Ohio Restricted Stock Bonus Plan of McDonald and Company Investments, Inc.

Description

How to fill out Restricted Stock Bonus Plan Of McDonald And Company Investments, Inc.?

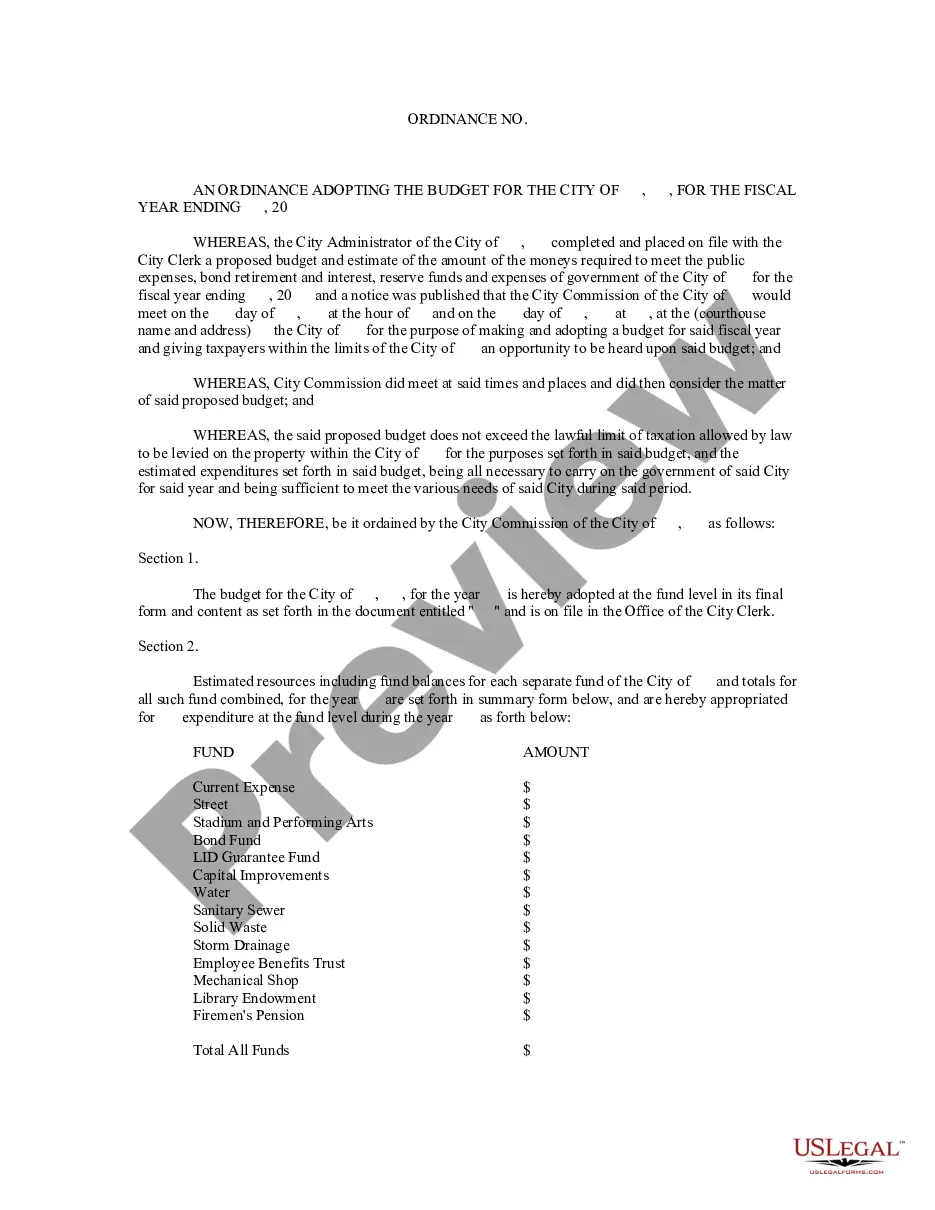

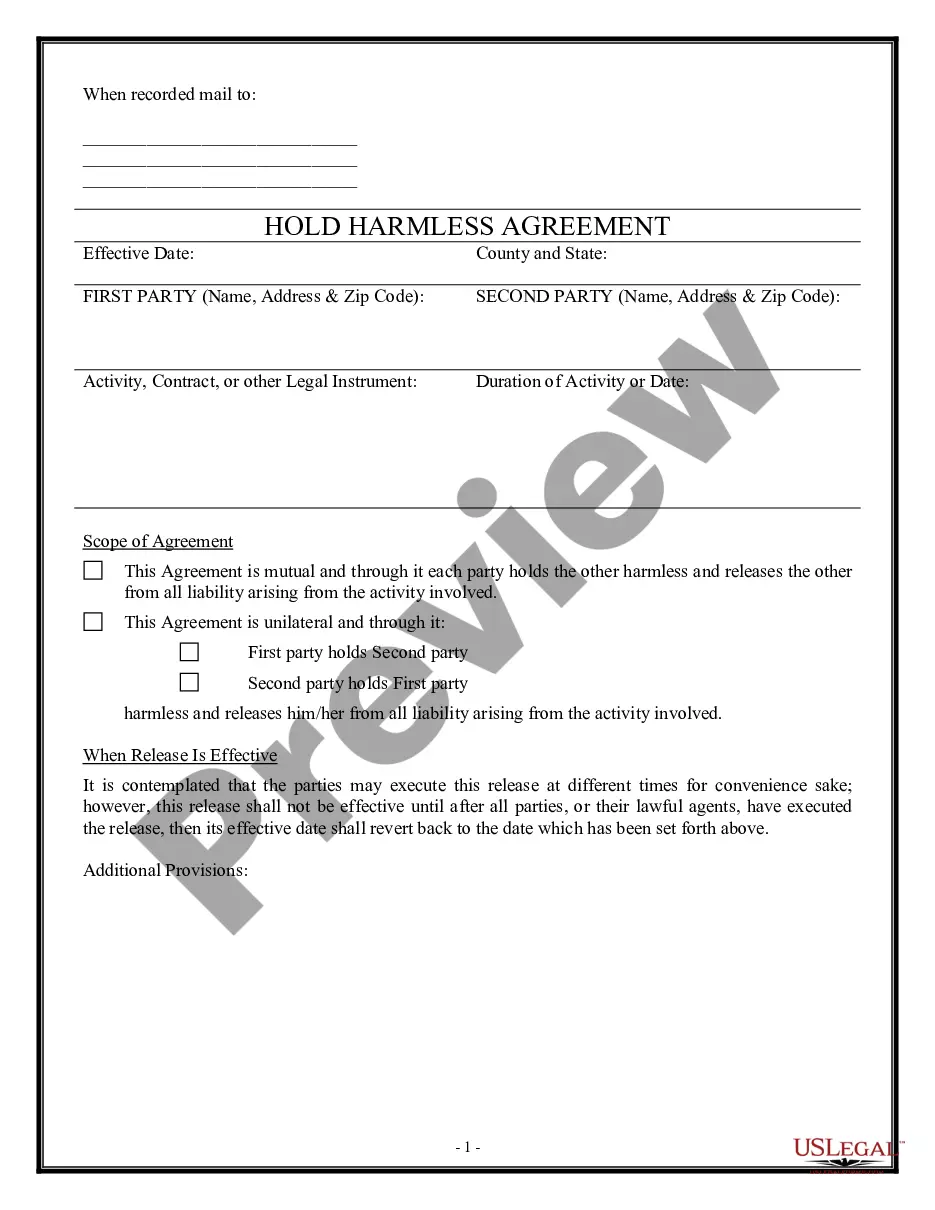

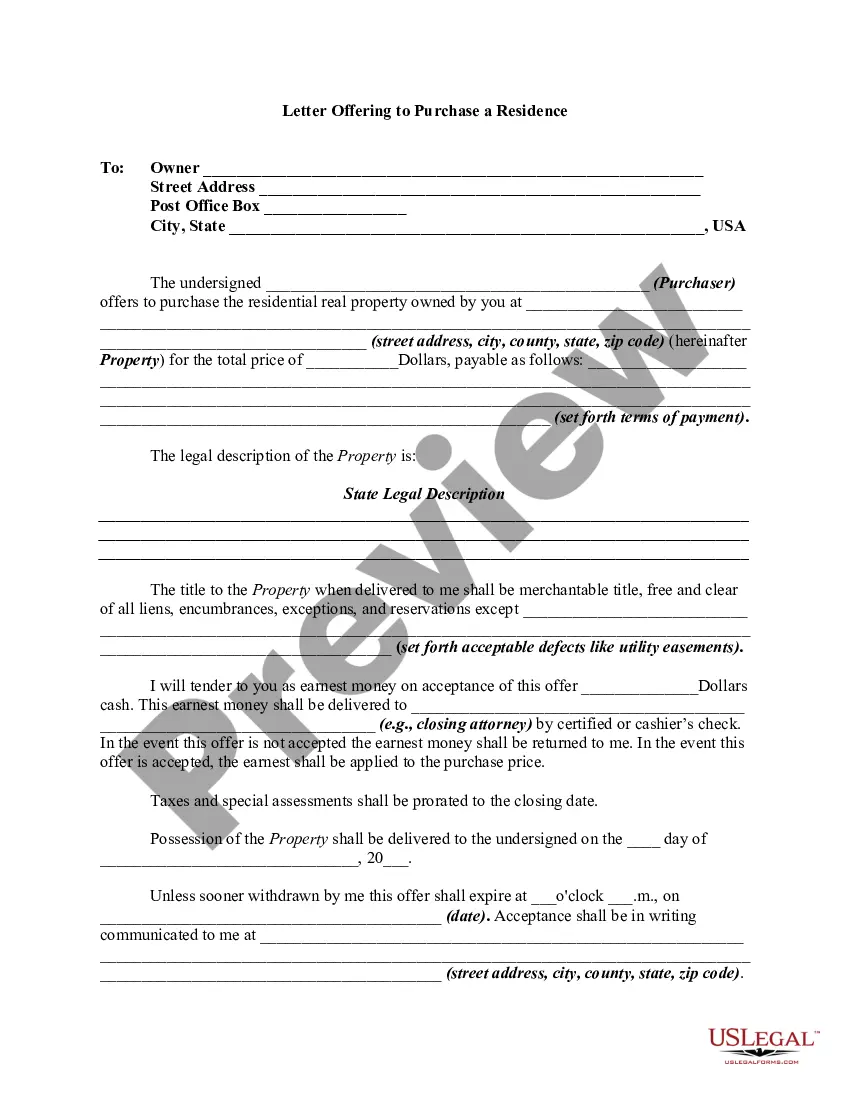

Are you presently in the placement where you will need files for sometimes business or individual functions nearly every working day? There are plenty of legal papers web templates available on the Internet, but getting ones you can rely isn`t simple. US Legal Forms offers thousands of type web templates, just like the Ohio Restricted Stock Bonus Plan of McDonald and Company Investments, Inc., which are published in order to meet federal and state requirements.

In case you are currently informed about US Legal Forms website and possess a merchant account, just log in. Following that, you may obtain the Ohio Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. web template.

Should you not have an account and want to start using US Legal Forms, adopt these measures:

- Obtain the type you will need and make sure it is for that right metropolis/region.

- Take advantage of the Preview key to review the form.

- Read the description to ensure that you have selected the proper type.

- If the type isn`t what you are searching for, make use of the Search discipline to get the type that meets your requirements and requirements.

- Whenever you discover the right type, simply click Purchase now.

- Choose the prices plan you would like, complete the required info to create your bank account, and purchase the order with your PayPal or Visa or Mastercard.

