The Ohio Agreement and Plan of Reorganization by Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. is a legal document that outlines the terms and conditions of a reorganization plan undertaken by these entities in the state of Ohio. This plan aims to restructure and consolidate their operations, assets, and liabilities to enhance efficiency and achieve strategic objectives. Under the Ohio Agreement and Plan of Reorganization, Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. may have different types or variations of reorganization plans, depending on their specific needs and goals. These may include: 1. Merger or Consolidation: This type of reorganization involves the merging or consolidation of the two entities into a single legal entity. It typically involves the transfer of assets, properties, liabilities, and contracts from one entity to another. 2. Spin-Off: In a spin-off reorganization, Wedge stone Realty Investors Trust or Wedge stone Advisory Corp. may establish a new entity, separate from the existing one. This new entity will inherit certain assets, liabilities, and businesses of the original entity, while the remaining entity continues to operate independently. 3. Transfer of Assets: This type of reorganization focuses on the transfer of specific assets or divisions from one entity to another. It allows Wedge stone Realty Investors Trust or Wedge stone Advisory Corp. to streamline their operations by concentrating on core businesses while divesting non-core assets or businesses. 4. Change in Legal Structure: Wedge stone Realty Investors Trust or Wedge stone Advisory Corp. may opt for a change in their legal structure, such as converting from a corporation to a limited liability company (LLC) or vice versa. This reorganization aims to optimize governance, taxation, and other legal aspects of their operations. The Ohio Agreement and Plan of Reorganization outlines the details and procedures of these reorganization types, including the rights and obligations of the entities involved, shareholder or member approvals, regulatory compliance, and implementation timelines. It may also address any changes to the management structure or board composition resulting from the reorganization. Disclaimer: This is a simplified and generalized description of the Ohio Agreement and Plan of Reorganization by Wedge stone Realty Investors Trust and Wedge stone Advisory Corp. It is important to consult the official legal documentation and seek professional advice for specific details and implications of any reorganization plan.

Ohio Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.

Description

How to fill out Ohio Agreement And Plan Of Reorganization By Wedgestone Realty Investors Trust And Wedgestone Advisory Corp.?

Are you presently inside a place in which you require paperwork for either company or person uses almost every time? There are a variety of lawful record themes available on the net, but locating types you can trust isn`t straightforward. US Legal Forms gives a large number of kind themes, such as the Ohio Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp., which can be published in order to meet state and federal needs.

In case you are previously knowledgeable about US Legal Forms web site and have an account, merely log in. After that, you can download the Ohio Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. design.

Should you not offer an account and want to begin to use US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is for the appropriate metropolis/state.

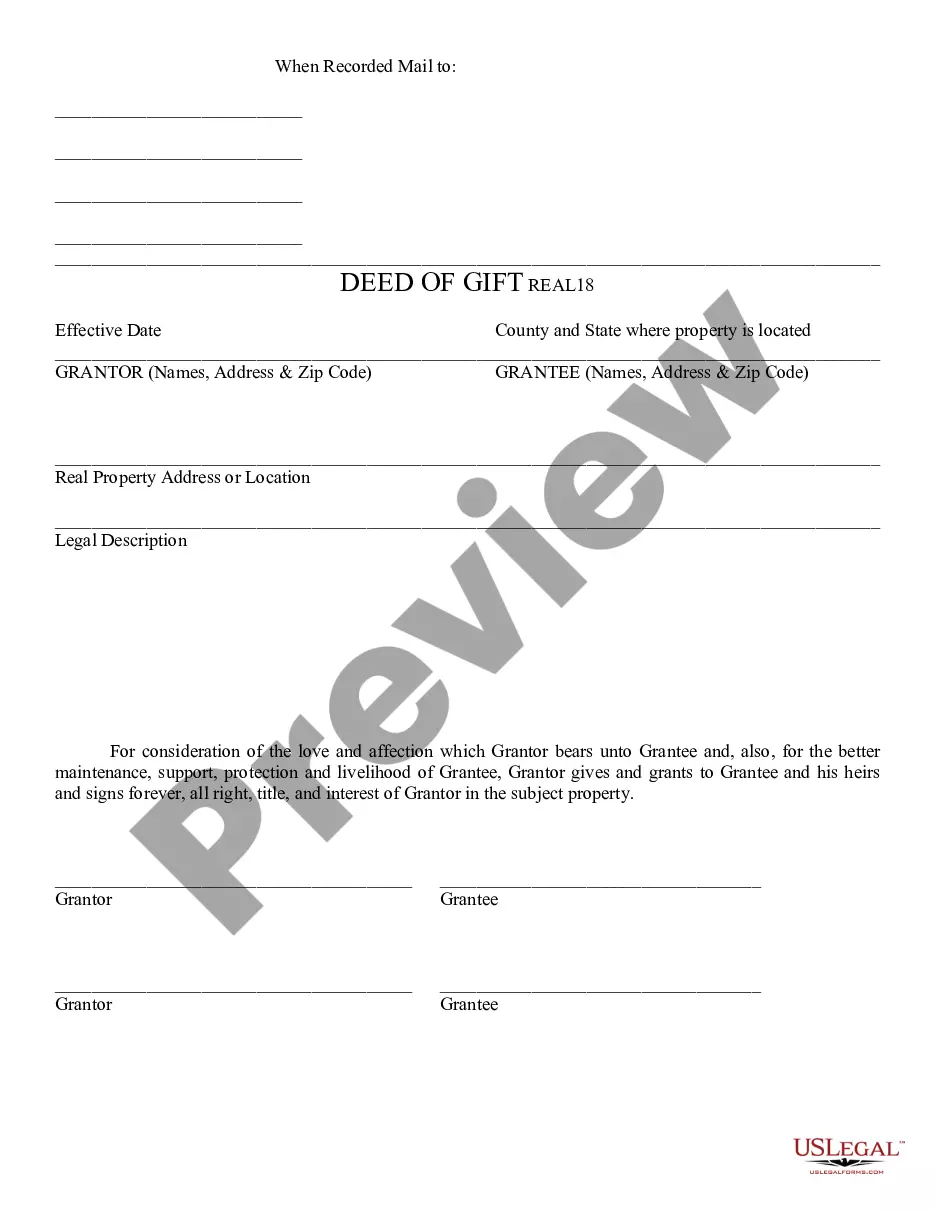

- Make use of the Review option to examine the shape.

- See the information to actually have selected the proper kind.

- In case the kind isn`t what you are trying to find, make use of the Look for discipline to find the kind that suits you and needs.

- Once you find the appropriate kind, click Buy now.

- Choose the rates strategy you want, fill in the specified info to produce your account, and buy the order using your PayPal or Visa or Mastercard.

- Pick a convenient data file structure and download your version.

Locate every one of the record themes you possess purchased in the My Forms menus. You can obtain a further version of Ohio Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. at any time, if required. Just click the essential kind to download or produce the record design.

Use US Legal Forms, probably the most extensive variety of lawful types, to conserve efforts and prevent blunders. The service gives professionally created lawful record themes that you can use for a variety of uses. Produce an account on US Legal Forms and start creating your life easier.