The Ohio Eligible Directors' Stock Option Plan of Kyle Electronics is a unique compensation program designed specifically for directors serving on the board of Kyle Electronics in Ohio. This stock option plan aims to incentivize and reward eligible directors by granting them the opportunity to purchase company stock at a predetermined price. Under this plan, eligible directors are given the right to acquire a specified number of company shares over a certain period. The option price is typically set at the fair market value of the stock on the date of grant, ensuring a fair and equitable distribution of benefits. One type of option available under the Ohio Eligible Directors' Stock Option Plan is the non-qualified stock option (NO). Non-qualified stock options provide directors with more flexibility in terms of exercising and selling their acquired shares. The income generated from exercising SOS is typically subject to regular income tax rates. Another type of option that may be part of the plan is the incentive stock option (ISO). Incentive stock options have certain tax advantages over SOS as they qualify for favorable tax treatment under the Internal Revenue Code. SOS provide directors with the potential to receive capital gains treatment upon selling their shares if specific holding period requirements are met. Directors participating in the Ohio Eligible Directors' Stock Option Plan may have different vesting schedules and exercise periods depending on the terms specified in their individual agreements. Vesting schedules often require directors to stay on the board for a specific period before they can exercise their options. The exercise period represents the timeframe in which directors can purchase the granted shares. The Ohio Eligible Directors' Stock Option Plan plays a pivotal role in attracting and retaining skilled board members for Kyle Electronics. By offering directors the opportunity to become shareholders and benefit from the company's growth, the incentive plan aligns the interests of directors with those of the shareholders. This, in turn, fosters a stronger sense of corporate governance and accountability among the board members. Overall, the Ohio Eligible Directors' Stock Option Plan of Kyle Electronics serves as a powerful tool to attract and motivate talented directors who can contribute to the long-term success of the company. Through the issuance of stock options, Kyle Electronics ensures that its board members have a vested interest in the company's growth and financial results.

Ohio Eligible Directors' Stock Option Plan of Wyle Electronics

Description

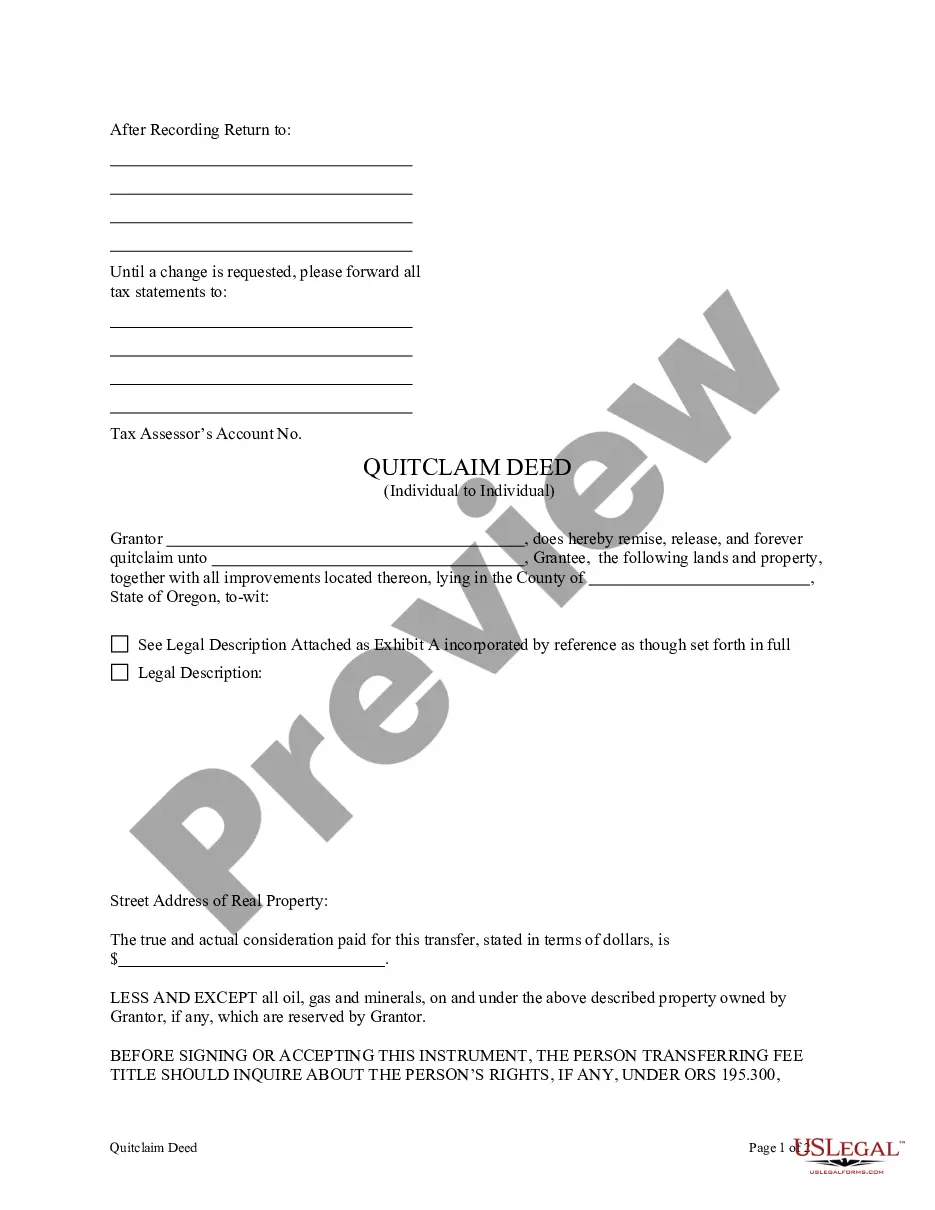

How to fill out Ohio Eligible Directors' Stock Option Plan Of Wyle Electronics?

You may spend time on the web searching for the lawful record format which fits the federal and state specifications you want. US Legal Forms gives thousands of lawful types which can be examined by pros. You can easily obtain or printing the Ohio Eligible Directors' Stock Option Plan of Wyle Electronics from your support.

If you have a US Legal Forms accounts, you may log in and then click the Download button. Next, you may complete, change, printing, or indication the Ohio Eligible Directors' Stock Option Plan of Wyle Electronics. Every lawful record format you buy is your own property forever. To acquire yet another copy associated with a acquired kind, proceed to the My Forms tab and then click the related button.

If you are using the US Legal Forms web site the first time, keep to the simple directions listed below:

- Very first, make sure that you have selected the proper record format for the county/metropolis that you pick. Browse the kind information to ensure you have picked out the appropriate kind. If accessible, utilize the Preview button to check with the record format at the same time.

- In order to find yet another edition of the kind, utilize the Research field to obtain the format that meets your needs and specifications.

- Upon having found the format you need, click on Purchase now to continue.

- Find the rates program you need, type your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal accounts to cover the lawful kind.

- Find the structure of the record and obtain it in your device.

- Make changes in your record if possible. You may complete, change and indication and printing Ohio Eligible Directors' Stock Option Plan of Wyle Electronics.

Download and printing thousands of record themes making use of the US Legal Forms web site, which offers the greatest collection of lawful types. Use skilled and status-distinct themes to tackle your company or individual needs.