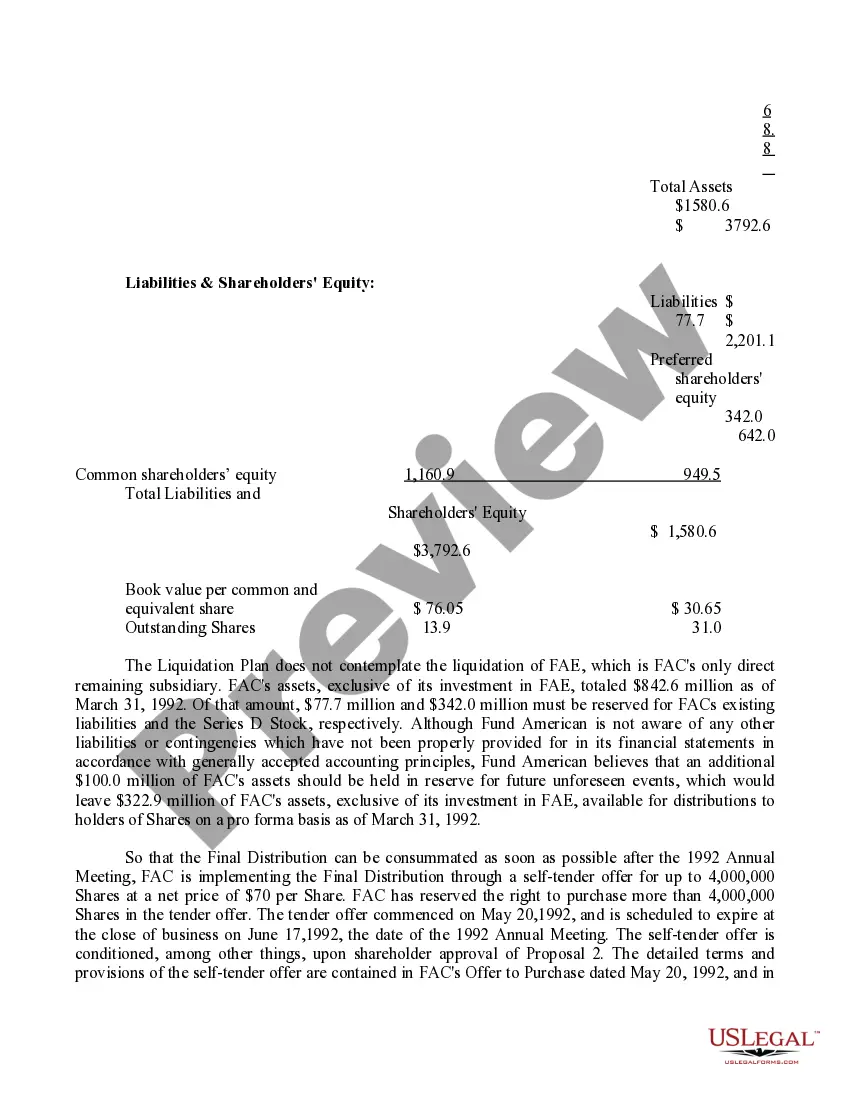

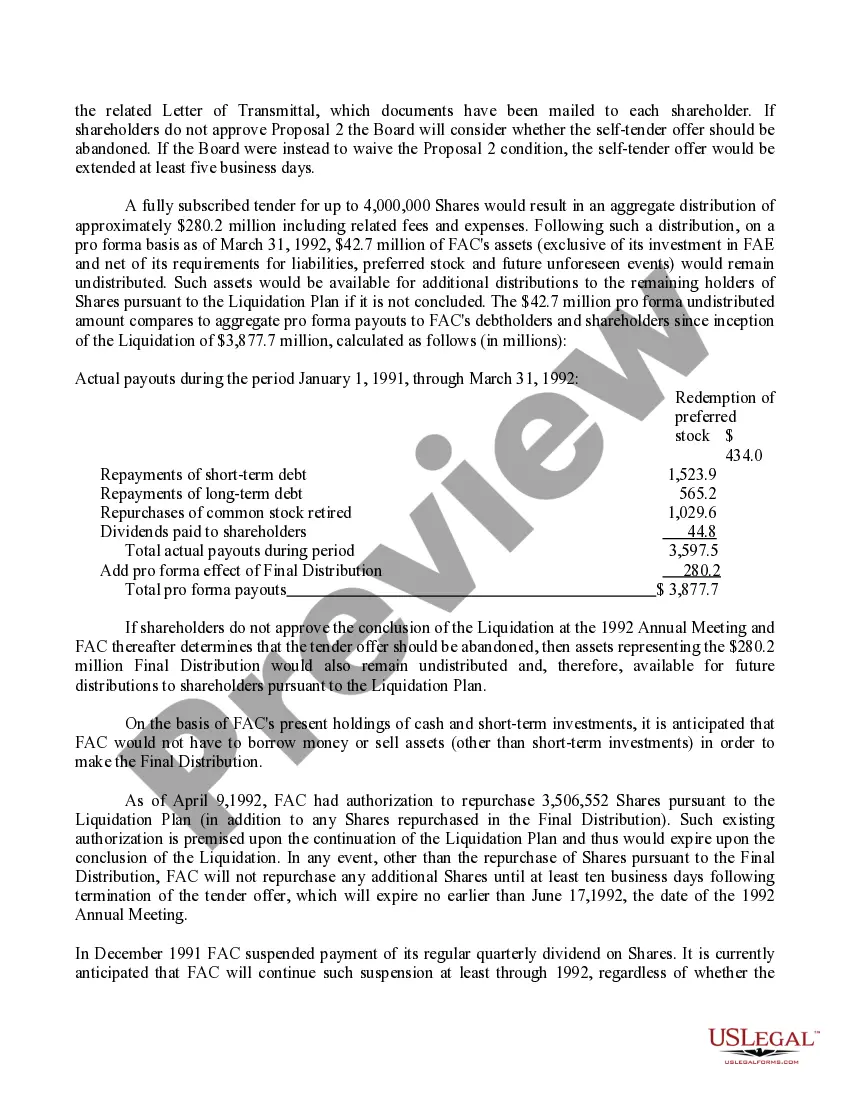

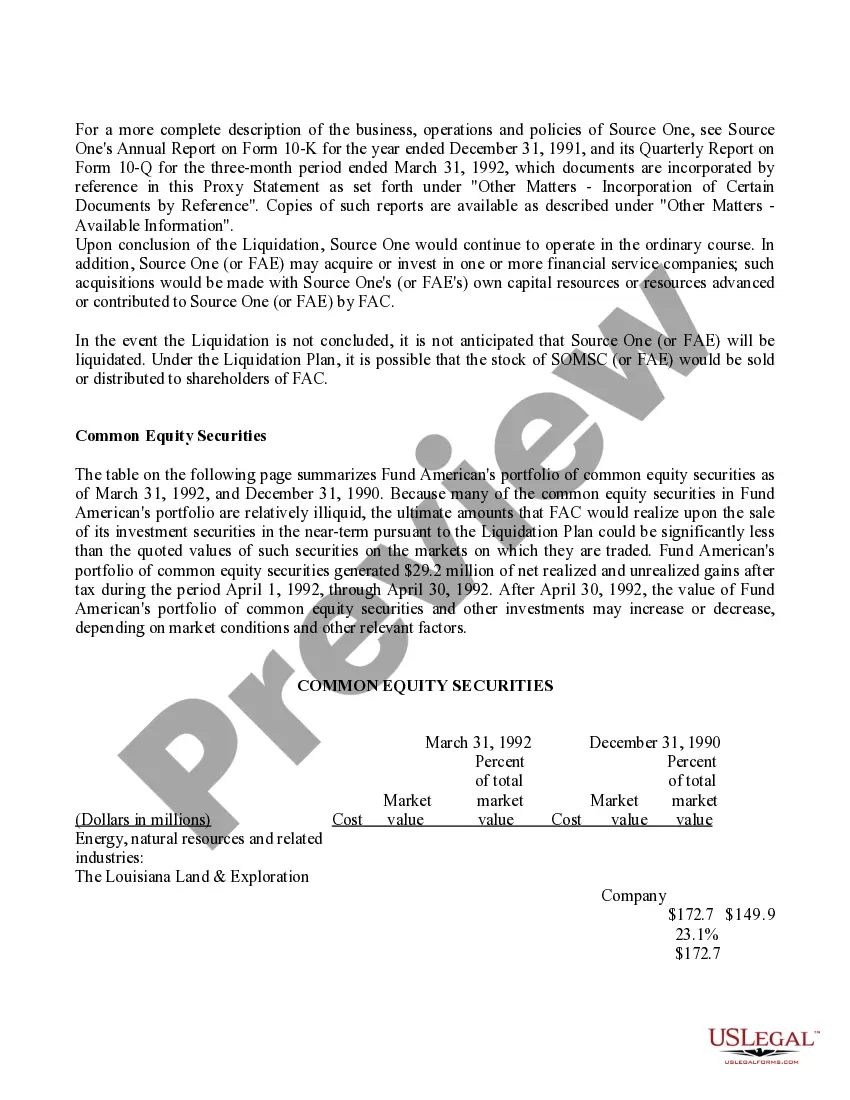

The Ohio proposal is a legal document that outlines the conclusion of the liquidation process along with an exhibit, providing a detailed account of the assets and liabilities involved in the liquidation process. It serves as the final step in dissolving a company or organization and distributing its remaining assets to creditors and shareholders. The Ohio proposal is prepared by the liquidator or the appointed representative responsible for overseeing the liquidation proceedings. It includes a comprehensive breakdown of the assets and liabilities, listing all the properties, equipment, accounts receivable, outstanding debts, and any other relevant information. The proposal also outlines how the assets will be distributed among the creditors and shareholders, following the order of priority as defined by Ohio law. Creditors with secured claims usually have the first right to be paid, followed by unsecured creditors and shareholders. In some cases, there may be different types of Ohio proposals for the conclusion of liquidation proceedings, depending on the specific circumstances or type of organization being liquidated. Some common variations include: 1. Business Liquidation Proposal: This type of proposal details the conclusion of a business liquidation, where a company's assets and liabilities are distributed among its creditors and shareholders. It may involve the sale of assets, settlement negotiations with creditors, and any other necessary actions to wind up the business. 