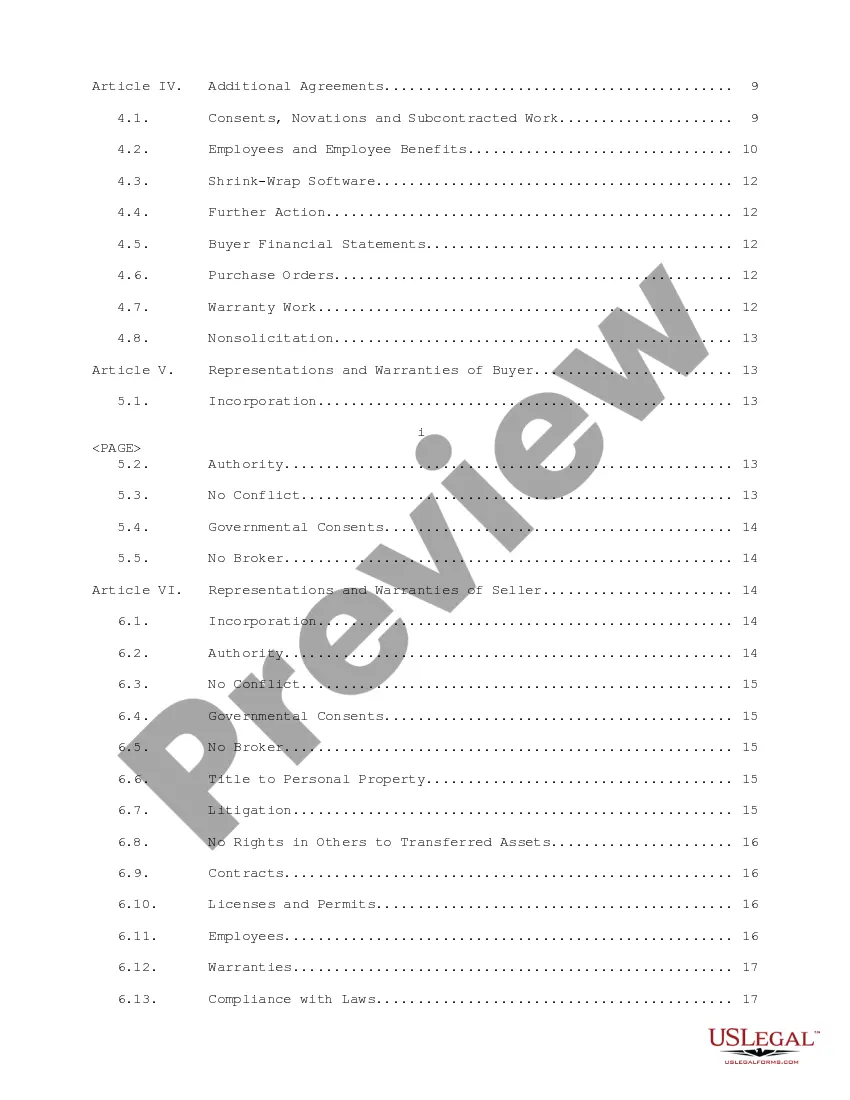

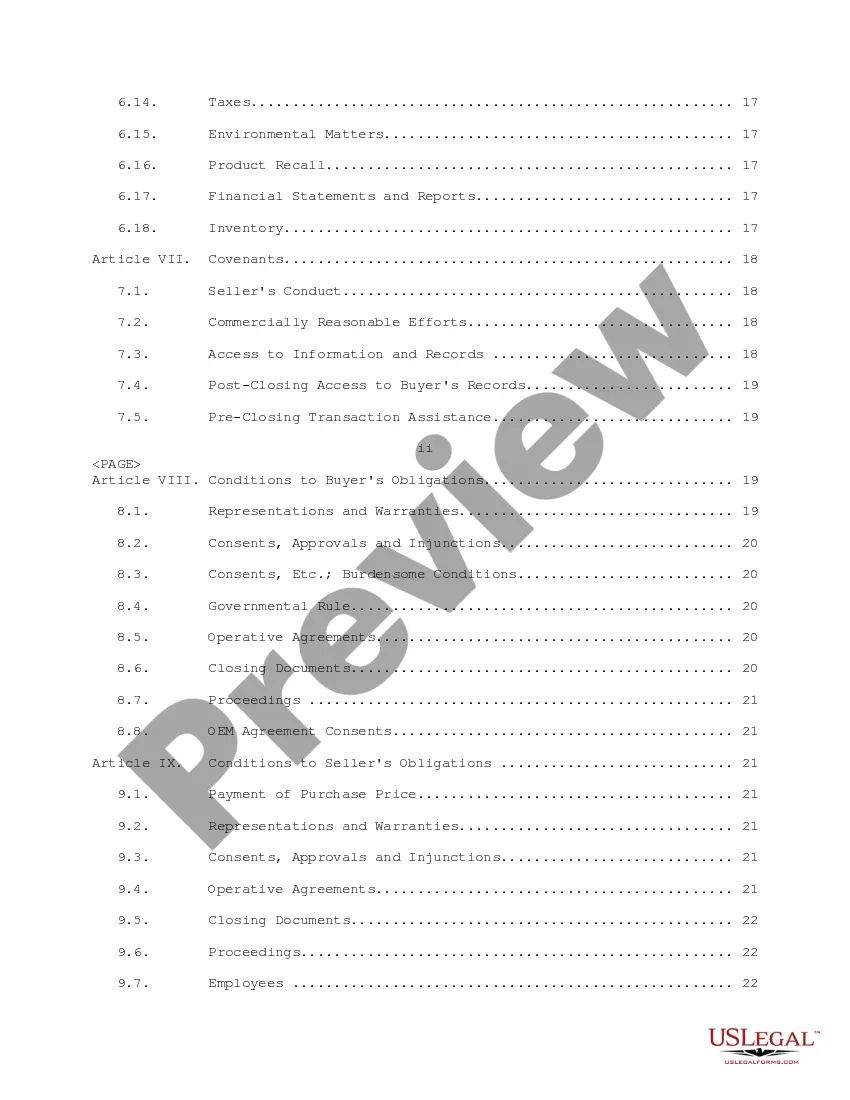

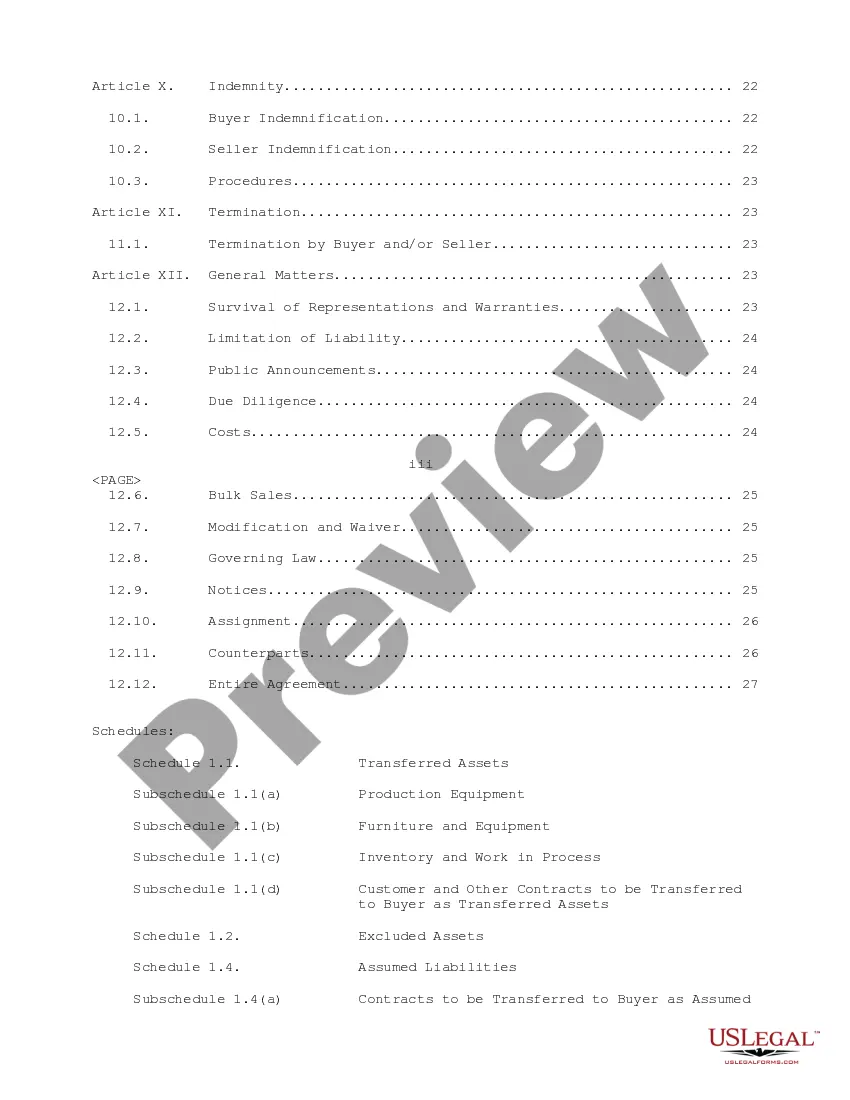

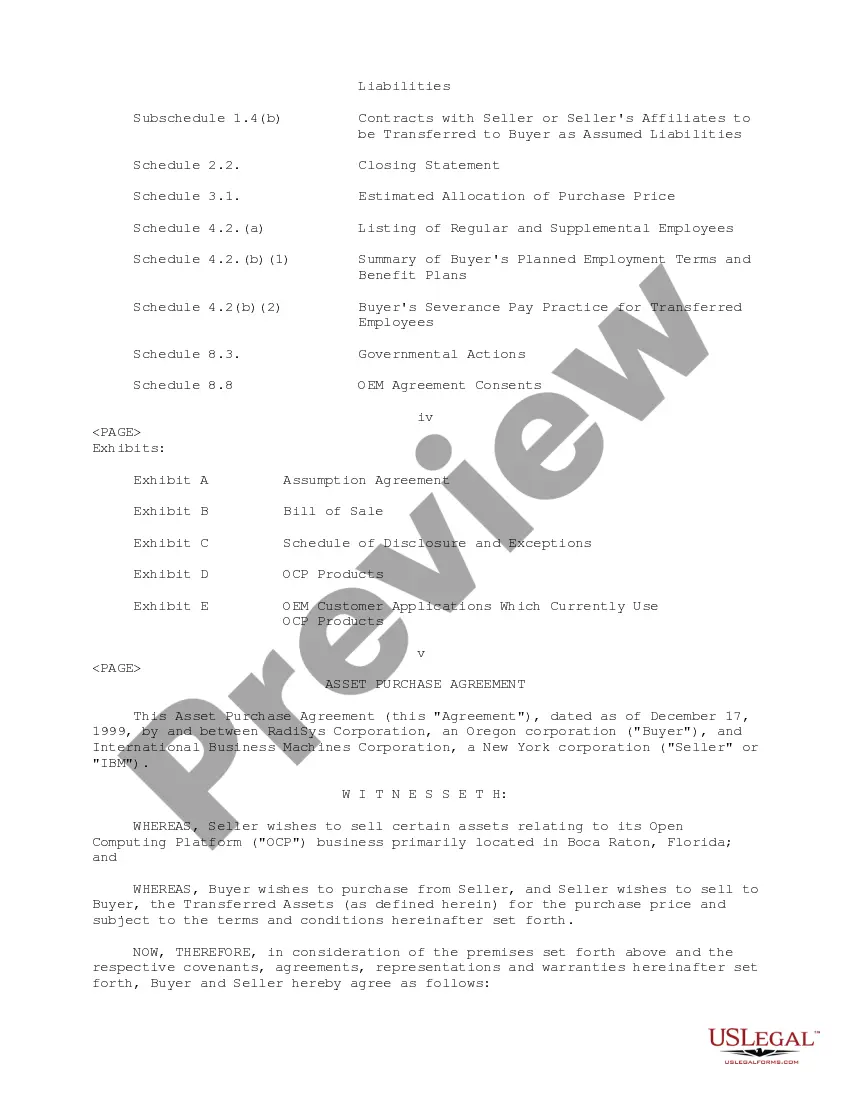

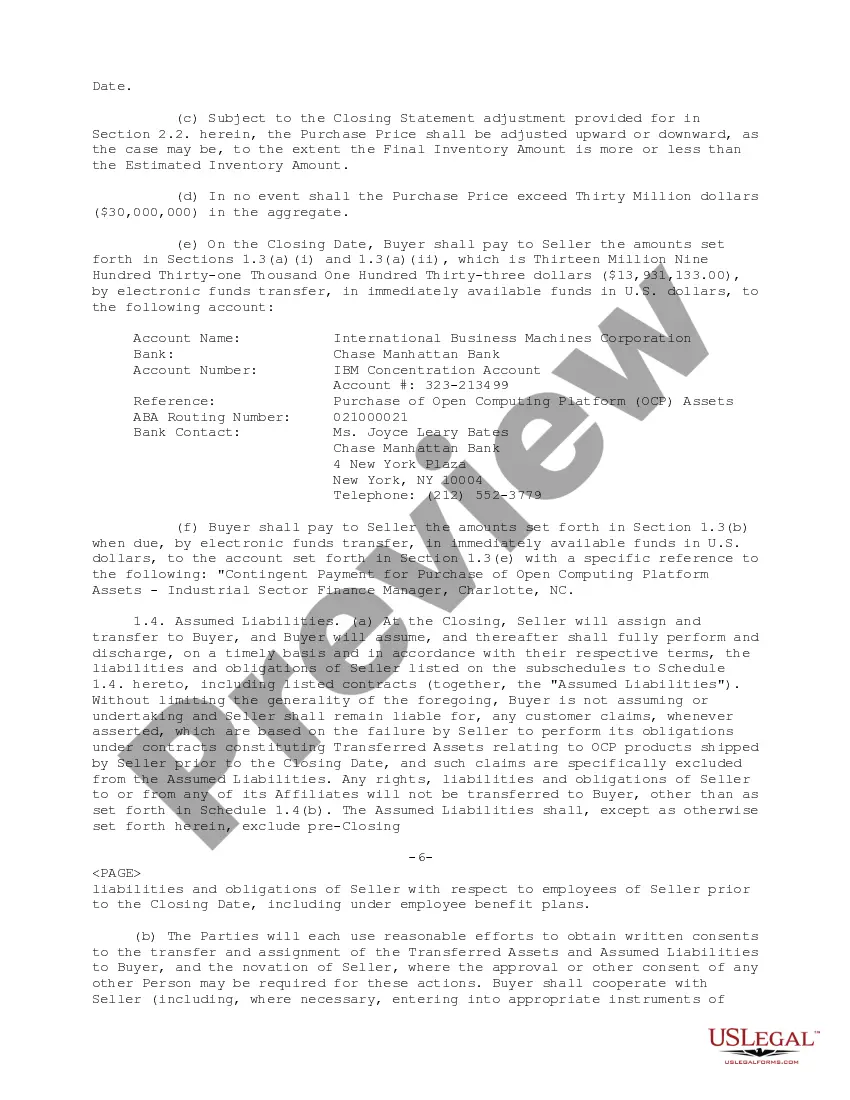

Ohio Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation — Sample This Ohio Sample Asset Purchase Agreement between Radius Corporation and International Business Machines Corporation is a comprehensive legal document outlining the terms and conditions of the asset purchase transaction between the two parties. The agreement specifies various details related to the acquisition of assets, obligations, and liabilities. Key points covered in this agreement include: 1. Parties involved: This section defines the parties involved in the transaction, namely Radius Corporation and International Business Machines Corporation. It outlines the legal names, addresses, and contact information of both entities. 2. Asset purchase: The agreement elaborates on the specific assets being acquired by International Business Machines Corporation from Radius Corporation. This includes a detailed list of assets, such as tangible and intangible property, contracts, intellectual properties, licenses, and more. The condition and valuation of these assets are thoroughly described. 