Ohio Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp

Description

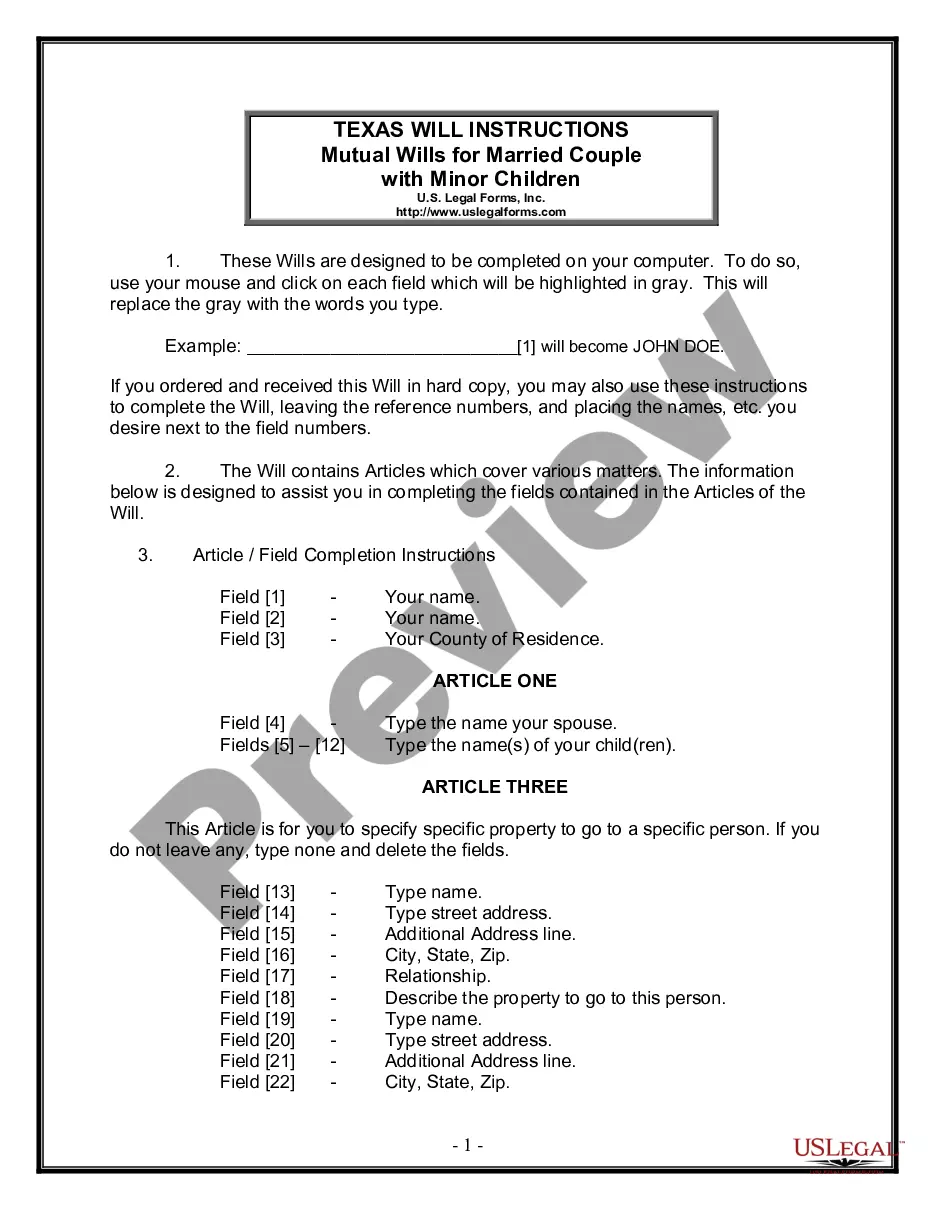

How to fill out Agreement And Plan Of Merger Between Fidelity National Financial, Inc. And Chicago Title Corp?

Are you in a position where you need to have documents for both enterprise or individual reasons nearly every day time? There are a variety of legal file web templates available online, but discovering types you can trust is not straightforward. US Legal Forms provides 1000s of kind web templates, such as the Ohio Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp, which can be published to meet federal and state requirements.

Should you be presently informed about US Legal Forms site and possess an account, merely log in. Afterward, it is possible to download the Ohio Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp web template.

Should you not offer an account and wish to begin using US Legal Forms, abide by these steps:

- Discover the kind you need and make sure it is to the appropriate town/county.

- Take advantage of the Preview button to analyze the shape.

- Read the outline to ensure that you have chosen the right kind.

- When the kind is not what you`re seeking, use the Search area to get the kind that meets your needs and requirements.

- If you obtain the appropriate kind, simply click Get now.

- Opt for the costs strategy you would like, fill in the specified information to produce your bank account, and buy the order with your PayPal or charge card.

- Choose a practical data file file format and download your backup.

Get all the file web templates you might have bought in the My Forms menus. You can aquire a further backup of Ohio Agreement and Plan of Merger between Fidelity National Financial, Inc. and Chicago Title Corp at any time, if necessary. Just go through the necessary kind to download or produce the file web template.

Use US Legal Forms, the most comprehensive collection of legal types, to save lots of some time and prevent errors. The services provides professionally made legal file web templates which can be used for a selection of reasons. Generate an account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Fidelity began trading on the New York Stock Exchange under the symbol FNF.

Fidelity National Financial split the company into Fidelity National Financial and F&G Annuity & Life. The structure of the spinoff was the distribution of F&G Annuity & Life shares as a taxable dividend.

Established in 1983, National Financial Services LLC, a Fidelity Investments company, is one of the largest providers of brokerage services.

Top 10 Owners of Fidelity National Financial Inc StockholderStakeShares ownedThe Vanguard Group, Inc.9.68%26,347,629BlackRock Fund Advisors7.51%20,443,499The WindAcre Partnership LLC5.76%15,684,500Brave Warrior Advisors LLC3.49%9,496,1726 more rows

However, Chicago Title, Fidelity National Title and Commonwealth Land Title are all owned by one parent company, Fidelity National Title Group. Together, they represent 31% of the title insurance market, with more than $6 billion in business.

The Board of Fidelity National Financial, Inc. (NYSE:FNF) announced the spin-off of 15% stake in F&G Annuities & Life Inc. on March 14, 2022. As per the record date of November 22, 2022, FNF shares and will receive 68 F&G shares for every 1,000 FNF shares held.

What do analysts say about Fidelity National Financial? Fidelity National Financial's analyst rating consensus is a Moderate Buy. This is based on the ratings of 5 Wall Streets Analysts.