Ohio Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

How to fill out Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

Have you been in a placement that you will need paperwork for possibly enterprise or individual reasons almost every working day? There are tons of legitimate file layouts available on the Internet, but getting ones you can trust is not effortless. US Legal Forms delivers a large number of type layouts, such as the Ohio Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit, that are published to meet federal and state specifications.

When you are already familiar with US Legal Forms website and have an account, simply log in. Following that, you are able to acquire the Ohio Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit template.

If you do not provide an accounts and want to start using US Legal Forms, adopt these measures:

- Get the type you want and make sure it is for the correct metropolis/region.

- Utilize the Review switch to examine the shape.

- Browse the information to actually have selected the proper type.

- In the event the type is not what you are seeking, make use of the Search industry to find the type that fits your needs and specifications.

- When you get the correct type, just click Purchase now.

- Select the costs strategy you desire, submit the specified information to produce your account, and purchase your order with your PayPal or charge card.

- Select a practical paper file format and acquire your version.

Find every one of the file layouts you possess purchased in the My Forms food selection. You can get a more version of Ohio Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit anytime, if possible. Just select the necessary type to acquire or print out the file template.

Use US Legal Forms, the most extensive selection of legitimate types, to save lots of efforts and avoid errors. The services delivers professionally created legitimate file layouts which you can use for a range of reasons. Generate an account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

This would affect only the number of shares and par value per share of the company. When there is a 2-for-1 stock split, that means that 1 share would increase to 2 shares after this stock split. The total amount of the stocks would be still the same, thus, par value per share would be affected.

If you already have par value and you want to raise or lower it, things are a bit more complicated. Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

Reverse stock splits are proposed by company management and are subject to consent from the shareholders through their voting rights.

A reverse stock split has no immediate effect on the company's value, as its market capitalization remains the same after it's executed. However, it often leads to a drop in the stock's market price as investors see it as a sign of financial weakness.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.

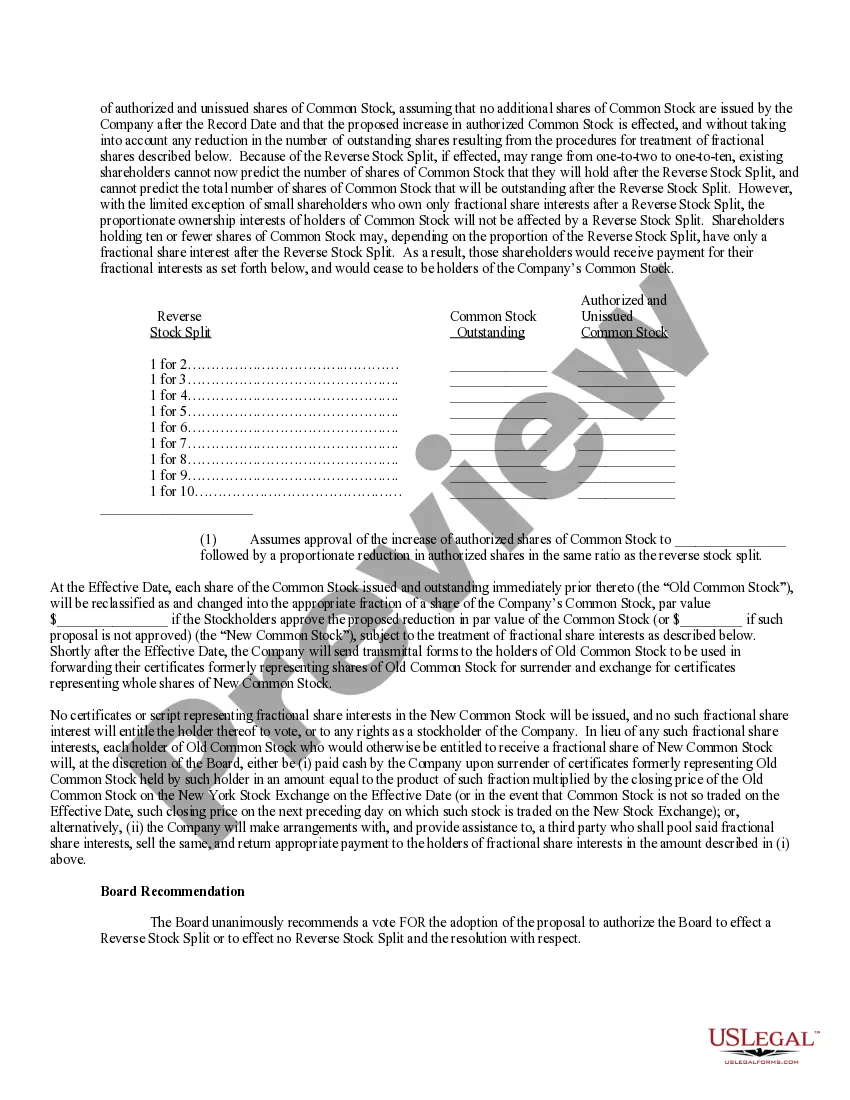

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

Will the reverse stock split change the par value of the share? Yes, the par value of each share will be increased proportionally to the exchange ratio, i.e. it will be multiplied by 20.