- Pick a handy data file format and obtain your version.

Discover each of the papers web templates you possess purchased in the My Forms menus. You can get a further version of Ohio Restricted Stock Bonus Plan of McDonald and Company Investments, Inc. anytime, if required. Just click the needed type to obtain or produce the papers web template.

Use US Legal Forms, probably the most substantial collection of legal varieties, to save lots of time as well as avoid mistakes. The service offers appropriately made legal papers web templates which can be used for a range of functions. Produce a merchant account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

McDonald's Retirement Plan Retirement Plan is great if you can make it to VP level. Plan is decent. In recent years management reduced the company match portion slightly. They are good with last minute vacation dates.

Largest shareholders include Vanguard Group Inc, BlackRock Inc., State Street Corp, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, VFINX - Vanguard 500 Index Fund Investor Shares, Jpmorgan Chase & Co, Geode Capital Management, Llc, Wellington Management Group Llp, Morgan Stanley, and Bank Of America ...

Vacation & Time Off Benefits McDonald's employees receive between 15 and 25 days per year of paid time off based on years of service.

Get 30% off your orders at participating McDonald's restaurants nationwide! Whether you're at your local McDonald's or taking a road trip, you can get 30% off your McDonald's meal orders with the National Employee Discount.

Moreover, Berkshire-owned Jazwares recently teamed up with the fast-food giant to launch a Squishmallow-branded Happy Meal and McFlurry. Buffett ? who proudly eats like a six-year-old ? has even bought McDonald's stock: Berkshire held a 4.3% stake in the company worth $1.4 billion at the end of 1996.

Shareholders NameEquities%The Vanguard Group, Inc. 9.004 %65,620,4339.004 %Geode Capital Management LLC 1.806 %13,163,6931.806 %Wellington Management Co. LLP 1.727 %12,585,3541.727 %Norges Bank Investment Management 1.219 %8,884,6061.219 %6 more rows

The company was founded by Richard and Maurice McDonald. In 1948, they opened their first restaurant in San Bernardino, California. Ray Kroc became involved with the company in 1954 and he purchased the franchise from them in 1961. Today, McDonald's is owned by The Walt Disney Company and Berkshire Hathaway Inc.

We offer a 6% employer match on 401K contributions and insurance benefits to our team members who work an average of 30 or more hours/week after one year ? Health, Dental, Vision, Life, Short-Term, and Long-Term Insurance. Every job has to have its perks!

McDirect Shares is a McDonald's stock purchase plan through which you are eligible to build your share ownership and reinvest dividends. You can purchase stock through convenient payroll deductions and a minimal start up fee. It's more important than ever to save for retirement.

In the U.S., we offer healthcare and retirement benefits, as well as paid time off and parental leave, to Corporate Staff and Company-owned restaurant employees working more than a certain number of hours or, for paid parental leave, based on position.