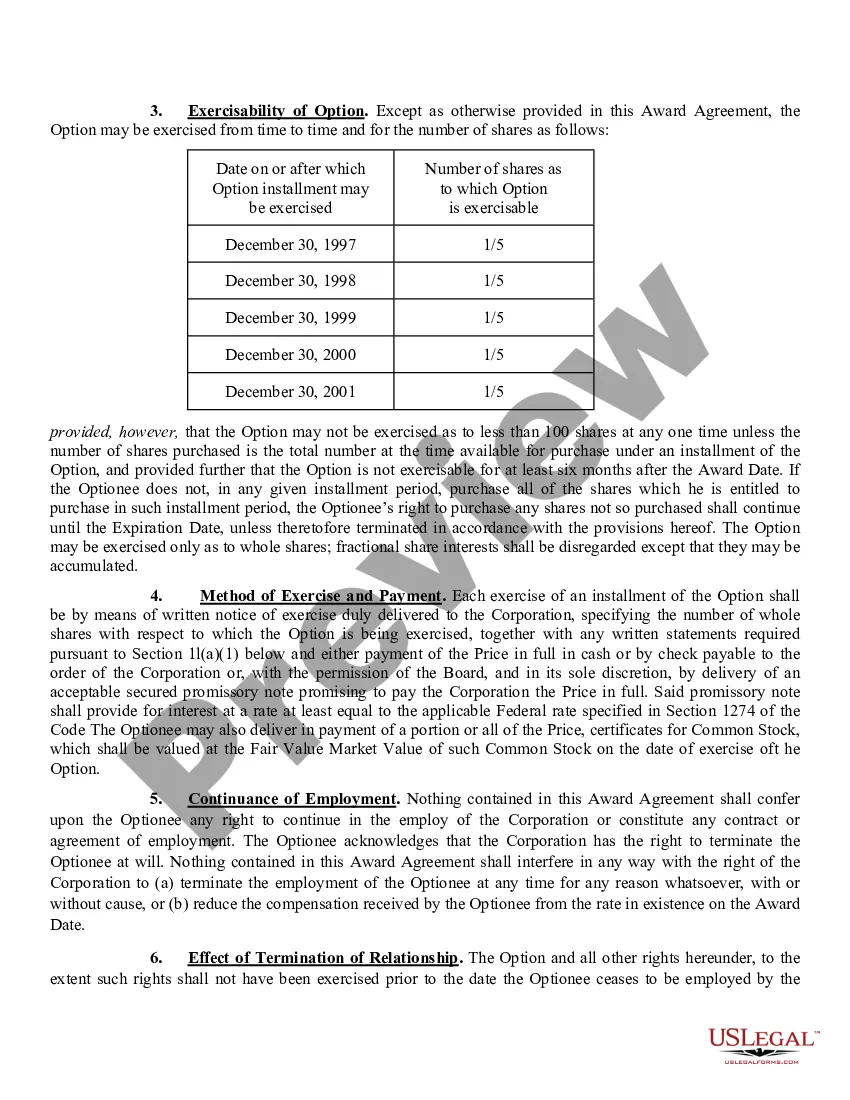

The Ohio Key Employee Stock Option Award Agreement is a legal document that outlines the terms and conditions for key employees in Ohio to receive stock options as part of their compensation package. This agreement serves as a mechanism to incentivize and retain top talent within a company by granting them the opportunity to purchase company stock at a predetermined price called the exercise price. Under this agreement, key employees in Ohio are awarded a specified number of stock options, which represent the right to purchase a specific number of shares in the company. The agreement specifies the exercise price, vesting schedule, and expiration date of the stock options. It also sets forth the terms and conditions under which the stock options may be exercised, including any restrictions on the sale of the purchased shares. There are different types of Ohio Key Employee Stock Option Award Agreements based on the conditions and requirements set by the company. Some common types include: 1. Non-Qualified Stock Option (NO): This type of agreement is available to all key employees and does not offer any special tax advantages. The employee is typically required to pay ordinary income tax on the difference between the exercise price and the fair market value of the shares at the time of exercise. 2. Incentive Stock Option (ISO): This type of agreement is more favorable from a tax perspective and is typically offered to key employees who meet certain eligibility criteria. If the employee holds the shares for a specific period of time, any profit from selling the shares may qualify for long-term capital gains tax rates, which are generally lower than ordinary income tax rates. 3. Restricted Stock Units (RSS): Although not technically stock options, RSS are another form of equity-based compensation that may be included in an Ohio Key Employee Stock Option Award Agreement. RSS represents a promise to deliver company stock at a future date upon meeting certain vesting conditions. The actual shares are not issued until the vesting requirements are met, and the employee is then taxed on the fair market value of the shares at the time of delivery. It is essential for both employers and employees to carefully review and understand the Ohio Key Employee Stock Option Award Agreement, as it outlines the rights, responsibilities, and obligations of both parties. Additionally, it is recommended to seek legal and tax advice to ensure compliance with applicable laws and optimize the potential benefits associated with stock options.

