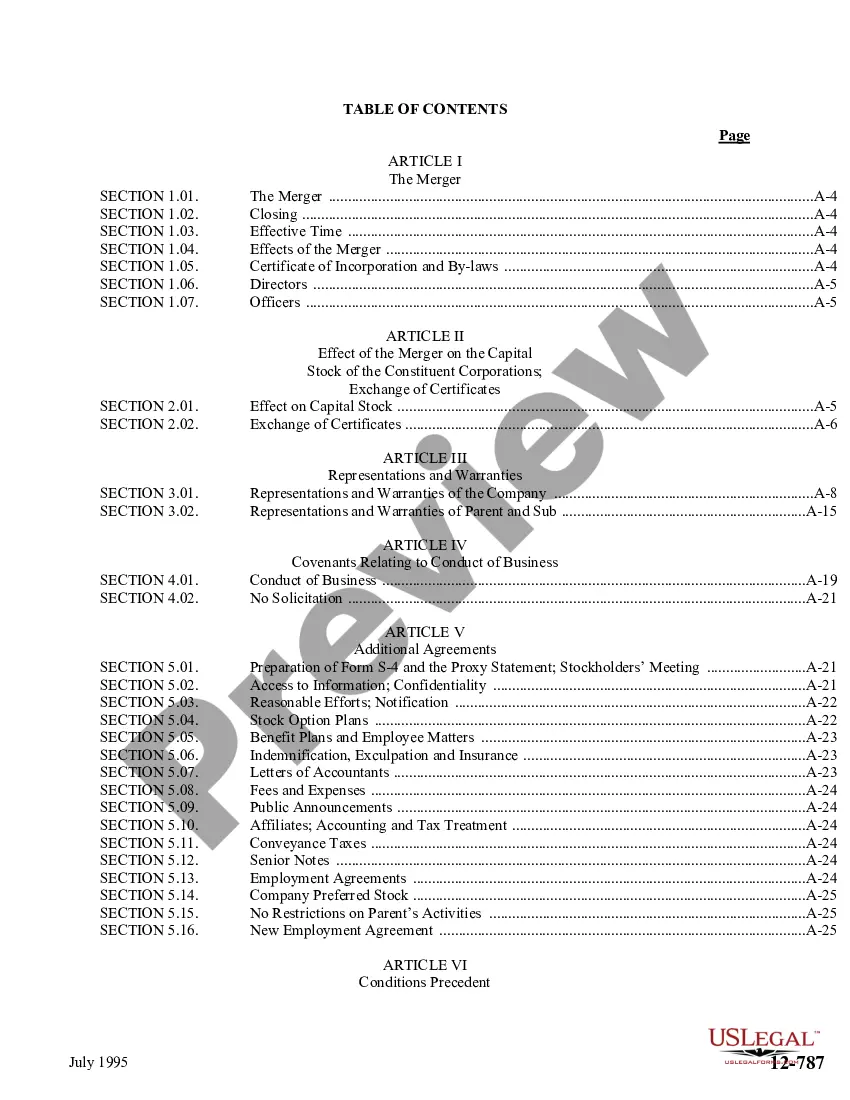

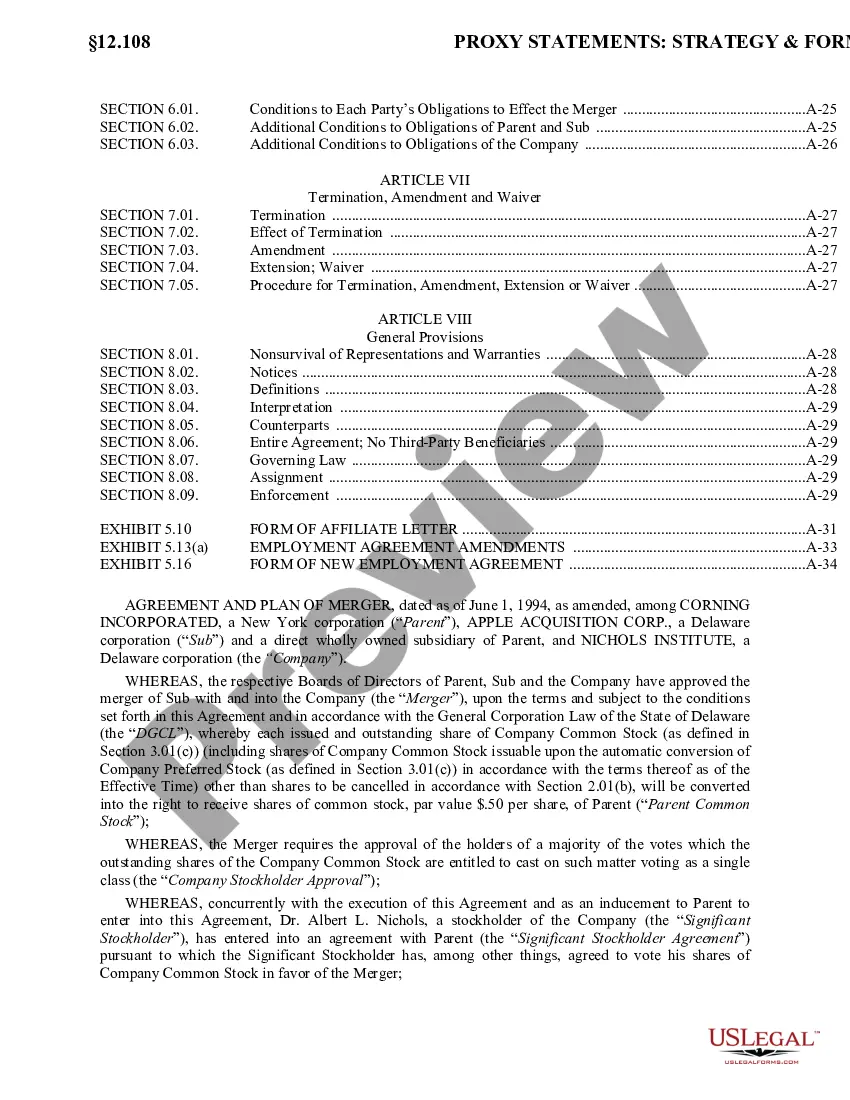

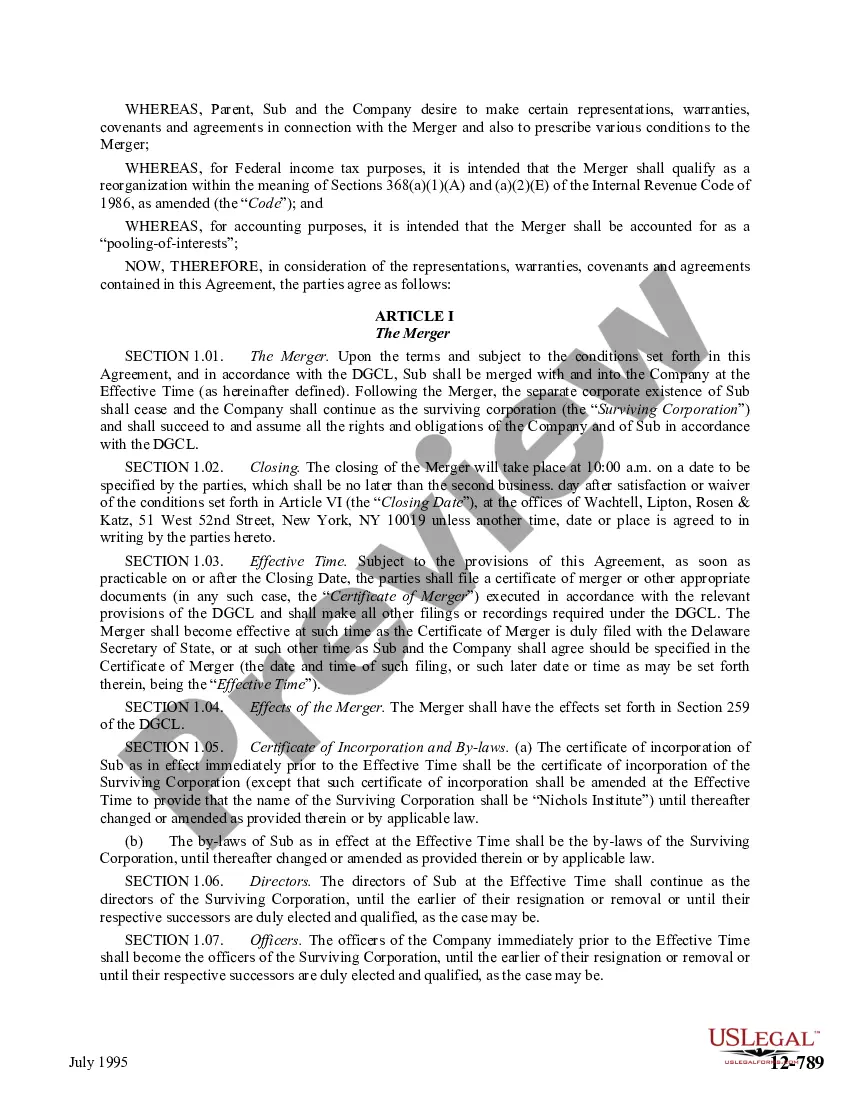

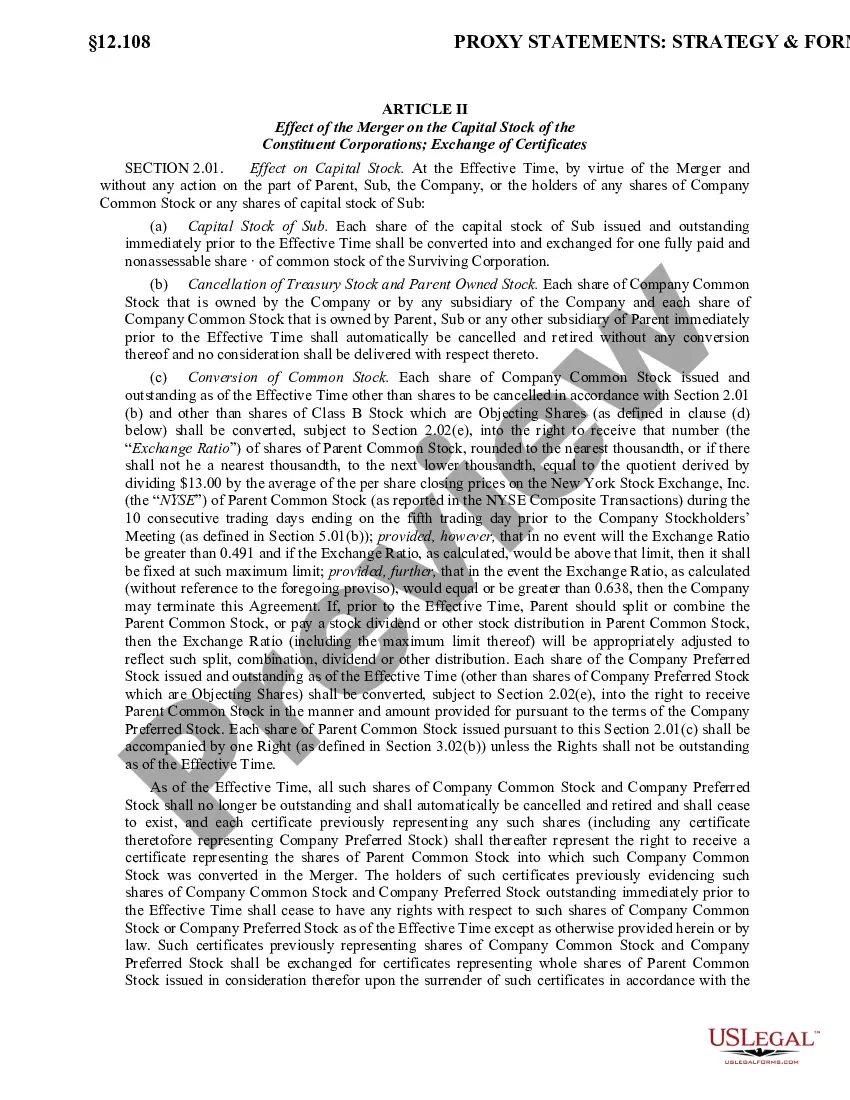

Ohio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute

Description

How to fill out Agreement And Plan Of Merger By Corning Inc, Apple Acquisition Corp, And Nichols Institute?

You can spend time on-line attempting to find the legitimate document design that fits the federal and state specifications you want. US Legal Forms supplies thousands of legitimate varieties which are evaluated by professionals. You can actually acquire or print the Ohio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute from our services.

If you have a US Legal Forms accounts, you can log in and then click the Down load option. Next, you can total, modify, print, or signal the Ohio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute. Every single legitimate document design you get is the one you have eternally. To get one more duplicate for any bought type, go to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms website initially, adhere to the easy guidelines under:

- Very first, ensure that you have selected the right document design for your county/town of your choice. See the type information to make sure you have chosen the right type. If offered, use the Review option to look from the document design too.

- If you wish to locate one more model in the type, use the Research industry to discover the design that meets your needs and specifications.

- When you have located the design you would like, just click Acquire now to move forward.

- Choose the rates plan you would like, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal accounts to fund the legitimate type.

- Choose the formatting in the document and acquire it in your system.

- Make changes in your document if needed. You can total, modify and signal and print Ohio Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute.

Down load and print thousands of document templates while using US Legal Forms site, which offers the largest collection of legitimate varieties. Use expert and condition-particular templates to handle your small business or individual requirements.