Ohio Proposal to amend certificate of incorporation to authorize a preferred stock

Description

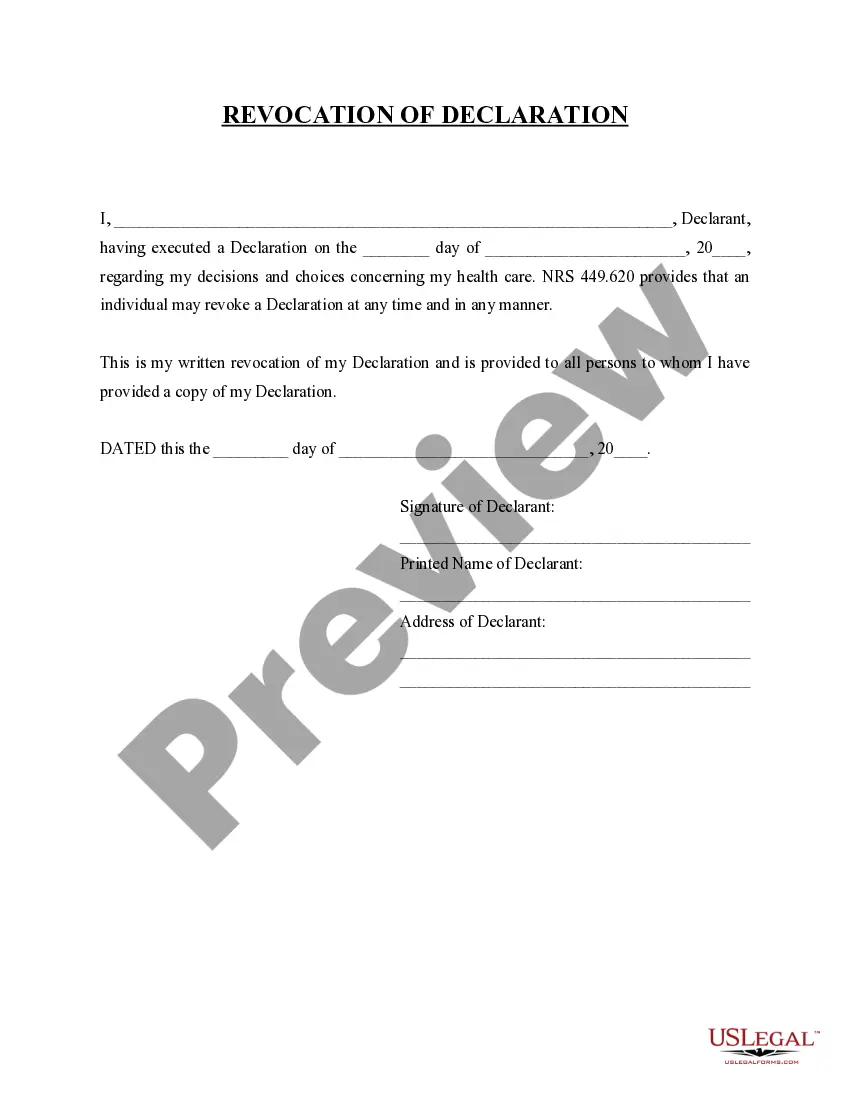

How to fill out Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

You are able to spend hours on the Internet trying to find the authorized document design which fits the state and federal specifications you need. US Legal Forms gives a large number of authorized kinds that happen to be evaluated by specialists. It is possible to down load or print out the Ohio Proposal to amend certificate of incorporation to authorize a preferred stock from my services.

If you currently have a US Legal Forms account, you are able to log in and then click the Obtain switch. Following that, you are able to full, change, print out, or signal the Ohio Proposal to amend certificate of incorporation to authorize a preferred stock. Every authorized document design you buy is the one you have forever. To obtain one more duplicate of any acquired develop, visit the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms web site initially, keep to the easy instructions listed below:

- First, be sure that you have chosen the correct document design to the state/area that you pick. Look at the develop information to ensure you have chosen the appropriate develop. If readily available, make use of the Preview switch to look through the document design also.

- If you want to locate one more model from the develop, make use of the Research discipline to get the design that fits your needs and specifications.

- When you have found the design you would like, click on Get now to carry on.

- Choose the pricing program you would like, type your references, and register for a free account on US Legal Forms.

- Total the deal. You should use your bank card or PayPal account to fund the authorized develop.

- Choose the formatting from the document and down load it for your gadget.

- Make modifications for your document if needed. You are able to full, change and signal and print out Ohio Proposal to amend certificate of incorporation to authorize a preferred stock.

Obtain and print out a large number of document web templates while using US Legal Forms site, which offers the biggest selection of authorized kinds. Use specialist and status-particular web templates to deal with your small business or specific needs.

Form popularity

FAQ

(A) If initial directors are not named in the articles, before subscriptions to shares have been received and before the incorporators have elected directors, the incorporators may adopt an amendment to the articles by a writing signed by them.

The termination of any action, suit, or proceeding by judgment, order, settlement, or conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner the person reasonably believed to be in or not opposed to the best ...

Section 1701.86 | Voluntary dissolution. (A) A corporation may be dissolved voluntarily in the manner provided in this section, provided the provisions of Chapter 1704.

Whoever knowingly and willfully obstructs or retards the passage of the mail, or any carrier or conveyance carrying the mail, shall be fined under this title or imprisoned not more than six months, or both. (June 25, 1948, ch. 645, 62 Stat.

(A) A corporation shall give notice of a dissolution by certified or registered mail, return receipt requested, to each known creditor and to each person that has a claim against the corporation, including claims that are conditional, unmatured, or contingent upon the occurrence or nonoccurrence of future events.

Ohio Revised Code section 1701.591 requires close corporations to have a close corporation agreement. This agreement must be approved by every single shareholder of the company.

Section 1701.01 | General corporation law definitions. As used in sections 1701.01 to 1701.98 of the Revised Code, unless the context otherwise requires: (A) "Corporation" or "domestic corporation" means a corporation for profit formed under the laws of this state.