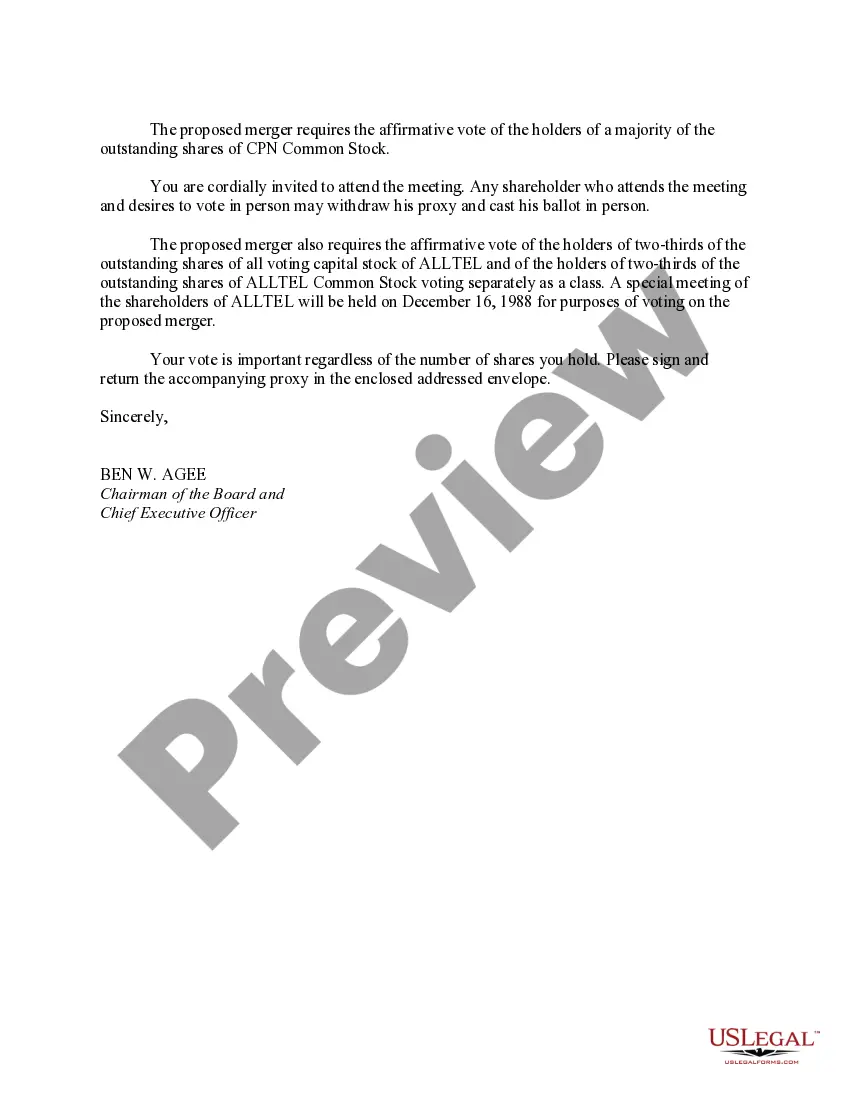

Ohio Letter to Shareholders is a formal communication issued by a company based in Ohio to its shareholders. This letter serves as a means to update shareholders on the company's performance, financial standing, strategic initiatives, and other relevant information related to their investments. Below are a few types of Ohio Letter to Shareholders: 1. Annual Ohio Letter to Shareholders: This type of letter is typically sent out annually, providing a comprehensive overview of the company's performance throughout the year. It highlights key financial metrics such as revenue, profit, and market share. Additionally, the letter may elaborate on any significant developments, changes in management, and future growth prospects. 2. Quarterly Ohio Letter to Shareholders: These letters are issued on a quarterly basis and focus on providing investors with a condensed update of the company's recent performance. They include financial results for the quarter, sales figures, operational achievements, and other material events that have taken place during the period. 3. Special Ohio Letter to Shareholders: Special letters are distributed in response to extraordinary events or circumstances affecting the company. Examples of such events could be mergers, acquisitions, strategic partnerships, regulatory changes, litigation outcomes, or any other major developments that have a notable impact on the company's shareholders. Regardless of the type of Ohio Letter to Shareholders, relevant keywords that may be included in the content are: Performancenc— - Revenue - Profit - Financial results — Markestarar— - Strategic initiatives - Management changes — Growth prospect— - Operational achievements — Special event— - Mergers and acquisitions — Regulatory change— - Litigation outcomes — Shareholder valu— - Dividends - Corporate governance — Transparenc— - Stakeholder engagement - Investor relations It is important to note that the content of an Ohio Letter to Shareholders should be tailored to the specific company and its objectives, providing comprehensive and accurate information to maintain transparency and inspire confidence among shareholders.

Ohio Letter to Shareholders

Description

How to fill out Ohio Letter To Shareholders?

Finding the right legal papers format can be quite a have difficulties. Obviously, there are a lot of layouts available on the net, but how would you find the legal form you will need? Use the US Legal Forms internet site. The services offers a large number of layouts, for example the Ohio Letter to Shareholders, that you can use for company and private needs. Each of the varieties are examined by specialists and meet up with federal and state requirements.

In case you are already authorized, log in in your profile and then click the Acquire button to have the Ohio Letter to Shareholders. Make use of profile to look through the legal varieties you possess bought in the past. Check out the My Forms tab of the profile and obtain another duplicate from the papers you will need.

In case you are a whole new end user of US Legal Forms, listed below are basic instructions so that you can follow:

- Initial, ensure you have chosen the appropriate form for your personal town/area. You may look through the form using the Review button and study the form explanation to make certain it is the right one for you.

- In the event the form is not going to meet up with your expectations, utilize the Seach area to get the appropriate form.

- When you are sure that the form would work, click the Purchase now button to have the form.

- Choose the prices prepare you would like and enter in the needed info. Create your profile and pay for the transaction with your PayPal profile or Visa or Mastercard.

- Pick the document format and download the legal papers format in your product.

- Full, edit and print and indication the attained Ohio Letter to Shareholders.

US Legal Forms may be the biggest local library of legal varieties for which you can find different papers layouts. Use the company to download expertly-produced files that follow express requirements.