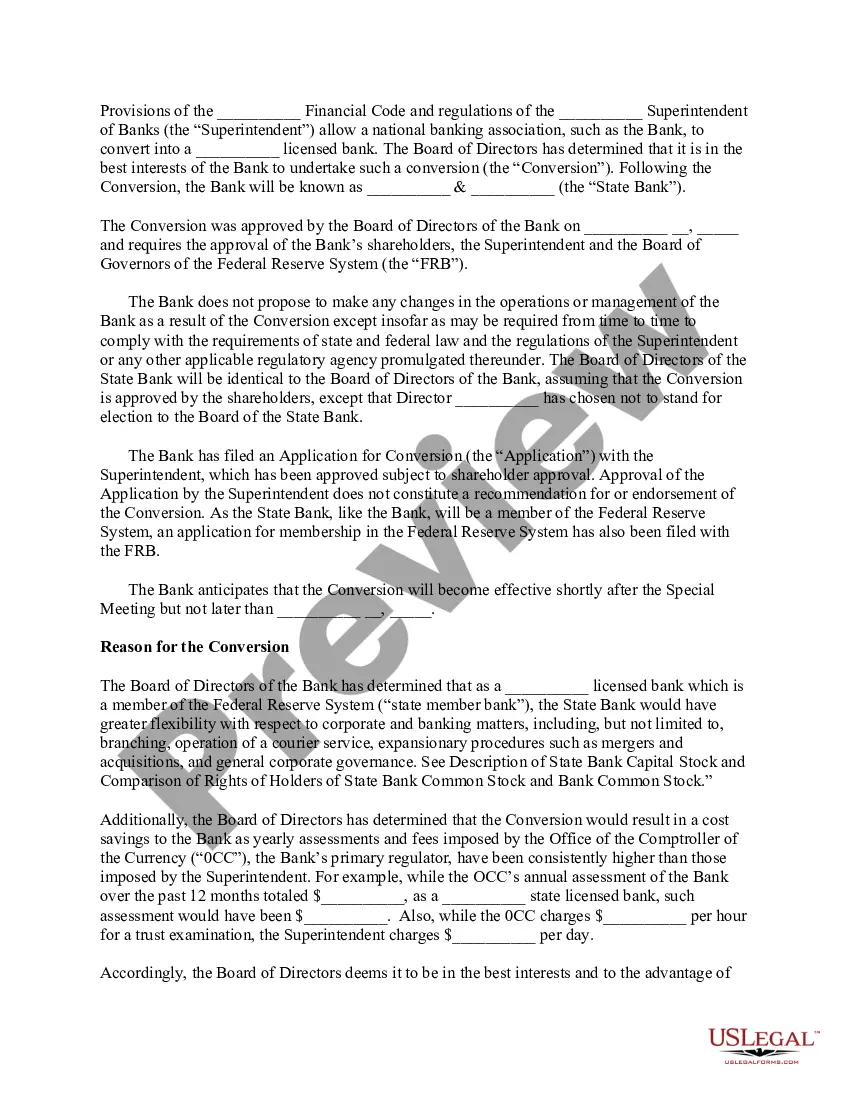

A proxy statement is an official document that provides detailed information to shareholders about matters to be discussed and voted on at a company's annual meeting. In the case of University National Bank and Trust Co., an Ohio-based financial institution, the Ohio Proxy Statement specifically relates to the bank's operations and governance in accordance with the state's laws and regulations. University National Bank and Trust Co. is legally required to distribute a proxy statement to its shareholders annually, allowing them to vote on significant corporate decisions. This document outlines proposals, such as electing board members, amending bylaws, or approving mergers and acquisitions, which directly impact the bank's governance and strategic direction. Key components highlighted in the Ohio Proxy Statement of University National Bank and Trust Co. may include: 1. Shareholder Meeting Agenda: It lists the topics and proposals to be discussed at the annual meeting, providing a clear outline for shareholders. 2. Board of Directors: The statement introduces the board members, their qualifications, experience, and roles within the bank. It may also mention any changes to the board's composition and structure, such as the retirement or appointment of directors. 3. Executive Compensation: Details about the compensation packages of the bank's top executives, including salaries, bonuses, benefits, and equity awards, are disclosed. This section aims to offer transparency and accountability to shareholders regarding the bank's compensation practices. 4. Shareholder Voting: The proxy statement provides shareholders with instructions on how to cast their votes on the proposed corporate actions. It often includes both physical and online voting options, ensuring maximum shareholder participation. 5. Auditors and Financial Information: The proxy statement also mentions the bank's auditors responsible for reviewing the financial statements. It may present the auditors' reports, which provide an overview of the bank's financial health and adherence to regulatory standards. 6. Other Relevant Information: Depending on the circumstances, the Ohio Proxy Statement may include additional information deemed essential for shareholders, such as information about shareholder proposals, potential legal disputes, or modifications to the bank's corporate governance guidelines. It is crucial to note that the specific content and structure of the Ohio Proxy Statement for University National Bank and Trust Co. may vary from year to year, depending on the bank's performance, developments, and regulatory requirements. Overall, the Ohio Proxy Statement by University National Bank and Trust Co. provides shareholders with an opportunity to understand and participate in the decision-making processes of the bank, ensuring transparency, accountability, and alignment of interests among all stakeholders.

Ohio Proxy Statement - University National Bank and Trust Co.

Description

How to fill out Ohio Proxy Statement - University National Bank And Trust Co.?

If you want to full, download, or print legal papers web templates, use US Legal Forms, the biggest collection of legal varieties, which can be found on the web. Take advantage of the site`s easy and hassle-free research to find the paperwork you will need. Different web templates for company and person reasons are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to find the Ohio Proxy Statement - University National Bank and Trust Co. within a number of clicks.

When you are already a US Legal Forms consumer, log in for your bank account and click on the Down load switch to get the Ohio Proxy Statement - University National Bank and Trust Co.. Also you can entry varieties you in the past delivered electronically inside the My Forms tab of the bank account.

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape for your correct area/country.

- Step 2. Use the Review choice to look through the form`s content material. Don`t forget about to see the outline.

- Step 3. When you are not happy using the form, use the Lookup field towards the top of the display to discover other versions of the legal form template.

- Step 4. Once you have found the shape you will need, click the Get now switch. Select the prices plan you choose and add your credentials to sign up to have an bank account.

- Step 5. Procedure the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the financial transaction.

- Step 6. Choose the format of the legal form and download it in your system.

- Step 7. Total, revise and print or indicator the Ohio Proxy Statement - University National Bank and Trust Co..

Each legal papers template you purchase is the one you have forever. You might have acces to every single form you delivered electronically in your acccount. Go through the My Forms section and decide on a form to print or download once more.

Remain competitive and download, and print the Ohio Proxy Statement - University National Bank and Trust Co. with US Legal Forms. There are many specialist and express-specific varieties you can use for the company or person requirements.