A finance master lease agreement in Ohio is a legal contract between a lessor (the financing company) and a lessee (the customer or business) to lease a specific asset over a predetermined period, with the option to purchase the asset at the end of the lease term. This agreement is commonly used to acquire equipment, machinery, vehicles, or other tangible assets. The Ohio Finance Master Lease Agreement defines the terms and conditions of the lease, including payment schedules, interest rates, lease period, upfront costs, and purchase options. It offers flexibility to businesses looking to acquire assets without the need for substantial upfront capital. There are different types of Ohio Finance Master Lease Agreements available, tailored to meet the specific needs of various industries or assets: 1. Capital Lease: Also known as a finance lease, this type of agreement allows the lessee to gain ownership of the asset at the end of the lease term. The lessee assumes all risks and benefits associated with the ownership, including maintenance and insurance costs. 2. Operating Lease: In an operating lease, the lessor retains ownership of the asset throughout the lease term. This type of lease is typically used for assets with a shorter useful life or high technological obsolescence risk. The lessee benefits from lower monthly payments and maintenance responsibilities. 3. Sale and Leaseback: This arrangement allows a business to sell an asset it already owns to a lessor and then leases it back. It provides immediate capital while enabling the business to continue using the asset. 4. Leveraged Lease: A leveraged lease involves the participation of a third-party lender who provides debt financing to the lessor. This structure allows the lessor to increase their investment and potentially reduce the lessee's monthly payments. Ohio Finance Master Lease Agreements offer businesses in Ohio an effective way to acquire essential assets while preserving their working capital. It provides flexibility, tax advantages, and the ability to upgrade equipment as technology advances. By understanding the various types of lease agreements available, businesses can choose the one that best aligns with their specific needs and financial objectives.

