In Ohio, the Pooling and Servicing Agreement (PSA) is a crucial document that outlines the contractual relationship between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One in relation to mortgage-backed securities. This agreement establishes the terms and conditions under which the parties will pool mortgage loans and create mortgage-backed securities for investment purposes. The Ohio Pooling and Servicing Agreement is designed to ensure the smooth functioning of the mortgage-backed securities market and provide clarity on the rights and responsibilities of each party involved. It outlines the various specifics related to mortgage loan pooling, servicing, and the distribution of payments to investors. Keywords: 1. Pooling and Servicing Agreement: The legal contract specifying the terms and obligations governing the pooling of mortgage loans, servicing activities, and investment distribution. 2. Ohio Pooling Agreement: Referring to the specific PSA executed in Ohio, tailored to comply with the state's regulations and requirements. 3. Credit Suisse First Boston Mortgage Securities Corp.: A financial institution involved in mortgage-backed security creation and trading. 4. Washington Mutual Bank F.A.: A lending institution participating in the pooling and servicing of mortgage loans. 5. Bank One: Another party engaged in the mortgage-backed securities market. Different types of Ohio Pooling and Servicing Agreements between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One may include variations based on specific loan types, maturities, interest rates, or geographic regions within Ohio. These variances facilitate customization to meet the requirements of different investor groups or specific market conditions. It's important to consult the actual PSA document to understand the exact nature of the agreements between these parties as multiple variations may exist.

Ohio Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

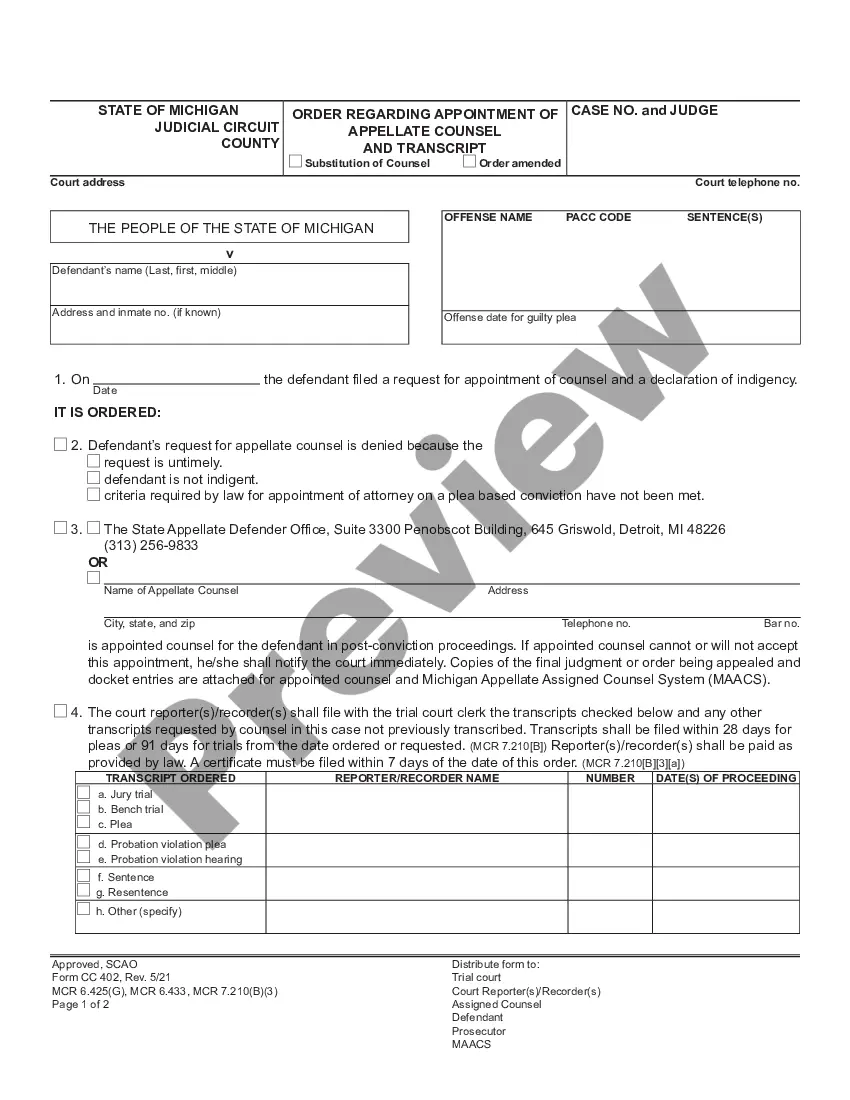

How to fill out Ohio Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

You are able to commit hours on-line trying to find the lawful document format which fits the federal and state specifications you want. US Legal Forms gives 1000s of lawful varieties that happen to be examined by experts. You can actually obtain or print out the Ohio Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One from our service.

If you currently have a US Legal Forms accounts, it is possible to log in and click on the Acquire switch. After that, it is possible to full, edit, print out, or indication the Ohio Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One. Every lawful document format you buy is the one you have forever. To have one more version associated with a acquired develop, check out the My Forms tab and click on the related switch.

If you are using the US Legal Forms internet site the very first time, stick to the simple directions under:

- Initial, be sure that you have chosen the best document format for that county/area that you pick. Browse the develop description to ensure you have picked the correct develop. If available, use the Preview switch to check throughout the document format as well.

- If you want to find one more edition from the develop, use the Research area to obtain the format that suits you and specifications.

- When you have found the format you need, just click Buy now to carry on.

- Select the pricing prepare you need, enter your references, and sign up for an account on US Legal Forms.

- Full the transaction. You can use your bank card or PayPal accounts to purchase the lawful develop.

- Select the file format from the document and obtain it to your gadget.

- Make alterations to your document if possible. You are able to full, edit and indication and print out Ohio Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One.

Acquire and print out 1000s of document templates while using US Legal Forms website, which offers the largest collection of lawful varieties. Use skilled and condition-certain templates to take on your organization or specific needs.

Form popularity

FAQ

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners.

When rates rise, there are fewer people who benefit from a new mortgage. Lenders and servicers adjust. Servicers looking to raise cash may make part or all of their portfolio available for sale to other servicers. Interested servicers may see this as an opportunity to grow their portfolio. Mortgage Servicing Transferred? Here's What You Should Know rocketmortgage.com ? learn ? mortgage-ser... rocketmortgage.com ? learn ? mortgage-ser...

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners. stop select portfolio servicing foreclosure Keep Your Keys ? selectportfolioservicing Keep Your Keys ? selectportfolioservicing

SPS is a mortgage servicer, which means we manage your account on behalf of the note holder. FrequentlyAskedQuestions - Select Portfolio Servicing Select Portfolio Servicing ? StaticDetails ? Help Select Portfolio Servicing ? StaticDetails ? Help

In 2005, Select Portfolio Servicing was purchased by Credit Suisse, a financial services company, headquartered in Zurich, Switzerland. Select Portfolio Servicing - Wikipedia wikipedia.org ? wiki ? Select_Portfolio_Servici... wikipedia.org ? wiki ? Select_Portfolio_Servici...

NOTE: Another way to find a PSA is to go to the SEC EDGAR search index page: .