form plays a critical role in establishing a transparent and lawful employment relationship and facilitates accurate record-keeping for employers in Ohio.

Ohio Employment Information Form

Description

How to fill out Ohio Employment Information Form?

Are you currently inside a situation the place you require papers for sometimes enterprise or individual purposes nearly every time? There are a lot of legitimate document web templates available on the net, but finding kinds you can depend on isn`t straightforward. US Legal Forms delivers a large number of type web templates, much like the Ohio Employment Information Form, that are created to meet federal and state requirements.

If you are already familiar with US Legal Forms internet site and get your account, just log in. After that, you are able to down load the Ohio Employment Information Form template.

Should you not provide an accounts and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you will need and make sure it is to the right area/county.

- Use the Preview button to check the shape.

- Browse the outline to actually have chosen the appropriate type.

- When the type isn`t what you`re seeking, use the Look for area to get the type that suits you and requirements.

- If you get the right type, click Acquire now.

- Opt for the costs prepare you would like, submit the specified info to produce your account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free file formatting and down load your duplicate.

Discover each of the document web templates you might have bought in the My Forms menu. You can aquire a extra duplicate of Ohio Employment Information Form anytime, if necessary. Just select the needed type to down load or print the document template.

Use US Legal Forms, probably the most considerable collection of legitimate types, to save time as well as steer clear of mistakes. The service delivers professionally produced legitimate document web templates that you can use for a variety of purposes. Produce your account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

To apply for Unemployment Insurance Benefits, you will need:Your Social Security number.Your driver's license or state ID number.Your name, address, telephone number, and e-mail address.Name, address, telephone number, and dates of employment with each employer you worked for during the past 6 weeks of employment.More items...

Under Ohio law, some individuals will be exempt from conducting work-search activities, including employees on a temporary layoff of 45 days or less, and individuals in approved training.

Acceptable 2019 or 2020 income documents, depending on the year you filed your claim, may include one or more of the following:Federal tax return (IRS Form 1040, Schedule C or F).State tax return (CA Form 540).W-2.Paycheck stubs.Payroll history.Bank receipts.Business records.Contracts.More items...?

1) Go to unemployment.ohio.gov 2) Click Employee, Unemployment Login, I agree, and Login. 3) Under Claimant Login, enter your Social Security number (SSN) and click Login. 4) You will be directed to the OHID login page.

PUA Application ProcessSocial Security number, date of birth and driver's license or state ID number.Name, address, telephone number, and valid email address.Name, address, telephone number and dates of employment for 2019 or 2020.Reason for unemployment.More items...

Go back to the SharedWork Ohio (SWO) Add Potential Participants screen in OJI and select the 'Browse...' button to find and attach your saved document. Once your document is attached, select Upload.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

If you are not able to work because of a medical condition, disability, or other reason, you will not be eligible for unemployment benefits.

Eligibility Requirements for Ohio Unemployment BenefitsYou must have earned at least a minimum amount in wages before you were unemployed.You must be unemployed through no fault of your own, as defined by Ohio law.You must be able and available to work, and you must be actively seeking employment.

To file weekly claims, you will need your Social Security number and PIN. You can file online 24 hours a day, 7 days a week, at unemployment.ohio.gov.