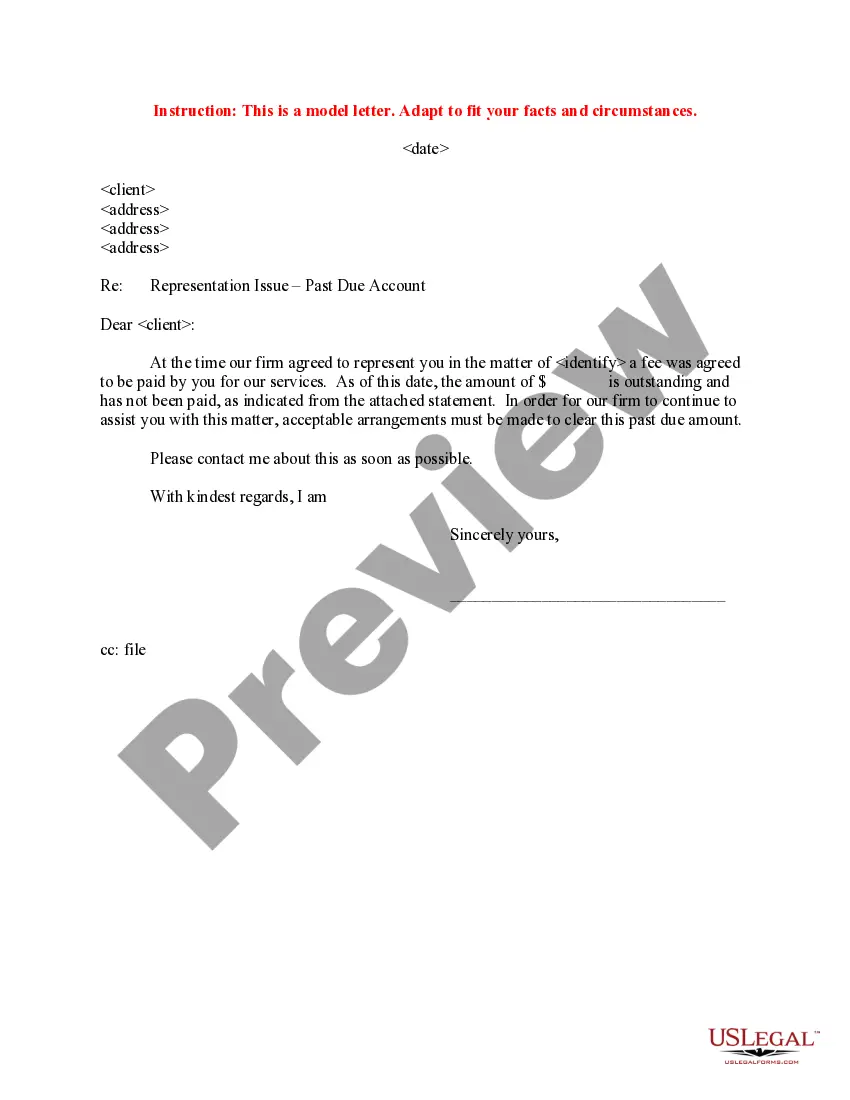

Ohio Letter to Client - Failure to pay account and proposed withdrawal

Description

How to fill out Letter To Client - Failure To Pay Account And Proposed Withdrawal?

Are you presently within a placement that you require papers for either business or specific uses virtually every day? There are a variety of legal papers layouts available on the Internet, but locating types you can rely is not simple. US Legal Forms gives thousands of develop layouts, just like the Ohio Letter to Client - Failure to pay account and proposed withdrawal, which can be composed to meet federal and state demands.

When you are previously familiar with US Legal Forms website and get a merchant account, merely log in. Next, you can obtain the Ohio Letter to Client - Failure to pay account and proposed withdrawal format.

Unless you offer an account and need to begin using US Legal Forms, follow these steps:

- Get the develop you want and make sure it is for your proper metropolis/state.

