Ohio Directors and Officers Indemnity Trust

Description

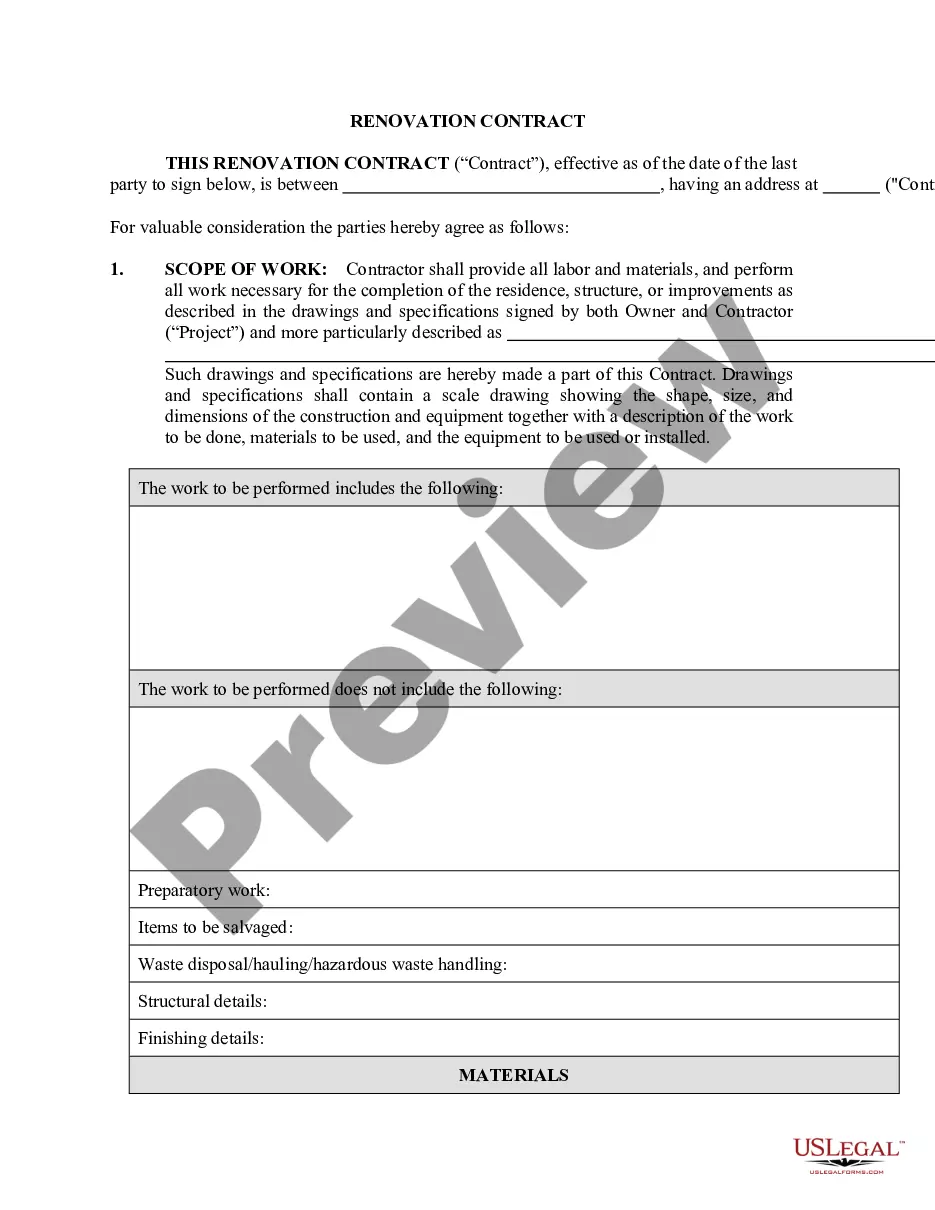

How to fill out Directors And Officers Indemnity Trust?

Have you been in a situation the place you need to have papers for sometimes business or person uses almost every day time? There are tons of authorized document web templates available online, but discovering types you can depend on is not easy. US Legal Forms provides thousands of develop web templates, just like the Ohio Directors and Officers Indemnity Trust, that happen to be composed to fulfill state and federal needs.

Should you be currently acquainted with US Legal Forms site and get a merchant account, basically log in. Afterward, you are able to down load the Ohio Directors and Officers Indemnity Trust design.

Unless you have an accounts and need to begin using US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is for that proper city/area.

- Utilize the Review key to check the shape.

- Read the outline to ensure that you have chosen the appropriate develop.

- In the event the develop is not what you are seeking, make use of the Search industry to get the develop that fits your needs and needs.

- When you find the proper develop, click Acquire now.

- Choose the rates program you want, fill in the specified details to produce your account, and buy your order with your PayPal or credit card.

- Pick a handy data file file format and down load your duplicate.

Locate every one of the document web templates you have purchased in the My Forms food list. You can get a further duplicate of Ohio Directors and Officers Indemnity Trust anytime, if necessary. Just click on the needed develop to down load or print out the document design.

Use US Legal Forms, probably the most comprehensive variety of authorized kinds, in order to save some time and stay away from errors. The services provides expertly created authorized document web templates which can be used for a variety of uses. Make a merchant account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

(A)(1) Subject to divisions (A)(2) and (3) of this section, an association may indemnify or agree to indemnify any person that was or is a party, or is threatened to be made a party, to any threatened, pending, or completed civil, criminal, administrative, or investigative action, suit, or proceeding, other than an ...

In the indemnity clause, one party commits to compensate another party for any prospective loss or damage. More common is in insurance contracts, in exchange for premiums paid by the insured to the insurer, the insurer offers to compensate the insured for any potential damages or losses.

The termination of any action, suit, or proceeding by judgment, order, settlement, or conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner the person reasonably believed to be in or not opposed to the best ...

In legal terms, an Act of Indemnity is a statute passed to protect people who have committed some illegal act which would otherwise cause them to be subjected to legal penalties.

SeeC. §153.81(A)(1)(b). Indemnification is limited to claims, damages, or loss, including reasonable attorney fees, costs, and expenses. Ohio follows the American Rule, which states that parties to litigation are to pay for their own attorneys' fees unless there is a specific exception to the rule that applies.

(A) A corporation may sue and be sued. (B) A corporation may adopt and alter a corporate seal and use it or a facsimile of it, but failure to affix the corporate seal shall not affect the validity of any instrument.

Indemnity is implicated when a person discharges another's duty: A person who, in whole or in part, has discharged a duty which is owed by him but which as between himself and another should have been discharged by the other, is entitled to indemnity from the other, unless the payor is barred by the wrongful nature of ...

These provisions generally require the portfolio company to expressly acknowledge that the director has rights of indemnification, advancement, and insurance from the sponsor; to agree that it is the indemnitor of first resort and that it is obligated to advance all expenses and indemnify for all judgments, penalties, ...