Ohio Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc. The American Annuity Group, Inc. offers its employees in Ohio an employee stock purchase plan (ESPN) that provides them with the opportunity to purchase company stocks at a discounted price. This ESPN is designed to promote employee ownership and provide a way for employees to share in the company's success. The Ohio Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc. ensures that this plan is compliant with all applicable Ohio state laws and regulations. It ensures that employees are provided with a fair and transparent process to participate in the ESPN. Benefits of Ohio Approval of Employee Stock Purchase Plan: 1. Employee Ownership: By participating in the ESPN, employees become part-owners of The American Annuity Group, Inc., aligning their interests with the company's success. 2. Discounted Stock Price: The ESPN allows employees to purchase company stocks at a discounted price, giving them the opportunity to potentially earn substantial returns on investment. 3. Tax Advantages: Depending on the specific Ohio state laws and regulations, the ESPN may offer tax advantages for employees. This can help maximize the value of their investments. 4. Financial Education: The American Annuity Group, Inc. provides resources to help employees understand the ESPN and make informed investment decisions. This promotes financial literacy and empowers employees to manage their investments effectively. Types of Ohio Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc.: 1. Pre-Approval Process: The Ohio Approval process may involve the initial submission of the ESPN details to the relevant state authorities for review and approval. This may include ensuring compliance with state-specific laws and regulations. 2. Ongoing Compliance: The American Annuity Group, Inc. must regularly monitor and ensure compliance with any changes in Ohio state laws and regulations related to employee stock purchase plans. This ensures that the ESPN remains legally valid and provides maximum benefits to employees. 3. Reporting and Documentation: Ohio Approval may require regular reporting and documentation to demonstrate compliance with state laws and regulations. This includes financial records, employee communications, and any required filings. Conclusion: Ohio Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc. is a vital process that enables the company to offer its employees in Ohio an attractive ESPN. By obtaining the necessary approvals and complying with state laws and regulations, the American Annuity Group, Inc. ensures a fair and transparent process while promoting employee ownership and participation in the company's success.

