Ohio Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

How to fill out Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

Are you within a situation that you need to have paperwork for either organization or person purposes almost every day? There are a variety of legitimate document layouts available on the Internet, but locating versions you can depend on isn`t effortless. US Legal Forms offers a huge number of form layouts, such as the Ohio Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc, that happen to be created to satisfy state and federal requirements.

Should you be presently familiar with US Legal Forms site and possess a free account, basically log in. Next, you can acquire the Ohio Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc template.

Unless you provide an account and want to start using US Legal Forms, follow these steps:

- Find the form you need and make sure it is for that proper city/county.

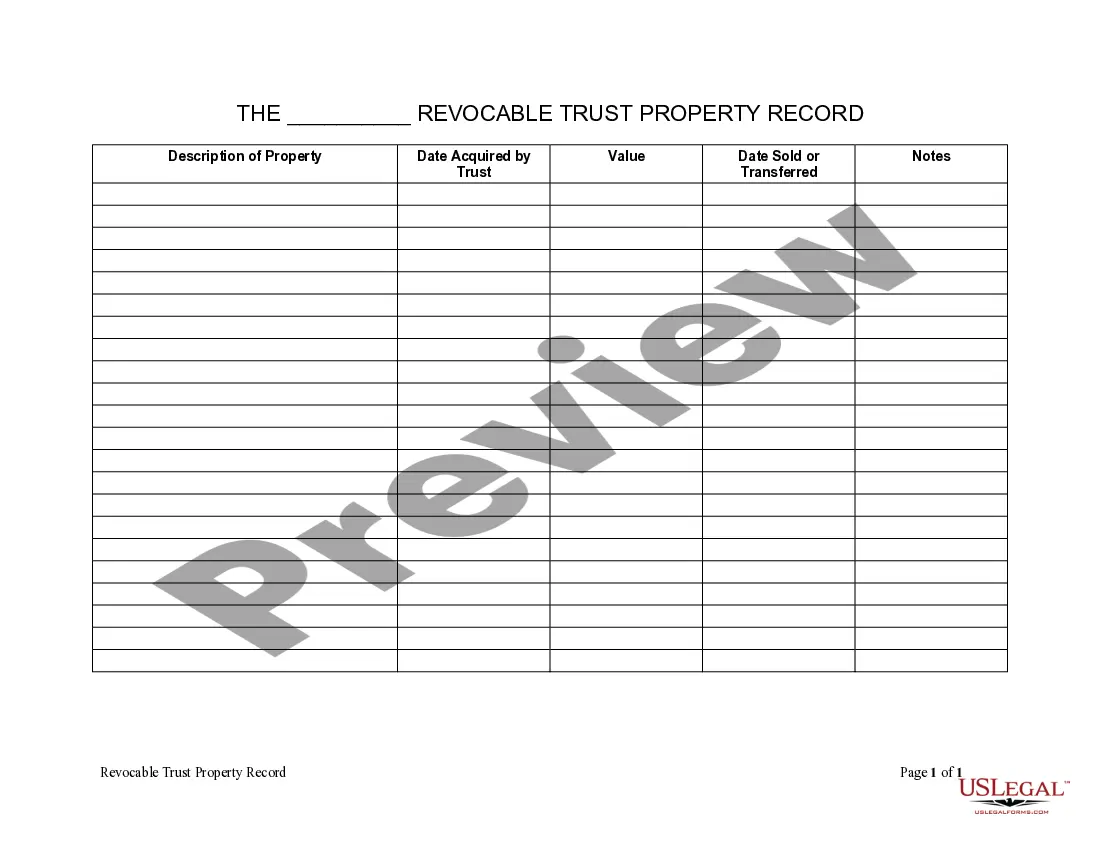

- Utilize the Review option to check the shape.

- Read the outline to ensure that you have chosen the appropriate form.

- If the form isn`t what you are searching for, use the Research discipline to find the form that fits your needs and requirements.

- Whenever you obtain the proper form, simply click Get now.

- Select the costs prepare you desire, fill in the required information and facts to create your money, and purchase the transaction making use of your PayPal or bank card.

- Select a convenient paper formatting and acquire your copy.

Find every one of the document layouts you possess purchased in the My Forms food list. You can get a extra copy of Ohio Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc any time, if needed. Just click the essential form to acquire or produce the document template.

Use US Legal Forms, one of the most substantial selection of legitimate kinds, to save lots of time and prevent errors. The assistance offers expertly created legitimate document layouts that you can use for a variety of purposes. Make a free account on US Legal Forms and commence producing your life a little easier.