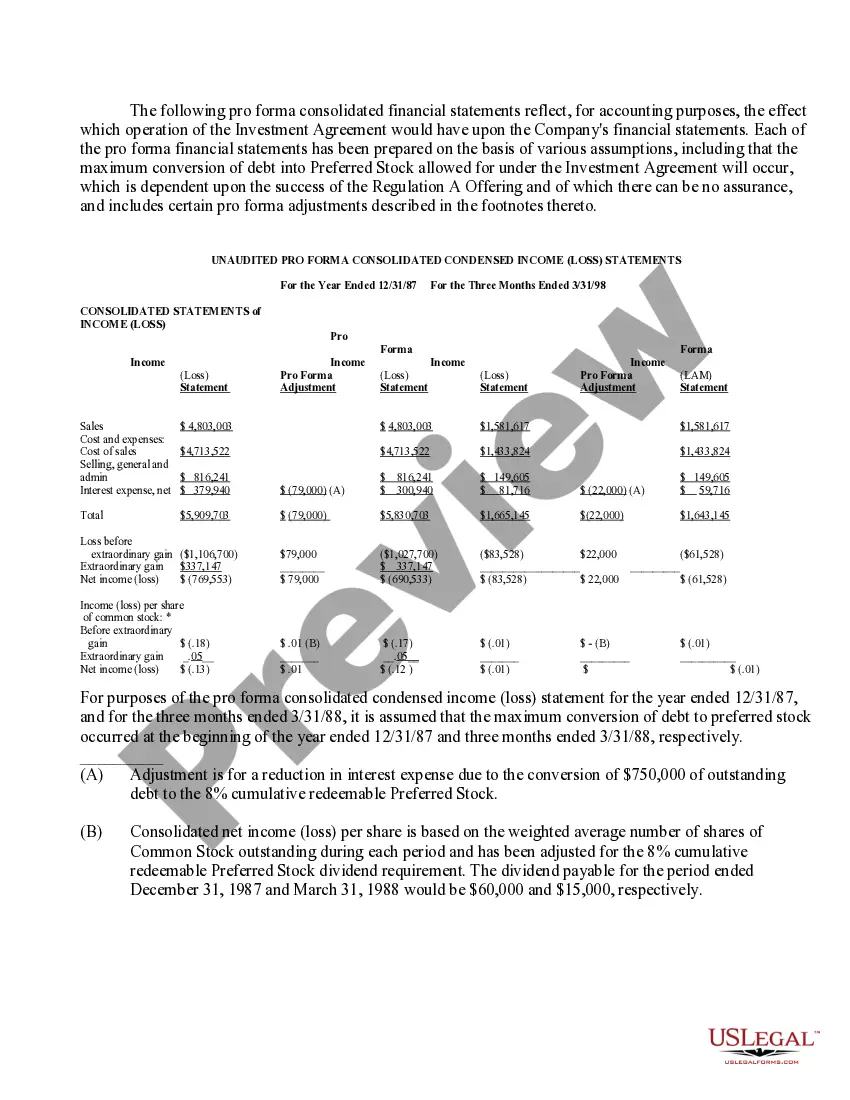

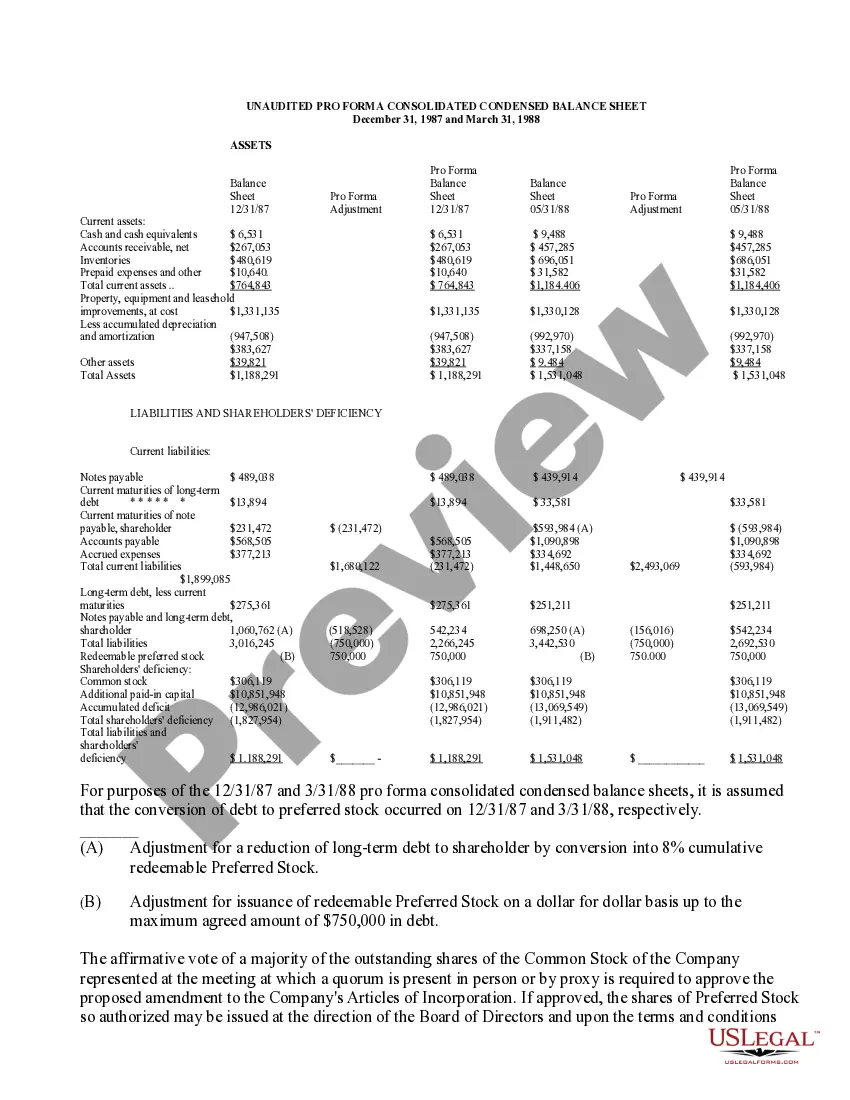

Title: Understanding Ohio Approval of Authorization of Preferred Stock Introduction: The Ohio approval of authorization of preferred stock refers to the process through which a corporation in Ohio can issue preferred shares to investors. These shares carry certain rights and privileges not available to common shareholders, providing additional flexibility in capital raising and corporate governance. This article will delve into the details of Ohio's approval process for authorizing preferred stock, highlighting its purpose, requirements, and potential types. Keywords: Ohio, approval, authorization, preferred stock, corporation, investor, rights, privileges, common shareholder, flexibility, capital raising, corporate governance. 1. Purpose of Ohio Approval of Authorization of Preferred Stock: The main objective of obtaining Ohio's approval for authorizing preferred stock is to allow corporations to attract potential investors by issuing preferred shares. These shares offer specific advantages, such as priority in dividend payments and liquidation proceeds, and often grant their holders voting rights on certain matters. 2. Requirements for Authorization: To gain Ohio's approval for issuing preferred stock, corporations need to meet certain legal and regulatory requirements. These may include obtaining approval from the state's regulatory authority, adhering to specific filing procedures, and ensuring compliance with Ohio's corporate laws and regulations. 3. Types of Preferred Stock: There are various types of preferred stock that a corporation in Ohio can seek authorization for. These may include: a) Cumulative Preferred Stock: This type of stock grants shareholders the right to accumulate any unpaid dividends, which must be paid before common shareholders receive any dividend payments. b) Convertible Preferred Stock: This stock provides investors with the option to convert their preferred shares into a predetermined number of common shares, offering potential benefits if the company's common stock value increases. c) Participating Preferred Stock: Holders of this type of stock not only receive their fixed dividends but are also entitled to an additional dividend based on a predetermined formula, allowing them to participate in the company's growth. d) Redeemable Preferred Stock: This stock provides the company with the option to buy back the preferred shares from investors at a pre-determined price after a specific time period. e) Adjustable Rate Preferred Stock: This stock allows for adjustment of dividend rates periodically based on changes in certain predetermined factors such as interest rates. 