The Ohio Agreement of Combination, also referred to as the Ohio Consolidation Agreement, is a legal document that allows one or more existing corporations to merge or consolidate into a single entity, thereby streamlining their operations and combining their resources. This agreement is applicable in the state of Ohio and follows the specific guidelines and regulations set forth under Ohio corporate law. The Ohio Agreement of Combination involves the unification of two or more corporations into a single entity, with the aim of creating a more efficient and competitive business structure. This agreement outlines the terms and conditions of the consolidation, including the rights, responsibilities, and obligations of each participating corporation, as well as the rights of the shareholders. The agreement typically includes relevant keywords such as "merger," "consolidation," "corporate restructuring," "Ohio corporate law," "merger agreement," and "corporate consolidation in Ohio." It is crucial to understand that there might be different types of Ohio Agreement of Combination, depending on the specific circumstances and goals of the participating corporations: 1. Horizontal Combination: This type of agreement occurs when two or more corporations operating in the same industry or sector merge together. The aim of this combination is to enhance market share, leverage economies of scale, and increase competitiveness by consolidating resources. 2. Vertical Combination: In this scenario, corporations operating at different stages of the production or distribution chain merge to streamline operations and achieve better coordination. This type of combination allows for increased efficiencies and potential cost savings. 3. Conglomerate Combination: When corporations from different industries or sectors merge, it is called a conglomerate combination. This type of combination enables diversification, risk reduction, and facilitates the expansion of business activities into new markets or industries. 4. Acquisition Combination: While not strictly a merger or consolidation by definition, the Ohio Agreement of Combination may also refer to the acquisition of one corporation by another. In this case, one corporation purchases a controlling stake in another corporation, resulting in a change of ownership and control. The Ohio Agreement of Combination should be prepared by legal professionals well-versed in Ohio corporate law to ensure compliance with all legal requirements. It is crucial for all participating corporations to conduct due diligence, including financial audits and legal assessments, to identify potential risks and liabilities before entering into the agreement. By carefully considering the terms and objectives of this agreement, corporations can strategically strengthen their market position and propel their growth in the state of Ohio.

