Ohio Directors and officers liability insurance

Description

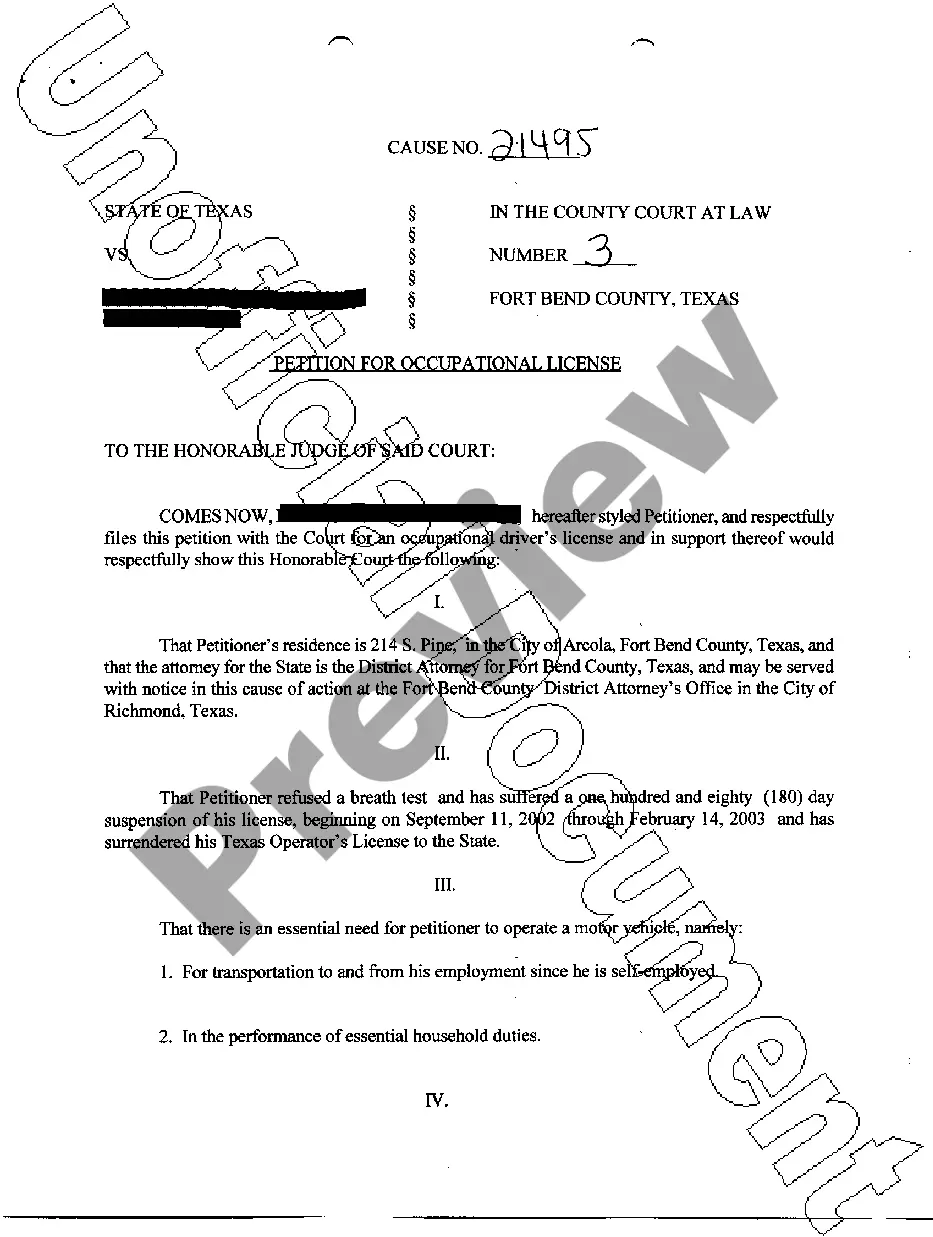

How to fill out Directors And Officers Liability Insurance?

You may devote several hours on the Internet attempting to find the legal file design that suits the federal and state specifications you require. US Legal Forms supplies thousands of legal kinds that happen to be analyzed by specialists. It is possible to acquire or print the Ohio Directors and officers liability insurance from my support.

If you have a US Legal Forms bank account, you may log in and then click the Down load button. After that, you may comprehensive, modify, print, or signal the Ohio Directors and officers liability insurance. Every single legal file design you buy is your own forever. To have yet another duplicate of any obtained type, visit the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms web site the first time, follow the basic directions beneath:

- Very first, ensure that you have selected the best file design for the area/metropolis of your liking. Look at the type information to ensure you have picked the correct type. If readily available, take advantage of the Preview button to search throughout the file design also.

- If you would like discover yet another variation in the type, take advantage of the Research field to discover the design that fits your needs and specifications.

- Once you have identified the design you would like, simply click Get now to proceed.

- Find the pricing plan you would like, type your qualifications, and sign up for a free account on US Legal Forms.

- Full the purchase. You may use your charge card or PayPal bank account to pay for the legal type.

- Find the formatting in the file and acquire it to the device.

- Make alterations to the file if necessary. You may comprehensive, modify and signal and print Ohio Directors and officers liability insurance.

Down load and print thousands of file layouts while using US Legal Forms site, which offers the greatest selection of legal kinds. Use skilled and condition-certain layouts to take on your small business or person needs.

Form popularity

FAQ

Directors' and officers' liability insurance ? also known as D&O insurance ? covers the cost of compensation claims made against your business's directors and key managers (officers) for alleged wrongful acts.

Some states require a business owners to have E&O insurance in order to conduct business, such as in the case of physicians. Management liability, as its name says, covers the business's management, not all of its employees.

Public Liability insurance policies, on the other hand, specifically exclude claims for professional advice or duty. Management Liability insurance protects businesses for breaches at management level or mismanagement but will often include additional cover such as for financial crimes committed against the business.

However, D&O is a product designed to protect the personal assets of company directors and officers in the event they were sued while acting in their capacity as a director or officer. Management liability protects the company as well as its directors and officers against legal liabilities and statutory obligations.

Further, officers and directors who participate in or authorize the commission of wrongful acts that are prohibited by statute, even if the acts are done on behalf of the corporation, may be held personally liable. Officers and directors may also be liable to the corporation or its shareholders.

D&O insurance typically covers legal fees, settlements, and financial losses when the insured is held liable. Common allegations covered include breaches of fiduciary duty, failure to comply with regulations, lack of corporate governance, creditor claims, and reporting errors.

Directors and officers (D&O) liability insurance protects the personal assets of corporate directors and officers, and their spouses, in the event they are personally sued by employees, vendors, competitors, investors, customers, or other parties, for actual or alleged wrongful acts in managing a company.