Ohio Employee Evaluation Form for Sole Trader

Description

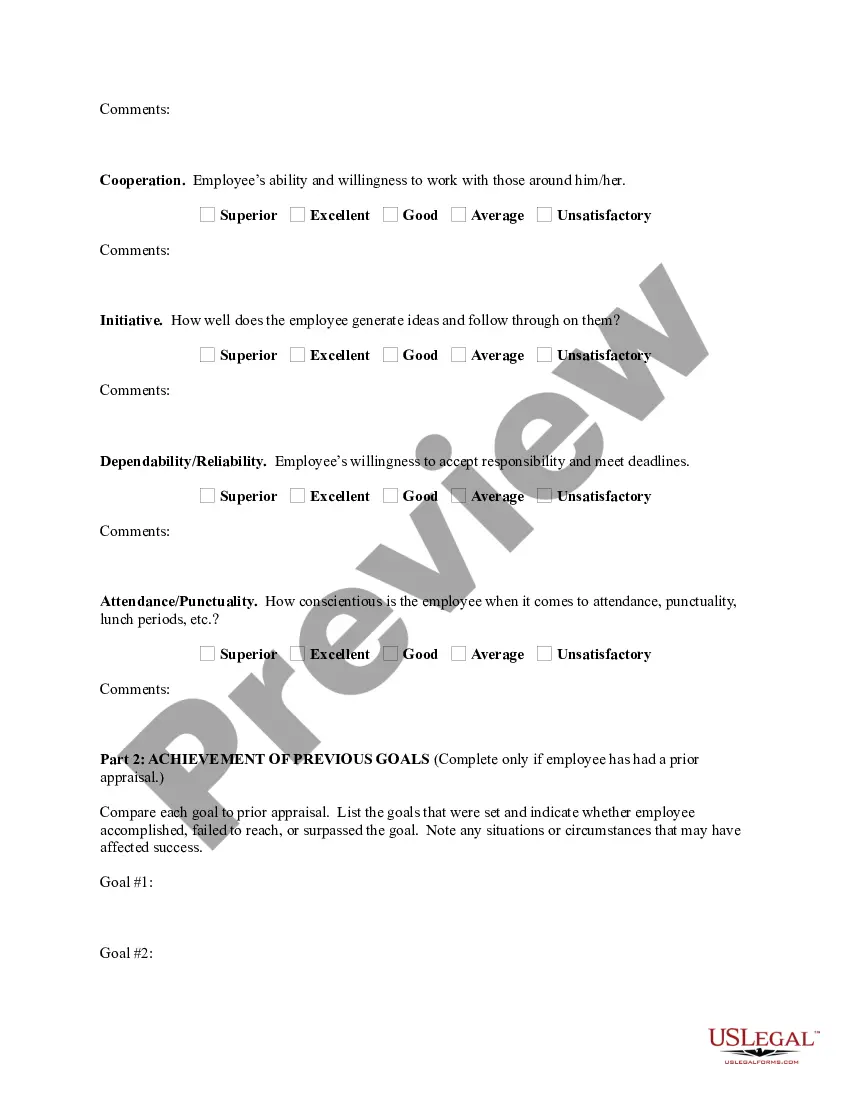

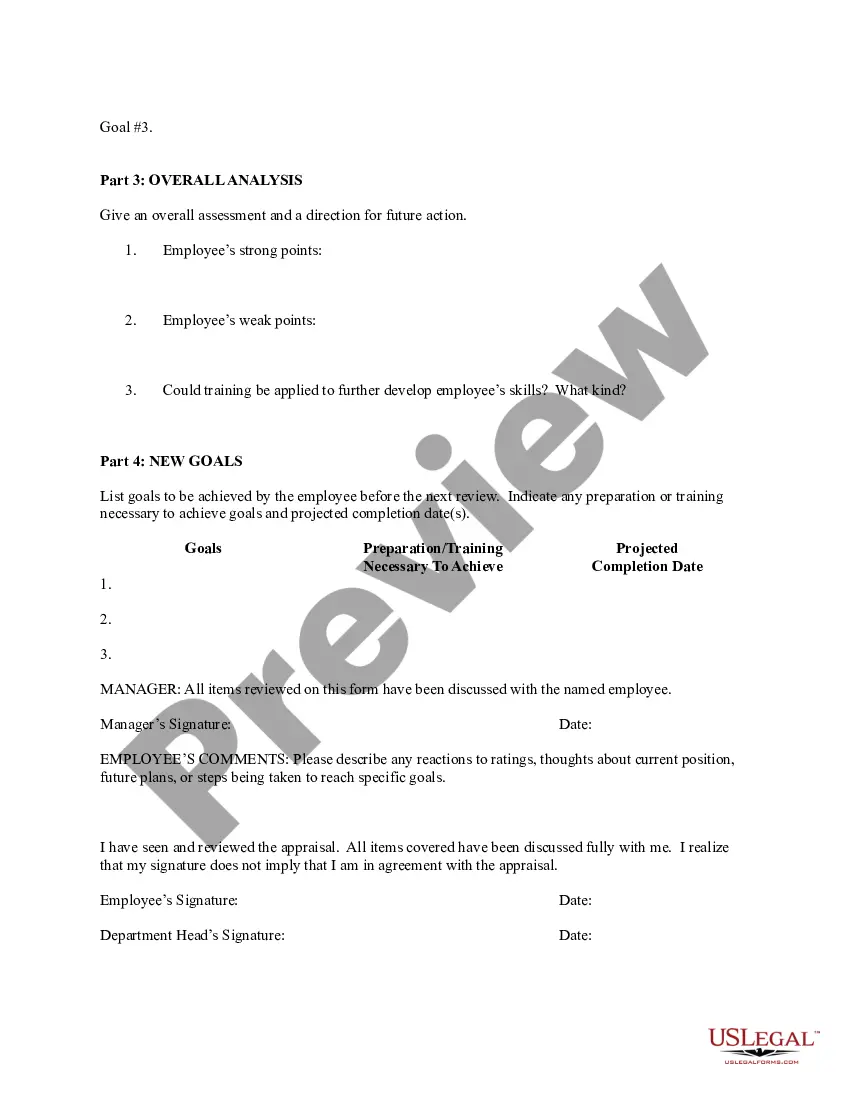

How to fill out Ohio Employee Evaluation Form For Sole Trader?

Are you inside a situation where you will need papers for sometimes enterprise or person purposes almost every day? There are plenty of legal document templates available on the Internet, but finding ones you can rely isn`t straightforward. US Legal Forms gives 1000s of kind templates, much like the Ohio Employee Evaluation Form for Sole Trader, which are published to fulfill federal and state requirements.

Should you be currently familiar with US Legal Forms website and get your account, simply log in. After that, you are able to obtain the Ohio Employee Evaluation Form for Sole Trader format.

Unless you have an profile and need to begin to use US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is for that right area/county.

- Make use of the Review button to review the shape.

- See the explanation to actually have chosen the proper kind.

- If the kind isn`t what you are searching for, utilize the Search field to discover the kind that fits your needs and requirements.

- If you find the right kind, click on Acquire now.

- Select the pricing prepare you want, fill out the desired information and facts to make your account, and buy your order making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free paper structure and obtain your version.

Find all the document templates you possess purchased in the My Forms food list. You can obtain a further version of Ohio Employee Evaluation Form for Sole Trader any time, if needed. Just select the necessary kind to obtain or printing the document format.

Use US Legal Forms, by far the most considerable collection of legal forms, to save efforts and stay away from faults. The support gives professionally made legal document templates that can be used for an array of purposes. Generate your account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

