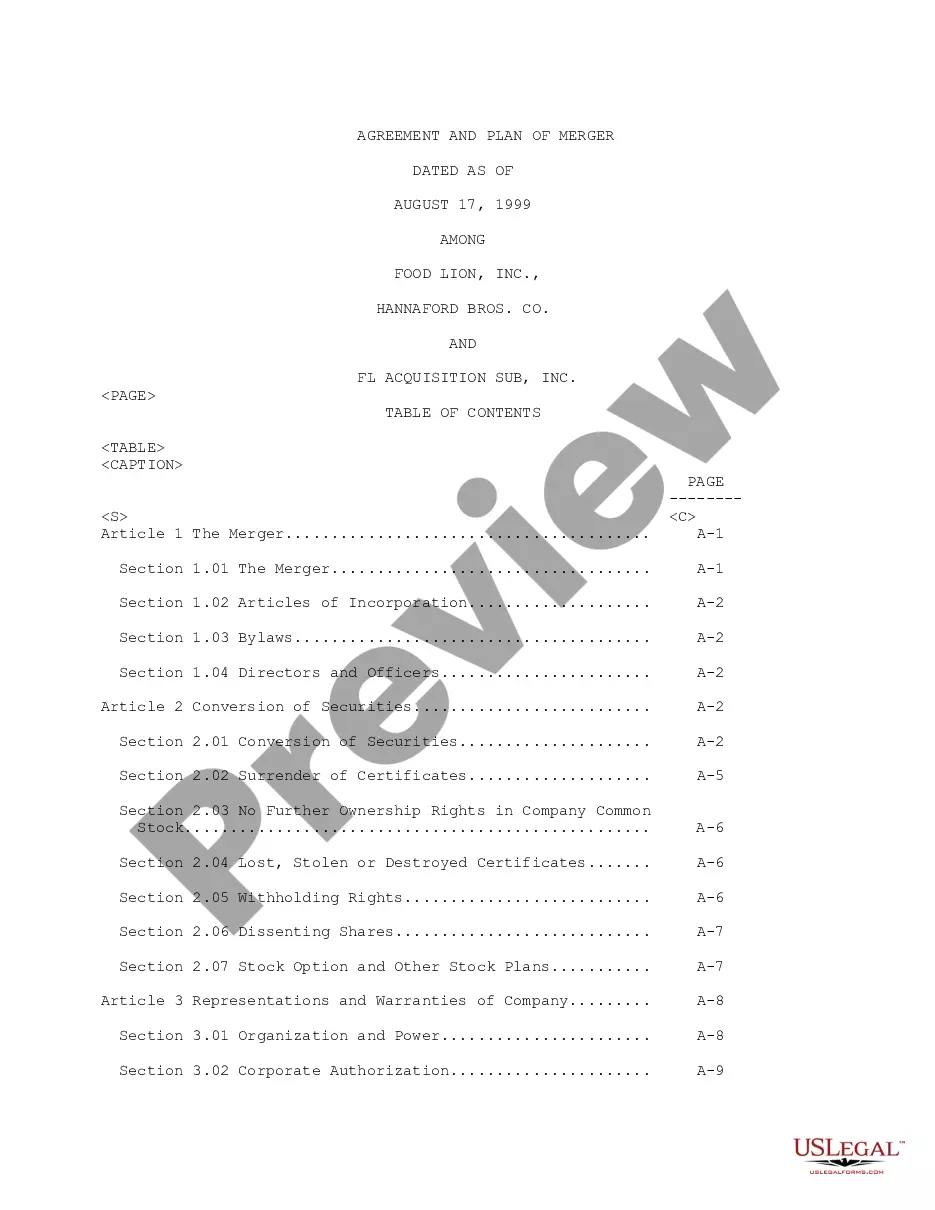

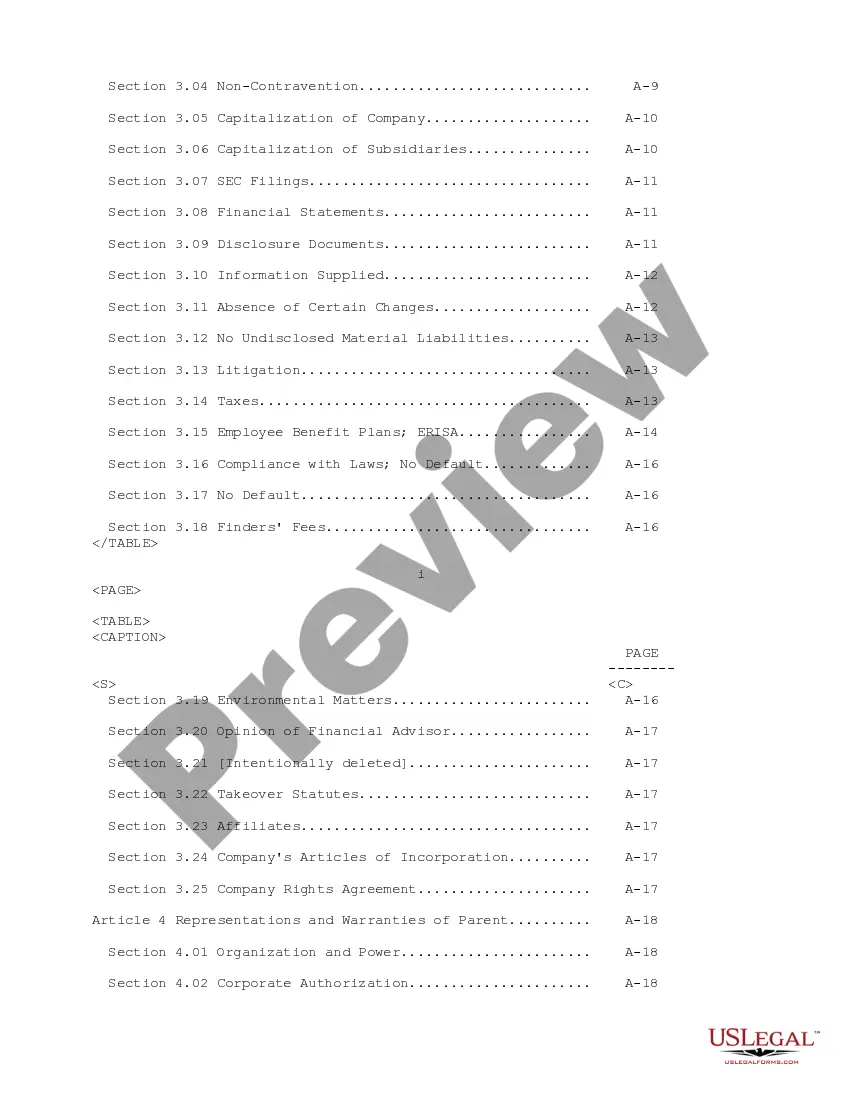

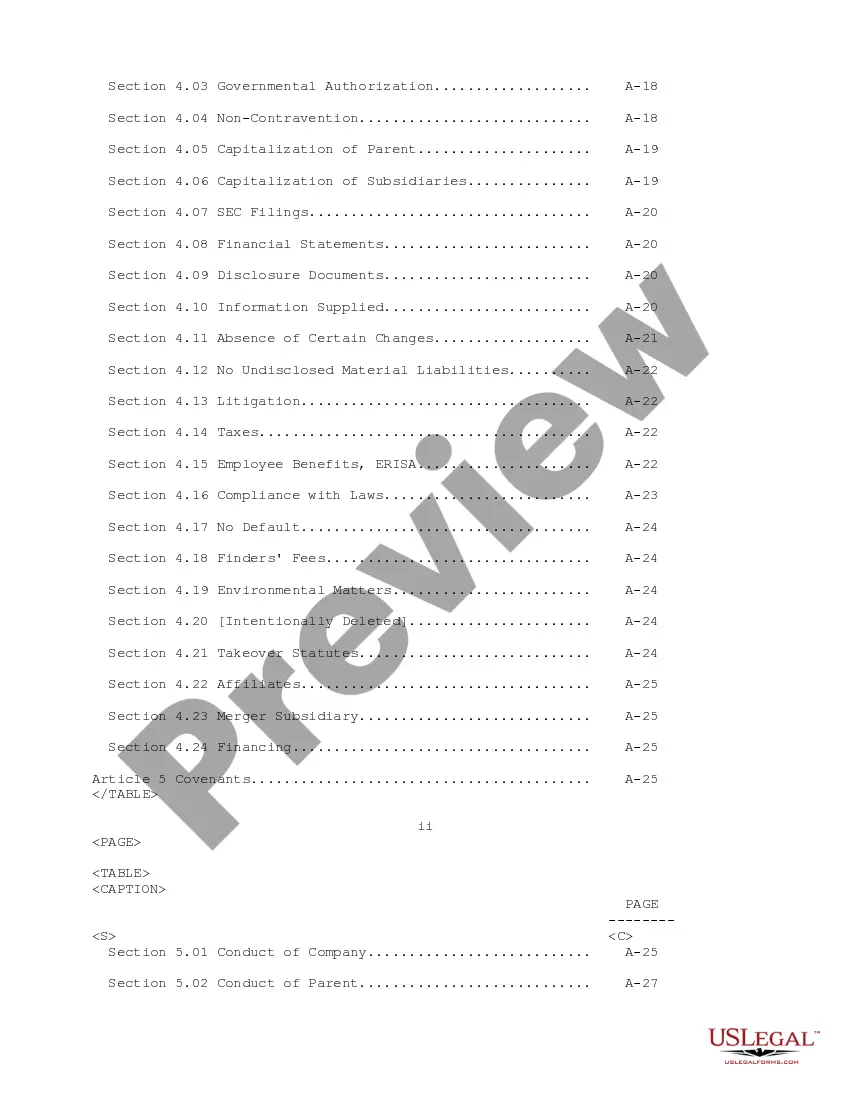

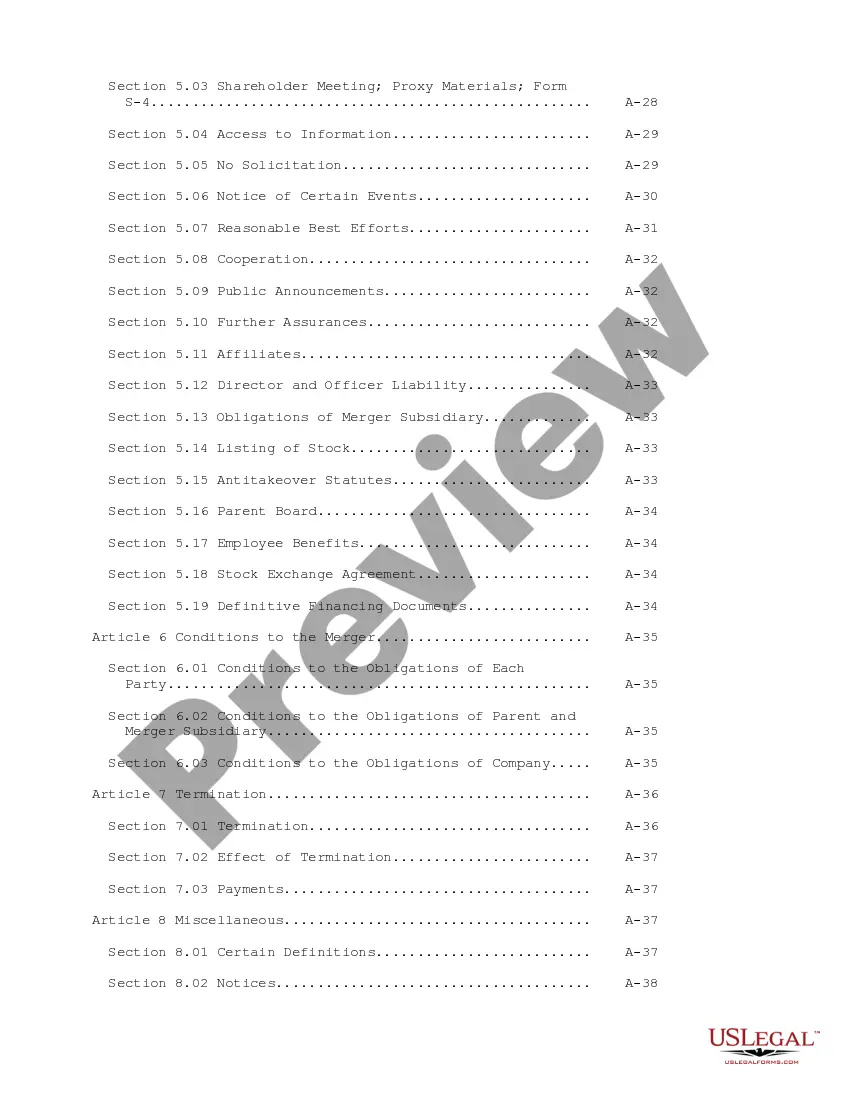

The Ohio Plan of Merger refers to a legal agreement between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. This plan outlines the terms and conditions under which these companies merge or combine their operations, assets, and resources to form a single entity in Ohio. The purpose of the Ohio Plan of Merger is to outline the step-by-step process of the merger, ensuring that all parties involved understand their respective roles and responsibilities. It addresses various aspects, including corporate governance, shareholders' rights, liabilities, and the distribution of assets and stocks. In terms of different types of Ohio Plan of Merger, there may be various considerations based on the specific goals and circumstances of the merger. Some key variations to consider are: 1. Stock-for-Stock Merger: This type of merger involves the exchange of company shares between Food Lion, Hanna ford Brothers, and FL Acquisition Sub. Shareholders from each company receive shares in the new combined entity proportionate to their ownership in the respective companies. 2. Cash Merger: In a cash merger, one company usually acquires the other by buying all outstanding shares. Here, shareholders receive cash in exchange for their shares rather than shares in the new entity. 