4. Process for Ohio Approval: The process for obtaining Ohio's approval for authorizing preferred stock typically involves filing necessary documents, such as a Certificate of Designation or Articles of Amendment, with the Ohio Secretary of State or other relevant authorities. These filings need to include comprehensive information about the preferred stock being authorized, its terms, and any specific rights or privileges granted to the shareholders. Conclusion: The Ohio approval of authorization of preferred stock plays a crucial role in facilitating capital raising efforts for corporations while providing additional benefits to investors. By understanding the purpose, requirements, and various types of preferred stock, businesses can navigate the necessary processes and leverage these shares strategically. It is essential to consult legal and financial professionals when seeking Ohio's approval for authorizing preferred stock to ensure compliance with all relevant laws and regulations. Keywords: Ohio, approval, authorization, preferred stock, corporation, investor, rights, privileges, cumulative, convertible, participating, redeemable, adjustable rate, process, compliance.

Ohio Approval of authorization of preferred stock

Description

How to fill out Ohio Approval Of Authorization Of Preferred Stock?

Discovering the right authorized file web template can be a struggle. Naturally, there are a lot of templates available on the Internet, but how do you discover the authorized type you require? Utilize the US Legal Forms site. The support gives a large number of templates, for example the Ohio Approval of authorization of preferred stock, which can be used for company and personal requirements. All the varieties are checked by professionals and satisfy state and federal needs.

When you are already listed, log in for your bank account and click the Down load option to obtain the Ohio Approval of authorization of preferred stock. Make use of your bank account to appear throughout the authorized varieties you might have purchased previously. Go to the My Forms tab of the bank account and obtain an additional copy of your file you require.

When you are a whole new user of US Legal Forms, listed below are simple guidelines so that you can comply with:

- First, be sure you have chosen the correct type for your town/region. You are able to look over the shape using the Review option and browse the shape description to make certain this is the best for you.

- When the type fails to satisfy your preferences, use the Seach field to get the correct type.

- When you are certain that the shape is proper, click on the Purchase now option to obtain the type.

- Pick the prices prepare you need and enter in the necessary info. Create your bank account and pay money for the transaction with your PayPal bank account or charge card.

- Select the data file format and obtain the authorized file web template for your system.

- Comprehensive, change and printing and sign the acquired Ohio Approval of authorization of preferred stock.

US Legal Forms may be the largest local library of authorized varieties that you can find various file templates. Utilize the service to obtain expertly-made paperwork that comply with express needs.