Ohio Agreement of Combination

Description

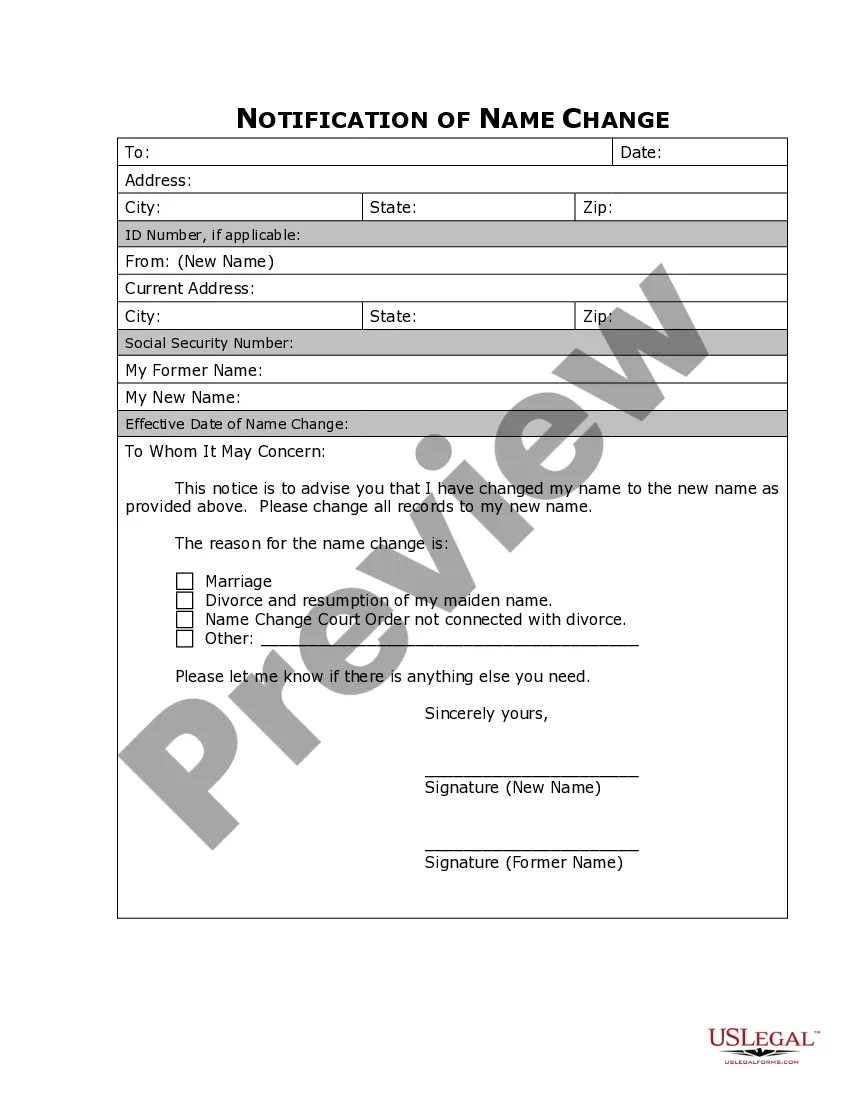

How to fill out Agreement Of Combination?

If you need to full, obtain, or print lawful document layouts, use US Legal Forms, the greatest collection of lawful varieties, that can be found on the web. Utilize the site`s simple and convenient lookup to discover the papers you want. Various layouts for enterprise and person purposes are categorized by categories and claims, or search phrases. Use US Legal Forms to discover the Ohio Agreement of Combination in a few clicks.

When you are presently a US Legal Forms client, log in in your account and then click the Obtain switch to find the Ohio Agreement of Combination. You may also entry varieties you previously acquired inside the My Forms tab of the account.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for your proper metropolis/region.

- Step 2. Take advantage of the Preview option to check out the form`s information. Do not forget to read the explanation.

- Step 3. When you are unsatisfied with the form, use the Research industry towards the top of the monitor to find other variations in the lawful form template.

- Step 4. After you have identified the shape you want, select the Acquire now switch. Pick the costs prepare you favor and add your qualifications to sign up for an account.

- Step 5. Approach the transaction. You can use your charge card or PayPal account to perform the transaction.

- Step 6. Select the file format in the lawful form and obtain it on your own gadget.

- Step 7. Full, edit and print or indicator the Ohio Agreement of Combination.

Each and every lawful document template you acquire is the one you have eternally. You have acces to every form you acquired within your acccount. Select the My Forms segment and choose a form to print or obtain once again.

Compete and obtain, and print the Ohio Agreement of Combination with US Legal Forms. There are many professional and condition-specific varieties you can use to your enterprise or person needs.

Form popularity

FAQ

No employee of the office of the attorney general shall purposely make available for inspection or copying documentary material, answers to written interrogatories, or transcripts of oral testimony provided pursuant to an investigative demand, nor disclose the contents of the material, answers, or transcripts, except ...

The certificate of the secretary of state, or a copy of the certificate of merger or consolidation certified by the secretary of state, may be filed for record in the office of the recorder of any county in this state and, if filed, shall be recorded in the official records of that county.

Ohio Revised Code section 1701.591 requires close corporations to have a close corporation agreement. This agreement must be approved by every single shareholder of the company.

Section 1331.01 | Monopoly definitions. (A) "Person" includes corporations, partnerships, and associations existing under or authorized by any state or territory of the United States, and solely for the purpose of the definition of division (B) of this section, a foreign governmental entity.

Section 1701.01 | General corporation law definitions. As used in sections 1701.01 to 1701.98 of the Revised Code, unless the context otherwise requires: (A) "Corporation" or "domestic corporation" means a corporation for profit formed under the laws of this state.

(A) A corporation shall give notice of a dissolution by certified or registered mail, return receipt requested, to each known creditor and to each person that has a claim against the corporation, including claims that are conditional, unmatured, or contingent upon the occurrence or nonoccurrence of future events.

Section 1701.82 - Conditions following merger or consolidation (A) When a merger or consolidation becomes effective, all of the following apply: (1) The separate existence of each constituent entity other than the surviving entity in a merger shall cease, except that whenever a conveyance, assignment, transfer, deed, ...

Section 1701.86 | Voluntary dissolution. (A) A corporation may be dissolved voluntarily in the manner provided in this section, provided the provisions of Chapter 1704.