This due diligence form is a worksheet and checklist that is used for gathering in formation about the current status of individual immigrant and nonimmigrant employees that the acquiring company hopes to retain following the business transactions.

Ohio Foreign Employee Status Worksheet and Document Checklist

Description

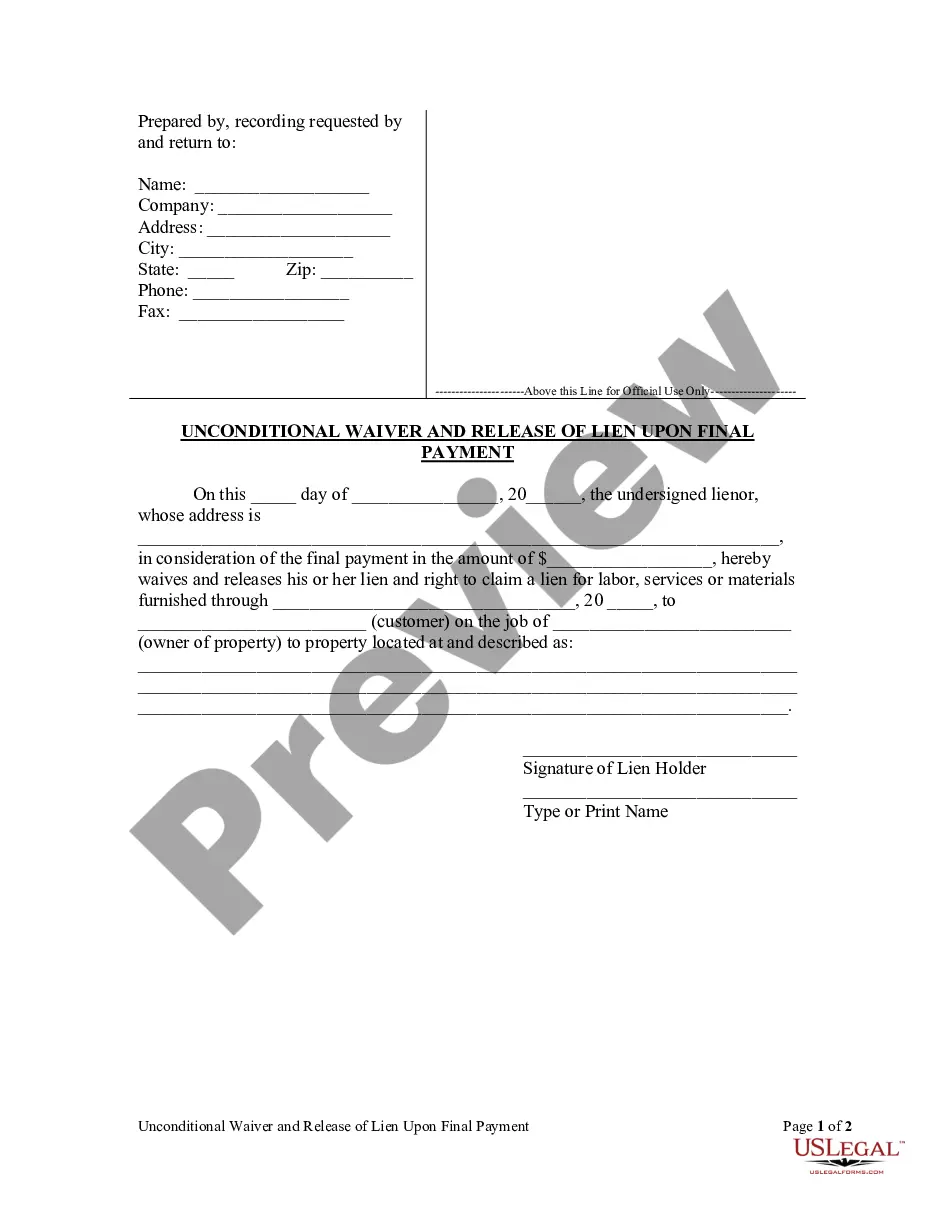

How to fill out Ohio Foreign Employee Status Worksheet And Document Checklist?

Choosing the right authorized file template can be quite a have difficulties. Naturally, there are a variety of themes available on the Internet, but how can you find the authorized kind you will need? Make use of the US Legal Forms internet site. The support delivers thousands of themes, such as the Ohio Foreign Employee Status Worksheet and Document Checklist, which you can use for business and personal requirements. All of the kinds are checked out by professionals and meet up with state and federal needs.

In case you are already registered, log in to your accounts and click the Obtain key to get the Ohio Foreign Employee Status Worksheet and Document Checklist. Make use of your accounts to check with the authorized kinds you possess ordered formerly. Proceed to the My Forms tab of your respective accounts and have an additional backup from the file you will need.

In case you are a fresh user of US Legal Forms, here are simple instructions that you can comply with:

- Initial, make certain you have selected the proper kind to your area/region. You are able to look over the form utilizing the Review key and browse the form outline to guarantee it will be the best for you.

- In the event the kind fails to meet up with your needs, use the Seach field to obtain the appropriate kind.

- When you are sure that the form is proper, click on the Get now key to get the kind.

- Pick the pricing plan you want and type in the needed information. Build your accounts and purchase the order using your PayPal accounts or charge card.

- Opt for the submit format and obtain the authorized file template to your system.

- Comprehensive, modify and print and sign the received Ohio Foreign Employee Status Worksheet and Document Checklist.

US Legal Forms is definitely the biggest collection of authorized kinds where you can see numerous file themes. Make use of the service to obtain expertly-produced documents that comply with state needs.

Form popularity

FAQ

If the qualifying pass-through entity or quali- fying trust has secured from the IRS an extension of time to file, use Ohio form IT-1140ES (for taxable years beginning in 2000) to remit any 5% withholding tax and/ or 8.5% entity tax due but not paid as of the unextended due date.

Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for each individual they hire for employment in the United States.

If you earn an income above $21,750, you must pay Ohio income taxes. Every resident and part-year resident of Ohio is subject to state income tax. Nonresidents with Ohio-source income also must file returns. Learn more about who must file state income tax in Ohio.

To order USCIS forms, you can download them from our website at or call our toll-free number at 1-800-870-3676. You can obtain information about Form I-9 from our website at or by calling 1-888-464-4218.

Driver's license or identification card issued by a state or outlying territory of the U.S., provided it contains a photograph or information such as name, date of birth, gender, height, eye color and address.

Form IT 1140 is an Ohio Corporate Income Tax form. Like the Federal Form 1040, states each provide a core tax return form on which most high-level income and tax calculations are performed.

Form I-9, the Employment Eligibility Verification, is a U.S. Citizenship and Immigration Services (USCIS) form used for verifying the identity and employment authorization of individuals hired for employment in the United States.

All qualifying pass-through entities and qualifying trusts must attach to form IT-1140 the K-1 Information (dis- cussed below). qualifying investor or qualifying beneficiary (see Tax Credits Available to Certain Investors and Ben- eficiaries, on this page).

But the one thing that hasn't changed is their state taxes. Ohio, unlike most other states, doesn't have a corporate income tax. Instead, businesses pay taxes on their total receipts rather than their total profits.

Qualifying pass-through entities whose equity investors are limited to nonresident individuals, nonresident estates and nonresident trusts can file either Ohio form IT 1140 or IT 4708. All other qualifying pass-through entities must file Ohio form IT 1140 and may also choose to file Ohio form IT 4708.