3. Purchase price and payment terms: The agreement states the purchase price for the assets and outlines the payment terms, including the mode and timing of payments. It also covers any adjustments, withholding, and escrow arrangements related to the transaction. 4. Representations and warranties: Both parties make representations and warranties regarding their authority, ownership, and compliance with laws and regulations. They also provide assurances regarding the existence and accuracy of financial statements, absence of undisclosed liabilities, valid contracts, and other aspects relevant to the agreement. 5. Confidentiality and non-competition: The agreement includes provisions relating to confidentiality of information disclosed during the transaction and non-competition commitments from Radius Corporation to International Business Machines Corporation. 6. Transfer of employees: If applicable, the agreement outlines the terms and conditions for the transfer of employees from Radius Corporation to International Business Machines Corporation as part of the asset purchase. This includes employment benefits, employment agreements, and related obligations. 7. Indemnification: The terms for indemnification and limitations of liabilities are defined in this section. Both parties agree to indemnify and hold harmless each other from any claims, losses, damages, or liabilities arising from breach of representations, warranties, or other obligations under the agreement. 8. Governing law and jurisdiction: The agreement specifies that Ohio law governs the interpretation and enforcement of the agreement. It also designates Ohio courts as the exclusive jurisdiction for any disputes arising from the agreement. Different types of Ohio Sample Asset Purchase Agreements between Radius Corporation and International Business Machines Corporation may exist based on specific asset classes, industries, or other factors. These variations might encompass agreements related to the acquisition of technology assets, real estate assets, intellectual properties, or other specific asset categories. It is important to consult with legal professionals to obtain the applicable Ohio Sample Asset Purchase Agreement specific to your requirements and ensure compliance with relevant laws and regulations.