2. Non-profit Liquidation Proposal: If a non-profit organization is being dissolved, a specific type of Ohio proposal is prepared to conclude the liquidation process. This proposal would outline how the remaining funds, assets, or donations will be distributed among other non-profit organizations or used for charitable purposes. 3. Estate Liquidation Proposal: In the case of an estate liquidation, when an individual's assets are being distributed after their death, a particular Ohio proposal is prepared. This proposal would outline the final distribution of the estate, considering any debts, taxes, and specific instructions outlined in the deceased person's will. Overall, the Ohio proposal for the conclusion of liquidation proceedings with an exhibit is a crucial document that ensures a fair and transparent distribution of assets and liabilities. It offers a comprehensive breakdown of financial information, guiding the liquidation process according to Ohio law and the specific circumstances of the organization or estate being dissolved.

Ohio Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Ohio Proposal - Conclusion Of The Liquidation With Exhibit?

Discovering the right authorized papers design could be a have a problem. Obviously, there are a lot of layouts available on the net, but how do you find the authorized develop you require? Use the US Legal Forms internet site. The support offers thousands of layouts, for example the Ohio Proposal - Conclusion of the Liquidation with exhibit, that you can use for business and personal demands. Every one of the kinds are inspected by professionals and meet federal and state needs.

If you are already signed up, log in to your bank account and click the Obtain key to obtain the Ohio Proposal - Conclusion of the Liquidation with exhibit. Make use of your bank account to look throughout the authorized kinds you may have bought formerly. Proceed to the My Forms tab of the bank account and get an additional duplicate from the papers you require.

If you are a fresh end user of US Legal Forms, listed here are basic directions that you should comply with:

- First, make certain you have selected the right develop for your metropolis/area. You may look through the form utilizing the Preview key and study the form outline to ensure it is the right one for you.

- If the develop will not meet your needs, utilize the Seach discipline to get the appropriate develop.

- When you are sure that the form would work, click on the Acquire now key to obtain the develop.

- Choose the prices plan you desire and enter in the required information and facts. Design your bank account and pay for the order using your PayPal bank account or bank card.

- Opt for the document formatting and acquire the authorized papers design to your device.

- Full, edit and printing and indicator the received Ohio Proposal - Conclusion of the Liquidation with exhibit.

US Legal Forms is the largest collection of authorized kinds for which you will find various papers layouts. Use the service to acquire professionally-produced paperwork that comply with status needs.