3. Asset Merger: In this type of merger, one company acquires only selected assets or divisions of another, as opposed to merging the entire entities. This type of merger allows companies to focus on specific areas of expertise and enhance their overall business operations. 4. Statutory Merger: A statutory merger involves merging two or more companies into one, following the guidelines and requirements set by the state statutes (in this case, Ohio) governing mergers and acquisitions. This process ensures compliance with legal regulations and ensures a smooth transition in terms of corporate structure and responsibilities. 5. Consolidation: A consolidation occurs when two or more companies combine to form an entirely new entity, with a separate legal and financial standing. All original companies cease to exist, and a new entity is formed. The Ohio Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. would provide specific details on the chosen type of merger, the share exchange ratio, any consideration of cash, and the overall strategic rationale behind the combination. It would also identify the new corporate structure, including board composition, management roles, and the timeline for integration. Additionally, the plan might address potential synergies, cost savings, and the potential impact on employees and stakeholders. It is crucial to note that this content is purely hypothetical, and no specific Ohio Plan of Merger exists between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc.

Ohio Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

How to fill out Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

It is possible to devote time on the Internet trying to find the authorized document format that suits the state and federal requirements you want. US Legal Forms provides thousands of authorized forms that are analyzed by experts. You can actually download or print the Ohio Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. from my service.

If you currently have a US Legal Forms bank account, you may log in and click on the Acquire key. Afterward, you may full, change, print, or indication the Ohio Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.. Every single authorized document format you acquire is yours eternally. To acquire one more version of any purchased form, proceed to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms internet site the very first time, adhere to the straightforward instructions below:

- First, make sure that you have chosen the best document format for the county/area of your choosing. Look at the form description to ensure you have selected the correct form. If available, use the Review key to appear throughout the document format as well.

- If you want to find one more edition of the form, use the Look for field to get the format that meets your requirements and requirements.

- Once you have discovered the format you would like, click on Purchase now to continue.

- Find the pricing prepare you would like, enter your accreditations, and sign up for an account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal bank account to fund the authorized form.