Ohio Finance Master Lease Agreement

Description

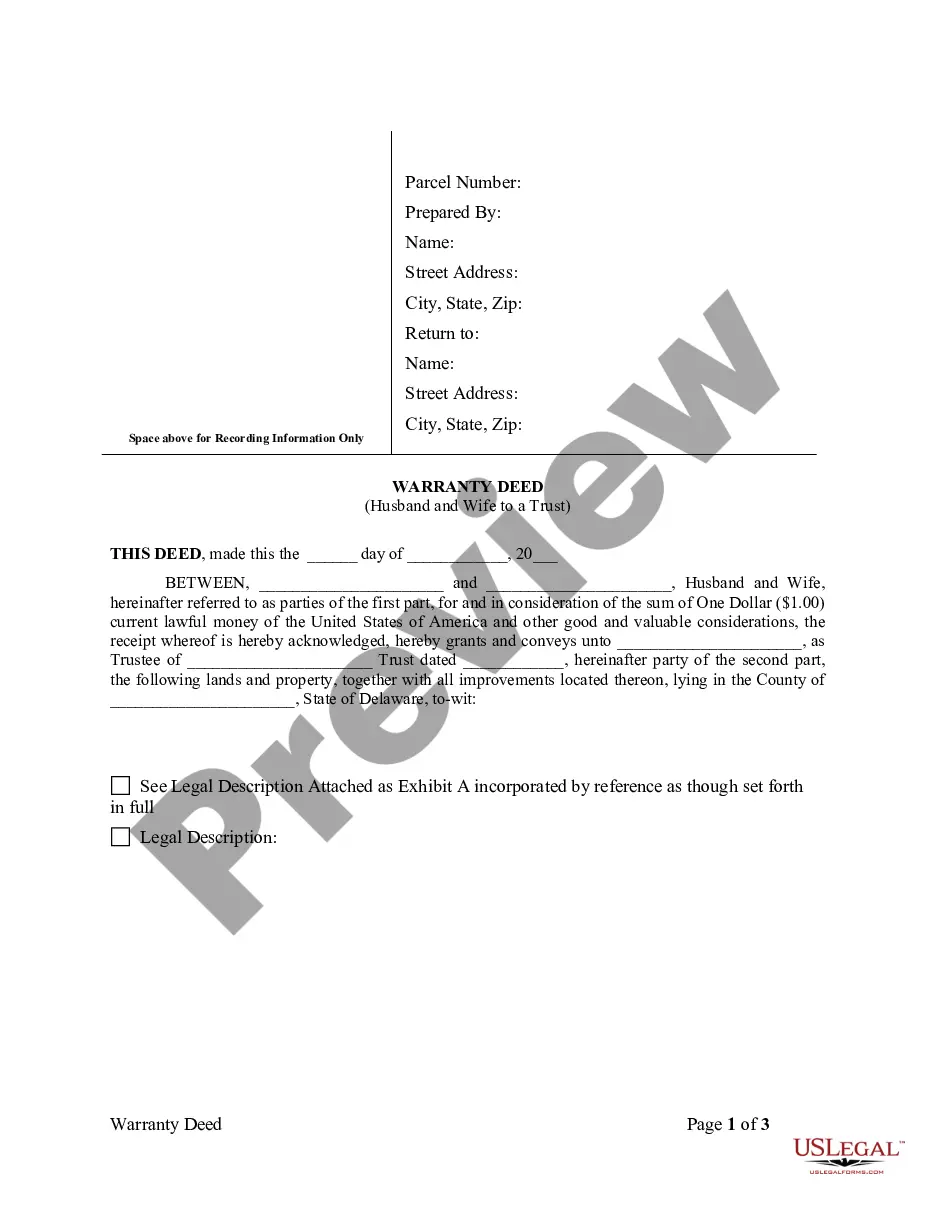

How to fill out Ohio Finance Master Lease Agreement?

If you need to complete, down load, or print out legal document layouts, use US Legal Forms, the greatest selection of legal kinds, that can be found on-line. Use the site`s easy and practical research to find the papers you need. Different layouts for business and person reasons are categorized by classes and says, or keywords and phrases. Use US Legal Forms to find the Ohio Finance Master Lease Agreement within a couple of mouse clicks.

Should you be previously a US Legal Forms client, log in for your accounts and click the Obtain option to get the Ohio Finance Master Lease Agreement. Also you can access kinds you in the past saved within the My Forms tab of your own accounts.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for that appropriate area/region.

- Step 2. Make use of the Preview choice to examine the form`s content material. Do not overlook to see the explanation.

- Step 3. Should you be unsatisfied with all the form, make use of the Lookup area on top of the display to locate other models of the legal form design.

- Step 4. Upon having identified the form you need, click on the Purchase now option. Select the pricing prepare you prefer and add your accreditations to sign up on an accounts.

- Step 5. Method the financial transaction. You can use your charge card or PayPal accounts to perform the financial transaction.

- Step 6. Find the format of the legal form and down load it in your product.

- Step 7. Complete, modify and print out or indicator the Ohio Finance Master Lease Agreement.

Every legal document design you purchase is the one you have permanently. You may have acces to every form you saved within your acccount. Click on the My Forms segment and choose a form to print out or down load yet again.

Contend and down load, and print out the Ohio Finance Master Lease Agreement with US Legal Forms. There are millions of professional and express-specific kinds you can utilize for the business or person requires.

Form popularity

FAQ

A master lease is a type of lease that gives the lessee the right to control and sublease the property during the lease, while the owner retains the legal title.

The Benefits of Percentage Leases for Landlords and Tenants Percentage leases can have a strong upside for tenants, who want to reduce their fixed costs, as well as for landlords, who want to increase their property's potential monthly revenues.

A master lease agreement is legal document where you lease an income-producing property as a single tenant-landlord and sublease to two or more tenants to produce income. One common example are shopping malls, which have many stores renting space from one landlord.

To be contrasted with a lease contract for a single transaction involving a specific unit of equipment, a Master Lease is essentially a line of credit to draw from over time in order to purchase equipment.

Instead of arranging the financing for one specific piece of equipment, you apply for a line of credit that is available to you for a fixed period of time. You can then lease a range of equipment types from the suppliers of your choice ? up to the amount of your credit limit.

A master lease is a continuing lease arrangement, preferred by customers who anticipate multiple installations over a sustained period of time. This arrangement allows the customer to sign a single agreement and make one agreed payment, instead of several agreements, with several separate payments.

You receive all profits, i.e., net cash flows after subtracting the regular lease payments and expenses. The buyer receives all tax benefits from the property. You are responsible for managing and maintaining the property, including paying utility bills, annual insurance premiums and property taxes.

Master leasing allows the system to overcome some of the more traditional barriers people face in accessing housing in the private rental market, including incarceration and eviction histories or issues related to credit, employment, or income.