Ohio Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out Ohio Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

If you have to total, acquire, or printing legal document web templates, use US Legal Forms, the biggest assortment of legal types, that can be found on the web. Take advantage of the site`s simple and easy practical research to discover the papers you require. A variety of web templates for business and specific reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to discover the Ohio Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample in just a handful of click throughs.

In case you are currently a US Legal Forms customer, log in in your accounts and then click the Acquire switch to have the Ohio Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample. Also you can entry types you formerly acquired from the My Forms tab of your respective accounts.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the form to the appropriate area/land.

- Step 2. Make use of the Review choice to check out the form`s articles. Don`t forget to see the description.

- Step 3. In case you are unsatisfied together with the kind, use the Research discipline towards the top of the screen to locate other models from the legal kind web template.

- Step 4. When you have identified the form you require, click the Buy now switch. Select the rates strategy you like and add your credentials to sign up on an accounts.

- Step 5. Procedure the transaction. You may use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Find the format from the legal kind and acquire it on your own gadget.

- Step 7. Total, modify and printing or signal the Ohio Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

Every legal document web template you buy is your own permanently. You may have acces to every kind you acquired in your acccount. Go through the My Forms section and decide on a kind to printing or acquire yet again.

Remain competitive and acquire, and printing the Ohio Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample with US Legal Forms. There are many professional and status-certain types you can use for your personal business or specific needs.