Ohio Key Employee Stock Option Award Agreement

Description

How to fill out Ohio Key Employee Stock Option Award Agreement?

Finding the right authorized document web template can be quite a battle. Obviously, there are tons of layouts available on the Internet, but how would you obtain the authorized type you require? Use the US Legal Forms internet site. The services offers a large number of layouts, such as the Ohio Key Employee Stock Option Award Agreement, that you can use for business and private requires. All the types are examined by pros and satisfy state and federal demands.

In case you are already authorized, log in for your account and click on the Download option to get the Ohio Key Employee Stock Option Award Agreement. Make use of your account to look throughout the authorized types you may have purchased in the past. Check out the My Forms tab of your respective account and have one more copy from the document you require.

In case you are a fresh user of US Legal Forms, allow me to share straightforward recommendations so that you can adhere to:

- Initial, make certain you have chosen the appropriate type for your town/area. You are able to check out the form making use of the Review option and study the form information to ensure this is basically the right one for you.

- In the event the type is not going to satisfy your preferences, make use of the Seach area to find the appropriate type.

- Once you are sure that the form is proper, click on the Purchase now option to get the type.

- Select the prices strategy you want and type in the needed information and facts. Make your account and pay money for the order using your PayPal account or bank card.

- Choose the submit formatting and download the authorized document web template for your gadget.

- Total, revise and printing and indication the acquired Ohio Key Employee Stock Option Award Agreement.

US Legal Forms will be the most significant collection of authorized types in which you can discover a variety of document layouts. Use the company to download skillfully-made files that adhere to express demands.

Form popularity

FAQ

Income tax: 2.765 percent to 3.99 percent Ohio has four tax brackets, ranging from 2.765 percent to 3.99 percent. Residents of many Ohio cities and villages also pay local income tax on top of state tax.

Under the American Rescue Plan, individuals who received unemployment benefits ? and earned less than $150,000 in adjusted gross income in 2020 ? can avoid income taxes on up to $10,200 in benefits. The exclusion is $10,200 per person, so spouses filing a joint return can avoid paying taxes on up to $20,400.

NOTE: If the income is to be deducted, but less than your weekly benefit amount, your weekly payment will be reduced by the amount of income for the week. Deductible Earnings? Ohio law allows that 20% of your weekly benefit amount be exempted from any earnings you may receive before a deduction is made.

Therefore, you are responsible for paying both federal and Ohio tax on your unemployment benefits. The amount of tax will depend on your tax bracket. If unemployment benefits are included in federal adjusted gross income (AGI), they are taxed under Ohio law.

Ohio does not have its own deduction for unemployment benefits. Thus, if the taxpayer does not qualify for the federal deduction, then all unemployment benefits included in federal AGI are taxable to Ohio.

Ohio has a 5.75 percent state sales tax rate, a max local sales tax rate of 2.25 percent, and an average combined state and local sales tax rate of 7.24 percent. Ohio's tax system ranks 37th overall on our 2023 State Business Tax Climate Index.

Every resident and part-year resident of Ohio is subject to state income tax. Nonresidents with Ohio-source income also must file returns. Learn more about who must file state income tax in Ohio. As a W-2 employee, your Ohio taxes are usually withheld and deposited from each paycheck automatically.

(A) Every employer doing business in this state shall, on or before the first day of each month, pay all its employees the wages earned by them during the first half of the preceding month ending with the fifteenth day thereof, and shall, on or before the fifteenth day of each month, pay such employees the wages earned ...