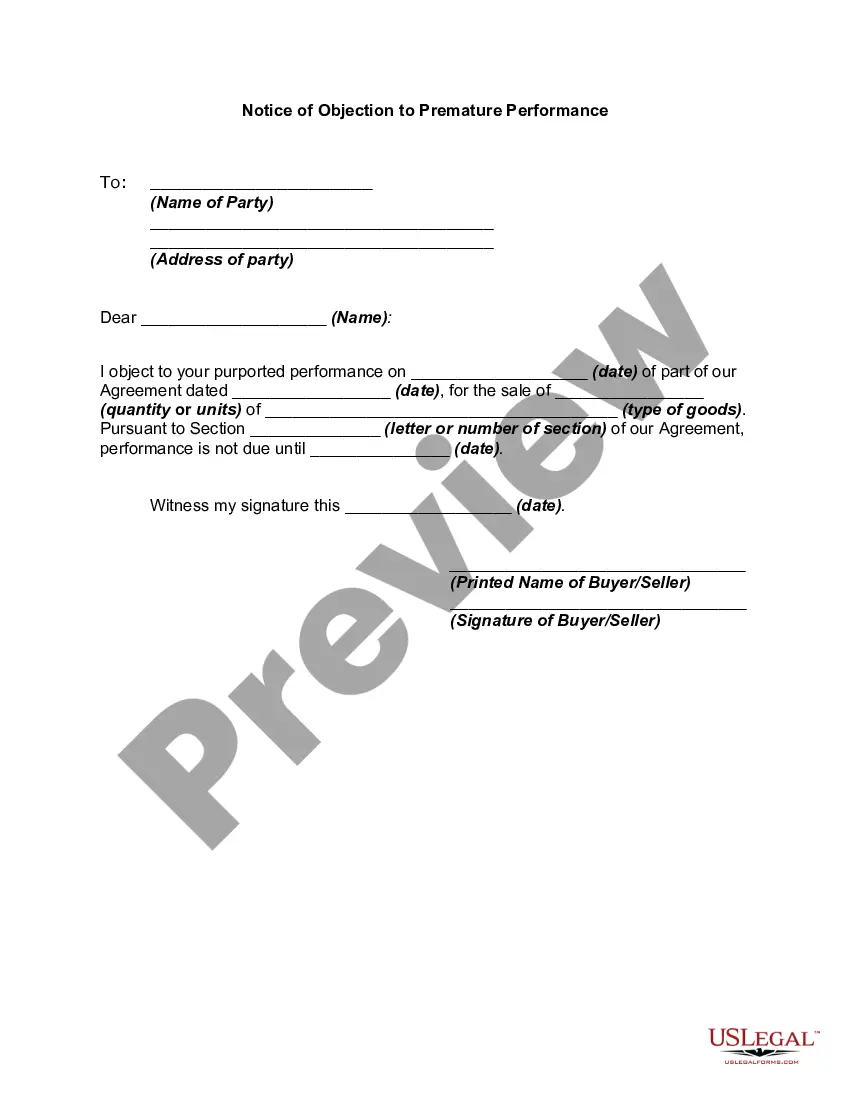

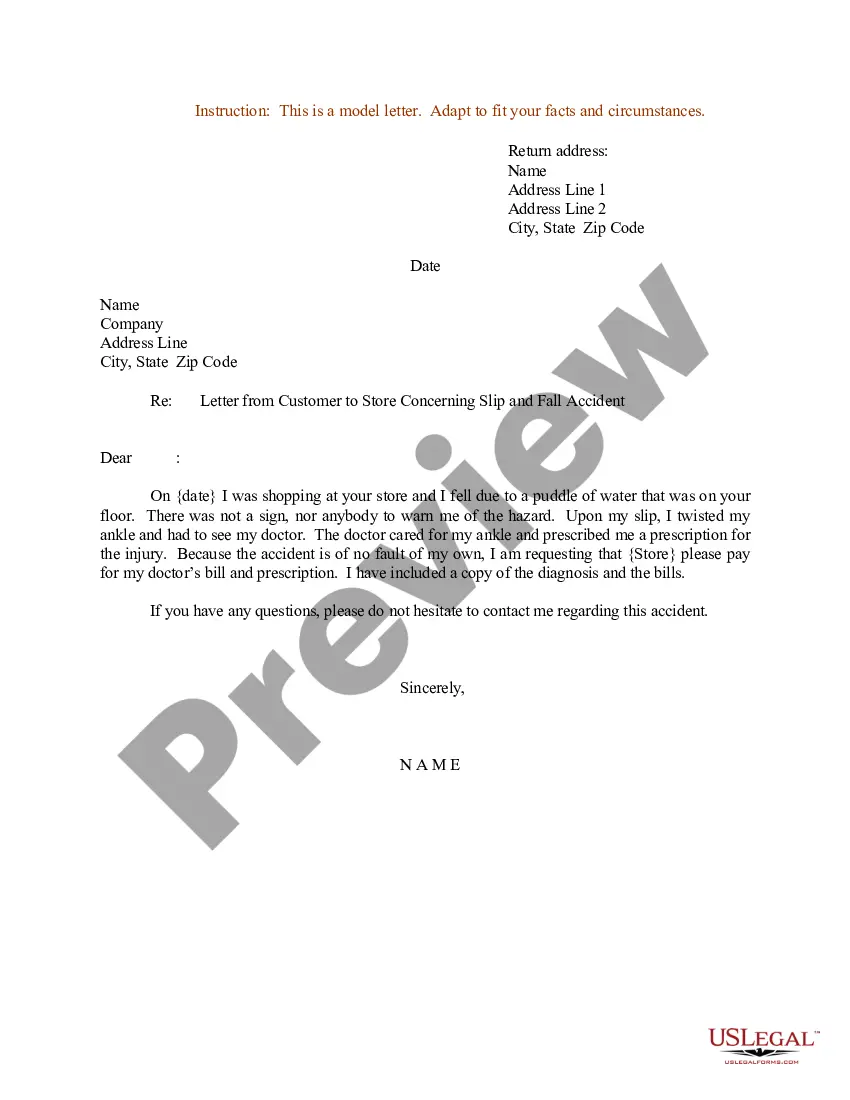

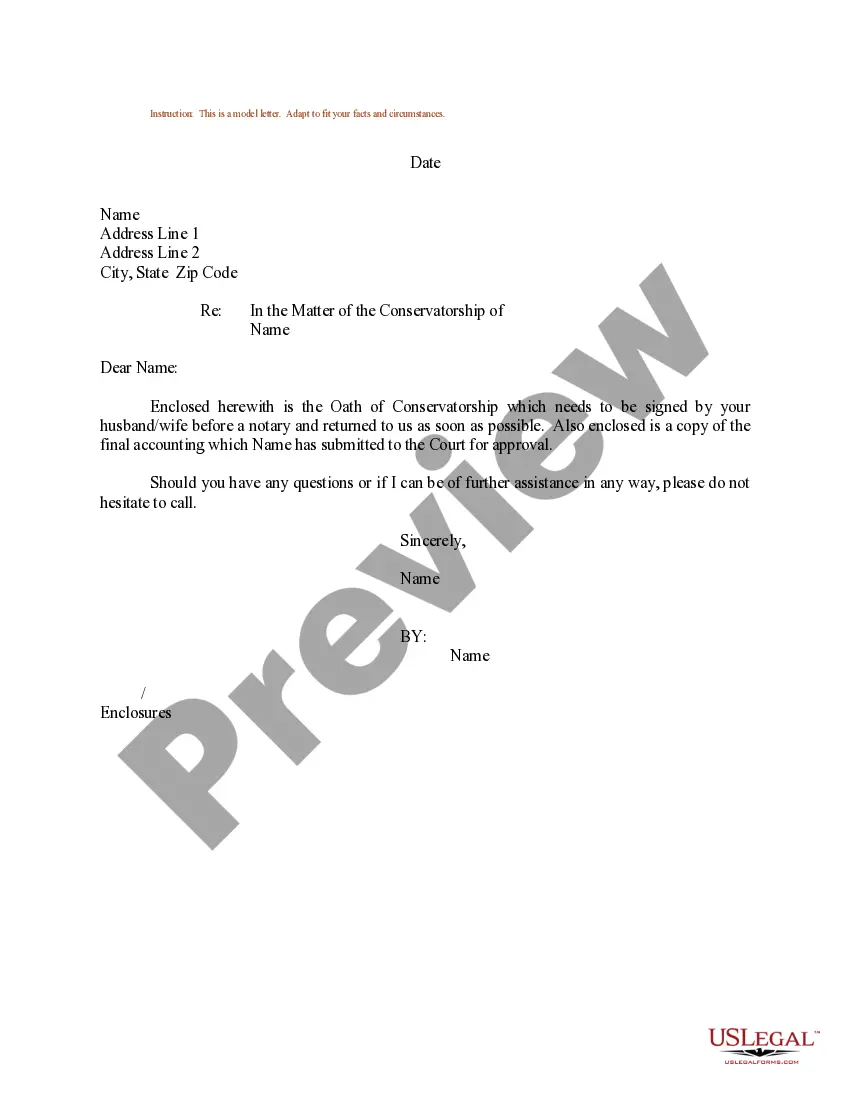

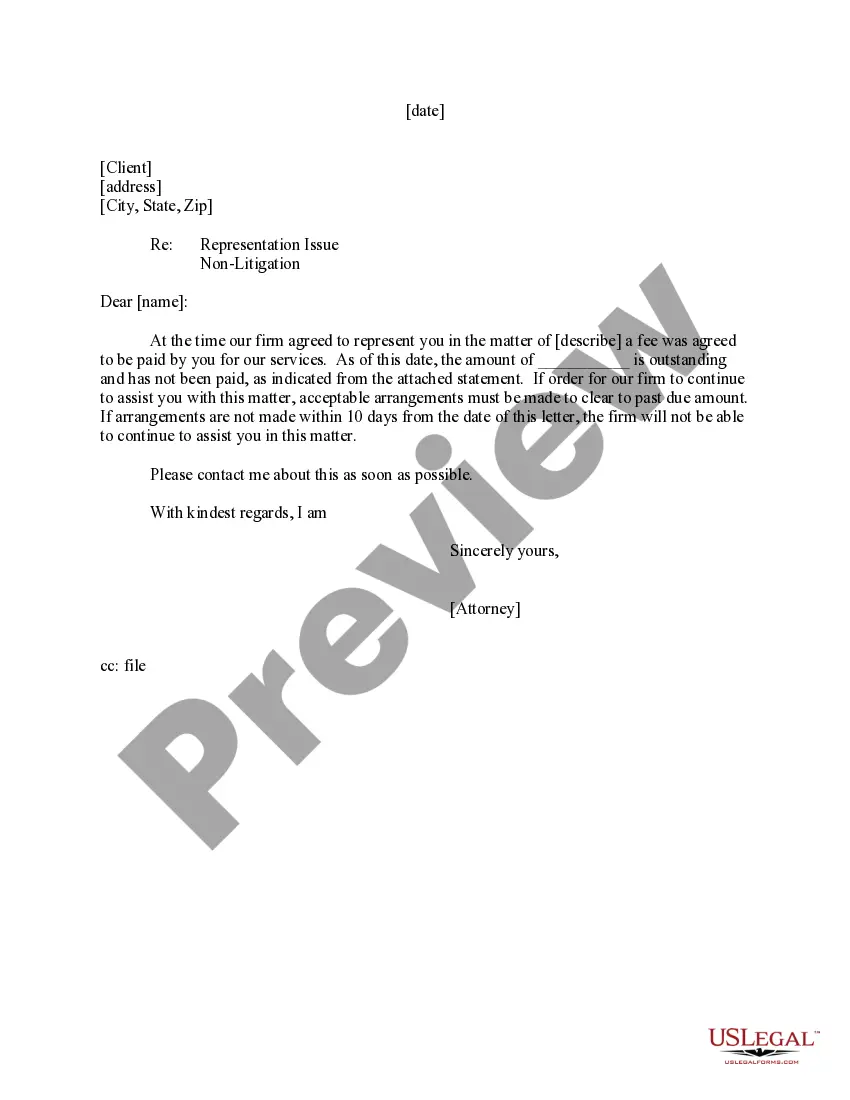

- Use the Review button to check the shape.

- See the information to ensure that you have selected the correct develop.

- In case the develop is not what you`re seeking, make use of the Look for industry to get the develop that suits you and demands.

- If you obtain the proper develop, just click Acquire now.

- Select the costs prepare you desire, submit the required information to make your money, and pay money for an order making use of your PayPal or charge card.

- Select a convenient document structure and obtain your duplicate.

Get every one of the papers layouts you possess bought in the My Forms food list. You can aquire a further duplicate of Ohio Letter to Client - Failure to pay account and proposed withdrawal anytime, if needed. Just select the needed develop to obtain or produce the papers format.