Ohio Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

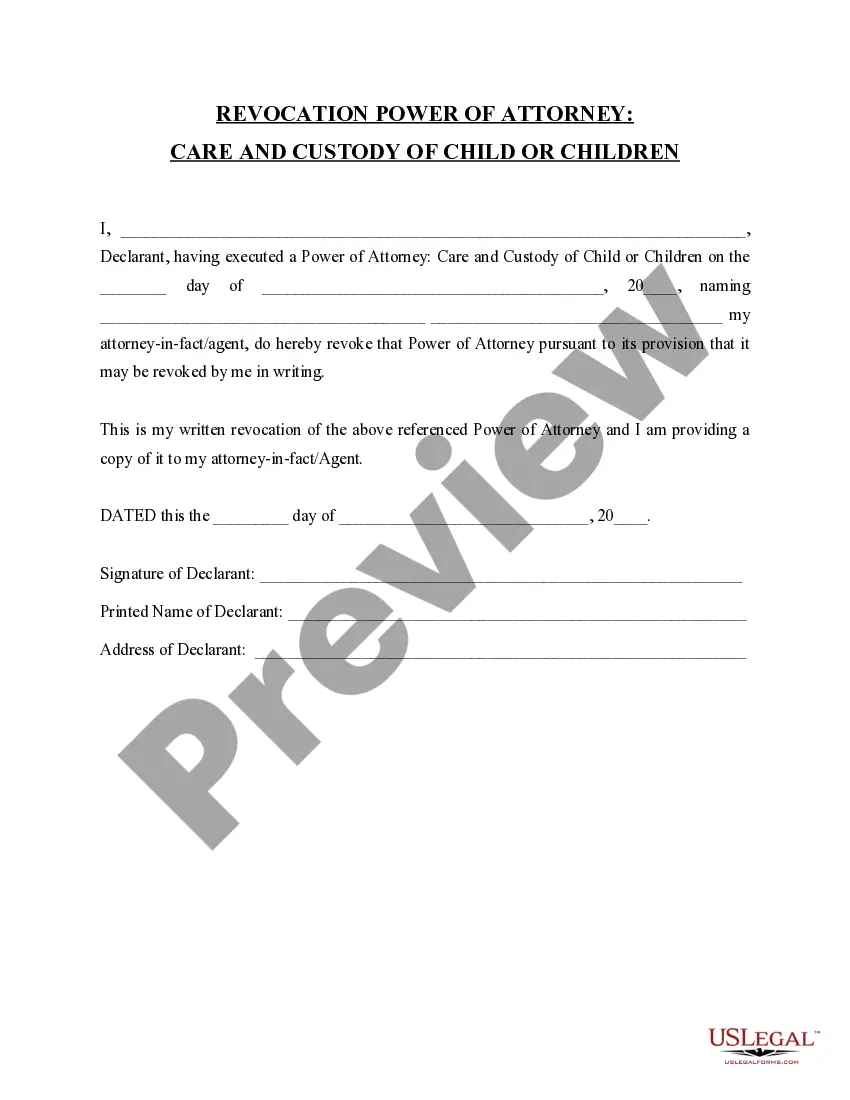

How to fill out Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

You are able to devote hours online looking for the legal record design that suits the state and federal needs you will need. US Legal Forms supplies 1000s of legal kinds that are evaluated by pros. It is possible to obtain or print out the Ohio Approval of employee stock purchase plan for The American Annuity Group, Inc. from our services.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Obtain key. After that, it is possible to full, edit, print out, or signal the Ohio Approval of employee stock purchase plan for The American Annuity Group, Inc.. Each and every legal record design you purchase is your own property eternally. To obtain an additional copy of any bought develop, proceed to the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms web site for the first time, follow the simple guidelines beneath:

- Initial, make certain you have chosen the right record design for that state/city of your liking. Browse the develop explanation to ensure you have selected the appropriate develop. If available, utilize the Preview key to appear throughout the record design also.

- In order to locate an additional version in the develop, utilize the Lookup industry to obtain the design that meets your needs and needs.

- After you have located the design you need, click on Acquire now to carry on.

- Pick the costs prepare you need, enter your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your Visa or Mastercard or PayPal bank account to purchase the legal develop.

- Pick the format in the record and obtain it for your system.

- Make adjustments for your record if required. You are able to full, edit and signal and print out Ohio Approval of employee stock purchase plan for The American Annuity Group, Inc..

Obtain and print out 1000s of record layouts making use of the US Legal Forms Internet site, which offers the biggest selection of legal kinds. Use specialist and status-particular layouts to handle your business or specific requires.

Form popularity

FAQ

If your company offers a tax-qualified ESPP and you decide to participate, the IRS will only allow you to purchase a maximum of $25,000 worth of stock in a calendar year. Any contributions that exceed this amount are refunded back to you by your company.

Employee Share Purchase Plan (ESPP) Employee Share Purchase Plan is another benefit provided by employers to their employees to buy the company's stock at a discounted value.

Under the specification in this study and some mathematical derivation, only the ESPP approach will have a dilution effect on the stock price. Moreover, by using the Black-Scholes-Merton formula, such a dilution effect will spread from the spot market of the stock to the option market.

Employee Stock Purchase Plan: Qualified or Non-qualified Now, we can have a look at the key difference between the two types. An ESPP qualified plan is designed and operates ing to Internal Revenue Section (IRS) 423 regulations, whereas a non-qualified ESPP does not meet those criteria.

Section 423 of the Code permits a plan to exclude employees who have been employed for less than two years or who are employed for less than 20 hours per week or five months per year. Also, owners of 5% or more of the common stock of a company by statute are not permitted to participate.

Yes, you can sell stock purchased through your ESPP plan immediately if you want to guarantee that you profit from your discount. Otherwise, the value of the stock may go up, which increases your profit, or it may go down, causing you to lose money.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

An ESPP must be approved by the stockholders of the sponsoring corporation within the period commencing 12 months before and ending 12 months after the ESPP is adopted by the sponsoring corporation's board of directors.