- Find the structure of the document and download it to your system.

- Make alterations to your document if necessary. It is possible to full, change and indication and print Ohio Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

Acquire and print thousands of document web templates utilizing the US Legal Forms website, which offers the greatest assortment of authorized forms. Use expert and express-distinct web templates to handle your organization or individual needs.

Form popularity

FAQ

In 2000, Delhaize America bought Hannaford; the purchase both eliminated an emerging competitor to its Food Lion chain in the Southeast and expanded Delhaize operations into the Northeast. Some Hannaford locations in North Carolina were sold to Lowes Foods upon the buyout by Delhaize while others were closed.

Founded and based in Salisbury, N.C., since 1957, Food Lion is a company of Ahold Delhaize USA, the U.S. division of Zaandam-based Ahold Delhaize. For more information, visit foodlion.com.

The Food Town chain was acquired by the Belgium-based Delhaize Group grocery company in 1974. The Food Lion name was adopted in 1983; as Food Town expanded into Virginia, the chain encountered several stores called Foodtown in the Richmond area.

Food Lion's parent company is Ahold Delhaize, the same owners since 1974. Delhaize merged with Ahold in 2015 and holds a wide range of retail stores in 10 different countries. In the United States, they also own the popular online grocery service FreshDirect, as well as my beloved hometown grocery store Giant.