In Ohio, because independent contractors are not considered employees, they are not eligible for workers' compensation benefits. However, if you manage an independent contractor, and regularly control their performance, this freelancer or subcontractor is now considered your employee and requires your coverage.

Steps to Hiring your First Employee in OhioStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Whatever the LLC considers itself for tax purposes determines whether the LLC owner must have workers' compensation coverage. If the LLC considers itself a sole proprietorship or partnership, coverage is optional for the owner. If the LLC considers itself a corporation, the owner must cover himself or herself.

An individual incorporated as a corporation, sole owner, zero employees does NOT have to establish or maintain an Ohio workersfffd compensation policy unless the employer is required by another authority to show proof of workersfffd compensation coverage (in which case having elective coverage would be sufficient) or if, at

Do you need workers' compensation in Ohio if you are self-employed? A sole proprietor or member of a partnership must carry workers' compensation insurance for any employees of the business, but it is optional for owners to have insurance for themselves.

Establishes both identity and employment authorization. Employers must report the employee's name, address, Social Security number, date of birth, date of hire and the state in which the employee works. Federal and state laws require all employers to report all employees who live or work in Ohio.

All employers must establish employment eligibility and the identity of new employees by completing Form I-9. 2. Employers need to keep completed I-9's for three years or one year after an employee leaves.

The average rates for workers compensation in Ohio are $0.64 per $100 in payroll.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.