Use US Legal Forms, one of the most extensive collection of legal forms, to save lots of time as well as stay away from errors. The support gives professionally created legal papers layouts that can be used for a variety of uses. Generate a merchant account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

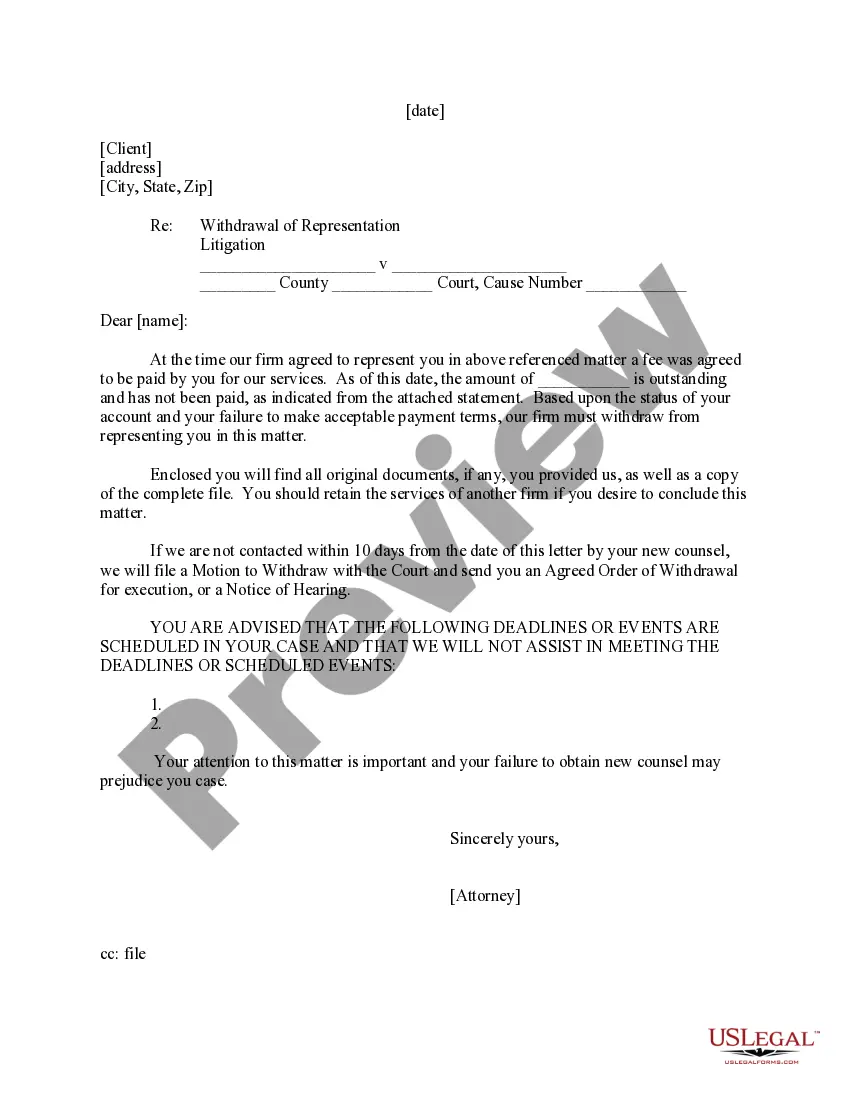

Regrettably, the difficulty we have had in [communicating with [client name]] [agreeing upon an appropriate course of action] [other] has led us to conclude that it is necessary for us to terminate our relationship and for [client name] to proceed with new counsel.

The letter should include the date of termination, the reason for termination (if applicable), any remaining obligations that either party may have, and an acknowledgement of contributions made by the employee during their time with the company.

The letter should include the date of termination, the reason for termination (if applicable), any remaining obligations that either party may have, and an acknowledgement of contributions made by the employee during their time with the company.

A disengagement letter professionally and formally terminates the CPA-client relationship and provides CPAs with a valuable tool to reduce potential legal liability. When written effectively, the disengagement letter can leave clients feeling that you considered their business needs and acted in their best interests.

But there is a formula you can use for this letter: Introduction. I see many draft withdrawal letters that start off in the middle of what happened that led to the withdrawal. ... Facts. The client should receive some explanation of why you are withdrawing. ... Timing. ... Deadlines. ... Files. ... Fees. ... Good luck.

Stay calm, rational and polite. Give reasons for terminating the relationship, but keep emotion and name-calling out of the conversation. Follow-up with a phone call. You can start the process with an email, but you should follow-up with a phone call to talk your client through the process and answer any questions.

A disengagement letter serves to make clear that a client has ceased to be a current client for conflict of interest analysis.

When drafting the client termination letter, keep the following in mind: It's not necessary, or suggested, to include a reason for the termination. The letter should simply and directly inform the client that you will no longer provide services to them.