Ohio Restricted Stock Plan of Guilford Mills, Inc.

Description

How to fill out Restricted Stock Plan Of Guilford Mills, Inc.?

Finding the right authorized document web template might be a have difficulties. Obviously, there are a lot of templates accessible on the Internet, but how will you get the authorized form you want? Utilize the US Legal Forms website. The assistance provides 1000s of templates, for example the Ohio Restricted Stock Plan of Guilford Mills, Inc., that you can use for enterprise and private requirements. Each of the types are checked out by professionals and satisfy federal and state demands.

In case you are currently listed, log in in your bank account and then click the Acquire key to get the Ohio Restricted Stock Plan of Guilford Mills, Inc.. Utilize your bank account to appear throughout the authorized types you may have purchased previously. Check out the My Forms tab of your bank account and have an additional backup in the document you want.

In case you are a new user of US Legal Forms, allow me to share straightforward directions that you should adhere to:

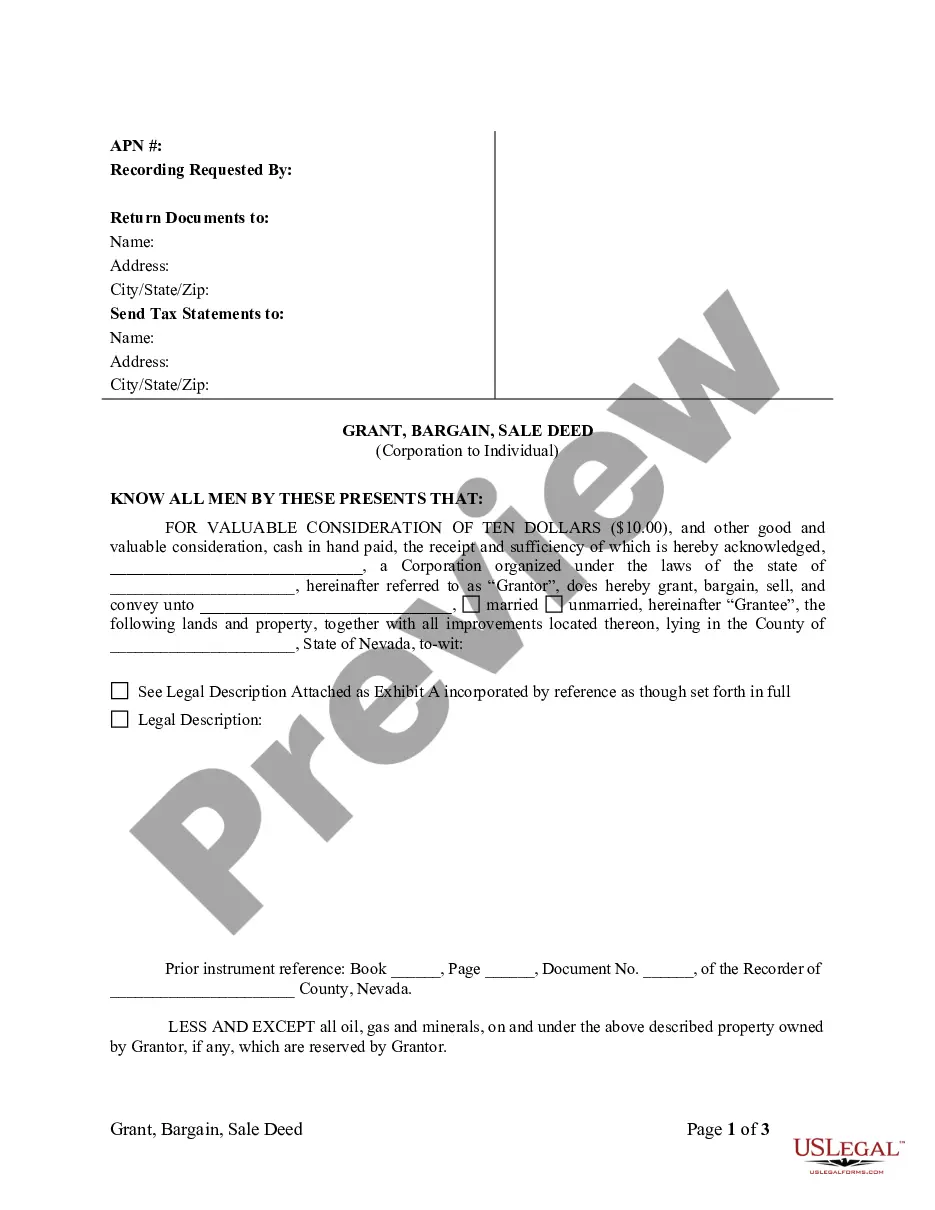

- Very first, make sure you have chosen the correct form for the metropolis/region. You can look over the shape while using Review key and browse the shape description to make sure it is the best for you.

- In case the form does not satisfy your requirements, take advantage of the Seach discipline to obtain the correct form.

- When you are certain that the shape would work, click the Acquire now key to get the form.

- Pick the costs strategy you would like and type in the required information. Make your bank account and purchase the order using your PayPal bank account or credit card.

- Choose the file format and down load the authorized document web template in your product.

- Complete, revise and printing and sign the attained Ohio Restricted Stock Plan of Guilford Mills, Inc..

US Legal Forms may be the most significant catalogue of authorized types for which you can discover numerous document templates. Utilize the service to down load expertly-manufactured paperwork that adhere to express demands.