Ohio Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

How to fill out Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

US Legal Forms - one of several greatest libraries of legal kinds in the States - delivers an array of legal record web templates you are able to down load or print. Making use of the web site, you will get a large number of kinds for business and person reasons, categorized by classes, suggests, or key phrases.You can get the most up-to-date types of kinds just like the Ohio Agreement and plan of merger by Gelco Corp. and Grossman Corp. within minutes.

If you already have a membership, log in and down load Ohio Agreement and plan of merger by Gelco Corp. and Grossman Corp. in the US Legal Forms catalogue. The Down load switch can look on every single develop you perspective. You have accessibility to all earlier delivered electronically kinds in the My Forms tab of your bank account.

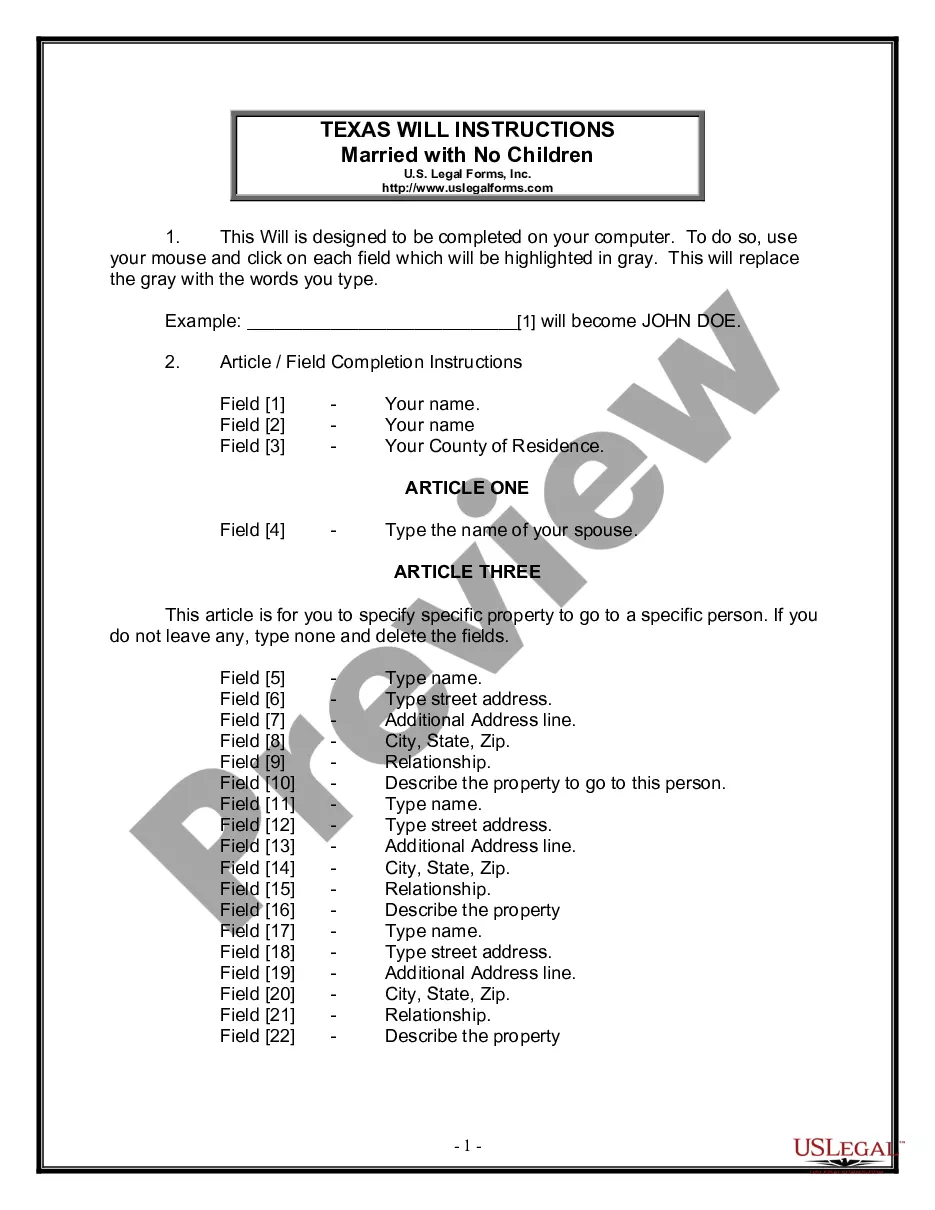

If you wish to use US Legal Forms for the first time, listed below are basic recommendations to help you get began:

- Be sure to have picked out the correct develop for the metropolis/county. Click on the Preview switch to examine the form`s content material. Browse the develop description to ensure that you have chosen the proper develop.

- When the develop doesn`t match your specifications, make use of the Search discipline towards the top of the screen to get the one which does.

- When you are content with the form, validate your decision by clicking on the Get now switch. Then, pick the costs strategy you favor and supply your qualifications to sign up on an bank account.

- Procedure the financial transaction. Make use of charge card or PayPal bank account to perform the financial transaction.

- Select the file format and down load the form on your own system.

- Make changes. Load, revise and print and indication the delivered electronically Ohio Agreement and plan of merger by Gelco Corp. and Grossman Corp..

Every design you put into your account lacks an expiration date and it is the one you have forever. So, if you would like down load or print yet another backup, just proceed to the My Forms segment and click on in the develop you will need.

Get access to the Ohio Agreement and plan of merger by Gelco Corp. and Grossman Corp. with US Legal Forms, the most substantial catalogue of legal record web templates. Use a large number of skilled and status-certain web templates that meet up with your small business or person requirements and specifications.

Form popularity

FAQ

Sec. 76. Plan or merger of consolidation. - Two or more corporations may merge into a single corporation which shall be one of the constituent corporations or may consolidate into a new single corporation which shall be the consolidated corporation.

Mergers and acquisitions (M&As) are the acts of consolidating companies or assets, with an eye toward stimulating growth, gaining competitive advantages, increasing market share, or influencing supply chains.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

Steps for the buyer in the M&A process Step 1: Develop an acquisition strategy. ... Step 2: Set the M&A search criteria. ... Step 3: Search for potential acquisition targets. ... Step 4: Begin acquisition planning. ... Step 5: Perform valuation analysis. ... Step 6: Begin negotiations. ... Step 7: Perform M&A due diligence.

A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity. The firms that agree to merge are roughly equal in terms of size, customers, and scale of operations. For this reason, the term "merger of equals" is sometimes used.