Ohio Adoption of incentive compensation plan

Description

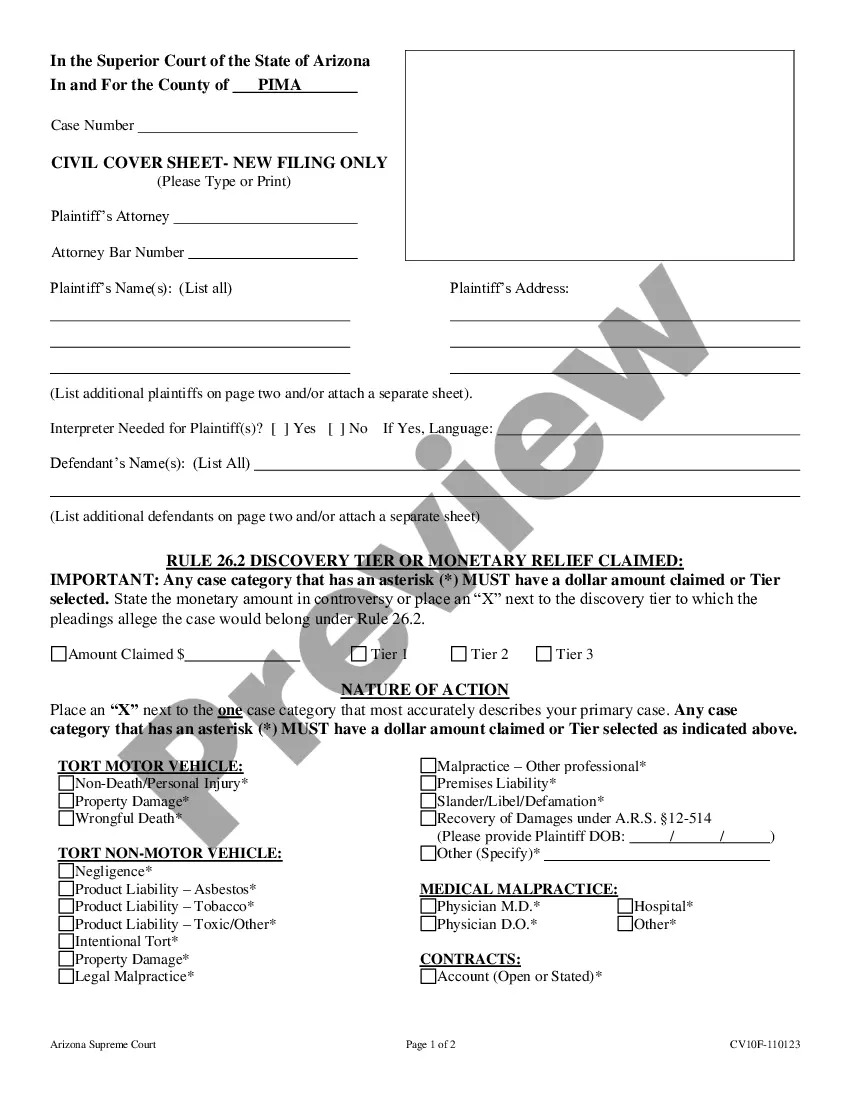

How to fill out Adoption Of Incentive Compensation Plan?

Choosing the best legitimate file web template can be a struggle. Naturally, there are plenty of web templates available on the Internet, but how do you obtain the legitimate develop you will need? Take advantage of the US Legal Forms web site. The assistance delivers a large number of web templates, like the Ohio Adoption of incentive compensation plan, that can be used for business and personal requires. All of the forms are checked out by specialists and meet state and federal needs.

Should you be currently authorized, log in in your profile and click the Down load key to have the Ohio Adoption of incentive compensation plan. Utilize your profile to check through the legitimate forms you might have acquired in the past. Check out the My Forms tab of the profile and have another duplicate from the file you will need.

Should you be a brand new user of US Legal Forms, listed below are simple recommendations that you should follow:

- Initially, make certain you have chosen the correct develop for the city/area. You may look over the form utilizing the Review key and look at the form description to guarantee it is the right one for you.

- When the develop is not going to meet your requirements, make use of the Seach discipline to find the correct develop.

- When you are sure that the form would work, click on the Get now key to have the develop.

- Opt for the pricing strategy you desire and type in the necessary info. Make your profile and pay money for the transaction with your PayPal profile or credit card.

- Pick the document format and download the legitimate file web template in your product.

- Total, revise and print out and signal the attained Ohio Adoption of incentive compensation plan.

US Legal Forms will be the greatest library of legitimate forms for which you can see different file web templates. Take advantage of the company to download skillfully-created paperwork that follow state needs.

Form popularity

FAQ

Taxpayers are allowed a deduction for grants, to the extent that the grant is included in adjusted gross income, issued through the Ohio adoption grant program.

Under the new program, applicable to adoptions finalized on or after January 1, 2023, an adoptive parent will receive one of the following: $15,000 for the adoption of that parent's foster child; $20,000 for the adoption of a special needs child; $10,000 in other cases.

Under the very new law, the Ohio adoption grant is $10,000, $15,000 for foster parents adopting the child they foster, and $20,000 for adopting a special needs child.

Benefits paid under an adoption assistance program are not subject to income tax withholding, however, they are subject to social security, Medicare and federal unemployment taxes. Employers should report financial reimbursement for adoption in the employee's W-2 in box 12 with code ?T.?

The answer to that question is ?no.? Payment for the placement of a child in an adoption is always illegal. There aren't any adoption agencies that pay you for placing a child. However, many expectant mothers are eligible to receive financial assistance for adoption in Ohio.

Through the program, families can receive up to $20,000 in financial assistance to help cover these costs. To be eligible for the Ohio Adoption Grants program, families must be residents of Ohio and the finalization of the adoption must be on or after January 1, 2023.

The program is open to families who are adopting children of any age, and there are no income restrictions or requirements for families to qualify.

Under the new program, applicable to adoptions finalized on or after January 1, 2023, an adoptive parent will receive one of the following: $15,000 for the adoption of that parent's foster child; $20,000 for the adoption of a special needs child; $10,000 in other cases.